Bitcoin experienced another up-and-down trade on February 19th, struggling to maintain its value due to a lower trading range.

Bitcoin faces volatility as trading range narrows

Bitcoin ( $BTC) endured another session of whiplash on February 19th, rebounding twice from lows below $66,000 and regaining the $67,000 level. While the volatility reflects the situation over the past 48 hours, technical analysts noted a downward shift in the asset’s trading range. The upper resistance has fallen from $69,000 to $67,000, and the lower support has fallen from $67,000 to just below $66,000.

As of Thursday afternoon, the cryptocurrency had recovered from an intraday low of $65,733 and was trading around $66,500, down 0.9% in 24 hours. Since being able to hold the $70,000 threshold on Monday, Bitcoin has lost about 5% of its value and continues to decline by more than 25% in the past 30 days.

Despite stagnant price trends, Bitcoin’s underlying network security continues to reach historic milestones. According to the report, the 7-day moving average hash rate reached approximately 1 Zettahash per second (ZH/s).

While an all-time high hash rate is a bullish fundamental and indicates the network is becoming more resilient to attack, it is generally considered a medium-term indicator that does not immediately translate into higher prices.

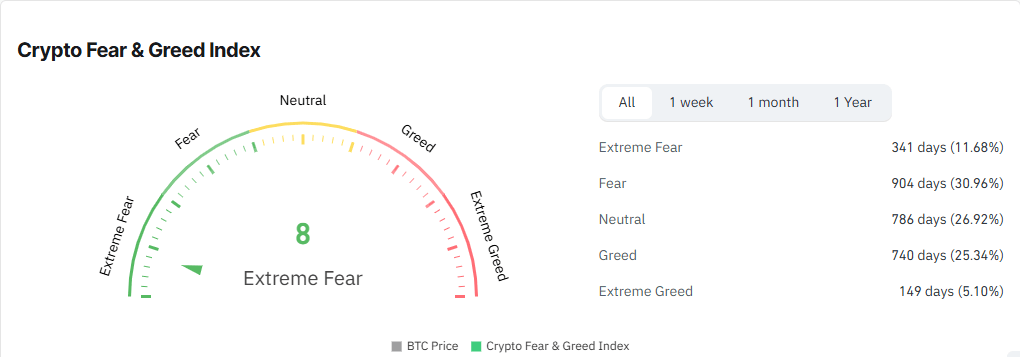

In the short term, market sentiment is driven by “extreme fear.” This bearish outlook was reinforced by two consecutive days of net outflows from spot Bitcoin exchange traded funds (ETFs). According to the latest data, the net withdrawal amount was $133.3 million (approximately $19.8 million) $BTC), noticeable acceleration from 1,520 $BTC The spill was recorded the previous day.

Geopolitical tensions and inflation risks

Bitcoin’s performance also appears to be tied to broader macroeconomic concerns. The asset, which is often correlated with the Nasdaq and high-growth tech stocks, was weighed down by escalating geopolitical tensions in the Middle East.

Observers fear that a possible U.S. military attack on Iranian targets could prompt Tehran to close the Strait of Hormuz, a key chokepoint for global trade. Beyond the logistics disruption, the dispute is likely to cause oil prices to soar, reigniting inflationary pressures and complicating prospects for rate cuts.

Amid market turmoil, Bitcoin is approaching a major psychological and mathematical milestone. The circulating supply is approaching 20 million coins minted. According to Coingecko data on February 19, the circulating supply was 19,991,937 units. $BTC—Only 8,063 people left $BTC before the network reached the 20 million mark.

With a hard cap set at 21 million, this milestone highlights the increasing scarcity of the asset as it moves into the final stages of issuance.

Frequently asked questions ❓

- Why did Bitcoin drop below $66,000 this week? Volatility was driven by technical resistance falling to $67,000 and ETF outflows accelerating.

- What is the health of Bitcoin’s network despite price fluctuations? The hashrate reached a record 1 ZH/s, showing increased security despite the price drop.

- Global risks weigh heavily $BTC Now? Geopolitical tensions in the Middle East and inflation concerns are weighing on risk assets.

- Why is the 20 million coin milestone important? This highlights Bitcoin’s scarcity, with less than 1 million coins remaining before the 21 million cap.