On-chain data suggests that Bitcoin (BTC) whales (cryptocurrency wallets that hold significant amounts of BTC) have resumed accumulation after a short period of dormancy.

Bitcoin accumulation rises among whales

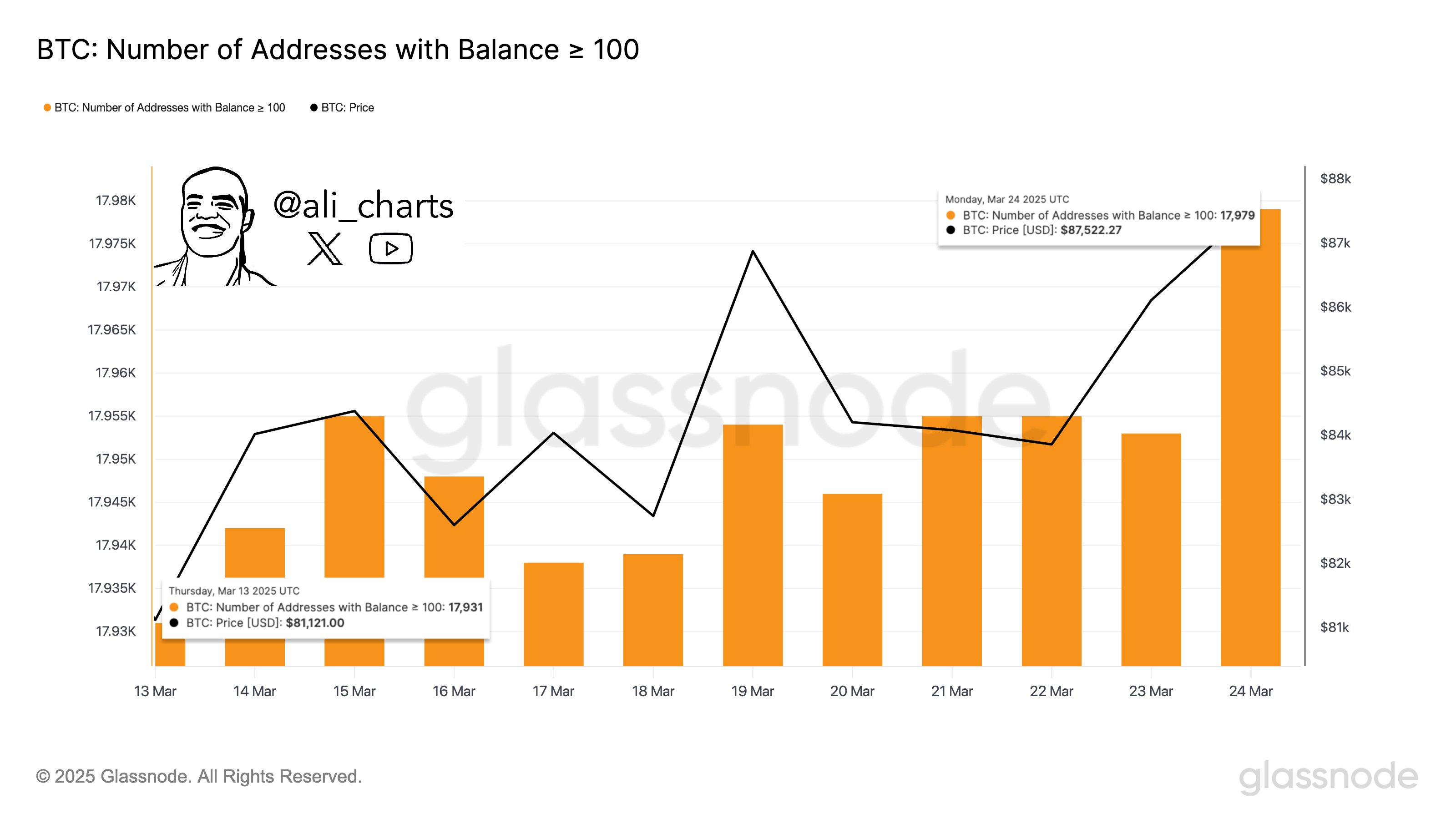

with x post veteran crypto analyst Ali Martinez, published today, highlighted a significant increase in BTC whales’ activity. He shared the following chart showing 48 new wallets holding over 100 BTC:

The surge in whale accumulation often indicates an increased confidence in Bitcoin’s long-term value. Major digital assets have risen more than 15% since March 10th, at around $76,600. At the time of writing, BTC is trading at a high price of $80,000.

New optimism about BTC’s price trajectory comes from several recent macroeconomic developments. cooler Expected Consumer Price Index (CPI) inflation data for February and reports that it is being adopted by US President Donald Trump A softer stance Regarding retaliatory tariffs scheduled to come into effect from April 2nd.

On-chain intelligence company Arkham It has been reported The long-term BTC whales are back in operation. In a post on X, the company highlighted that wallets, which had held $3 million worth of BTC in 2017, were active recently in eight years, and are now valued at nearly $250 million.

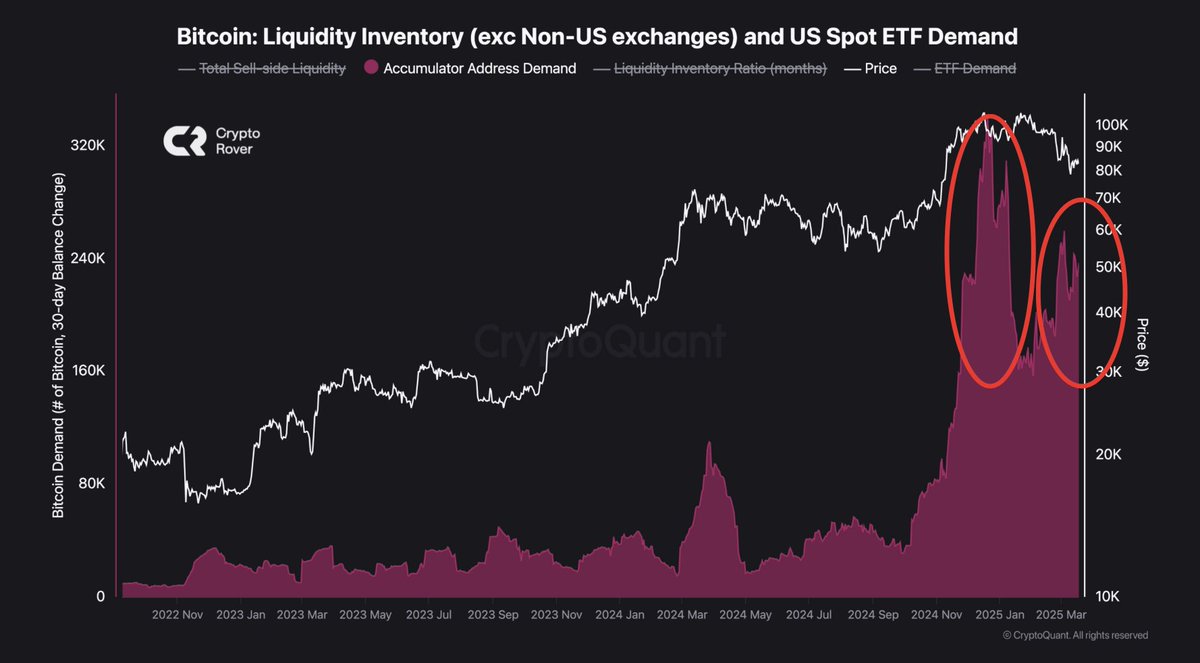

fellow Crypto analyst Crypto Rover shares the following chart, showing a sharp rise in whale accumulation since late 2024. It is noteworthy that data excludes wallets where its data is tied to non-US exchanges and excludes US Spot Bitcoin Exchange-Traded Funds (ETFs).

Is BTC paying attention to the highs of new records?

Several crypto analysts believe that BTC has already bottomed out this cycle and may have entered a new bullish phase, setting the stage for a potentially fresh, highest height (ATH).

Recently, Arthur Hayes, Crypto entrepreneur and former Bitmex CEO Proposed That BTC hit the bottom of this cycle on March 10th, reaching $76,600. Hayes added that there may be a bottom of BTC, but the stock could face more downsides.

Momentum indicators such as relative strength index (RSI) also look smug. Recently Bitcoin’s Daily RSI It broke out It promotes hopes of a sustained upward momentum out of months of downward trend.

Furthermore, Martinez projection That BTC could surge to $112,000 if it decisively breaks its resistance level of $94,000. However, if you fall below $76,000, the door to a deeper decline could open up, potentially at $58,000.

Additionally, the latest investor memo suggests digital asset management company Bitise On a risk-adjusted basis, it could be the right time to purchase BTC. As of press time, BTC is trading at $88,069, an increase of 1% over the past 24 hours.

Featured Images from Unsplash, X and TradingView.com Charts