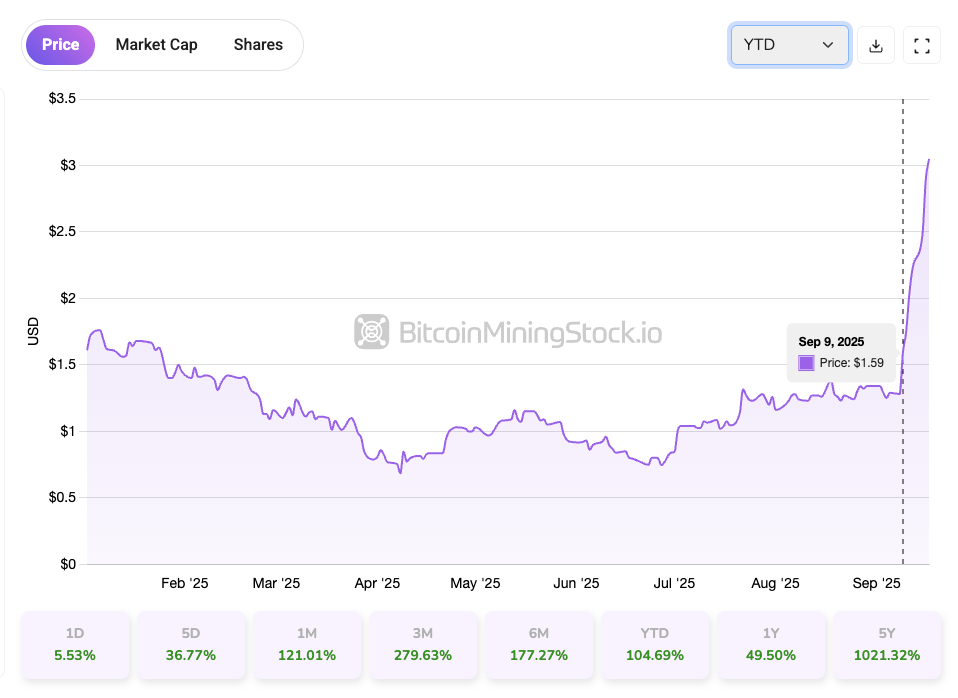

The BITF has taken off and the momentum has not waned. Are there any quietly priced developments in the market? Or is it time to completely revalue the stock?

The next guest post comes from bitcoinminingstock.io, A public market intelligence platform that provides data on companies exposed to Bitcoin mining and cryptocurrency strategies.

BitFarms Stock Price Surge – What’s the next time?

BitFarms (NASDAQ: BITF) last week Top Performance Bitcoin mining stock tracked by BitcoinminingStock.io recorded a spectacular 72.86% increase over the five-day trading period. The rally began around September 9th and there are few signs of slowing down as of writing. This preparation especially occurred when no company news releases were announced. Instead, investors’ feelings are A new understanding of BitFarms’ business transformationCEO Bengagnon amplified at HC Wainwright’s 27th Annual Global Investment Conference.

The presentation was not widely aired, but investor debates about X took the pace and social feeds became significantly bullish in BITF. For those who are familiar with me December 2024 Reportthis marks the shift. At the time I wrote:

“BitFarms’ financial and operational strategies are consistent with industry trends, but the company struggles to stand out due to lack of a clear and unique competitive advantage.”

Nine months later, it appears the company has found Edge – Becomes the North American energy and computing infrastructure company. And this evolving strategy is finally attracting investors’ attention.

So I would like to go back to the fundamentals of BitFarms’ recent developments and decide if it’s time to revalue the stock.

What Bitfarms CEO said at HC Wainwright Conference

At HC Wainwright At the event, Gagnon positioned BitFarm as the future “North American Energy and Computing Infrastructure Company.” He did the company’s 18 eh/s Bitcoin mining operations “Low-cost bridge funding tool” To support migration to HPC and AI infrastructure. Mining still covers all operating expenses and contributes to CAPEX. No further miners purchases or fleet expansions are planned. Instead, existing fleets, which benefit from low-cost power and high operational efficiency, are expected to generate stable free cash flows throughout 2026 in most BTC pricing scenarios. In short, BitFarms plans to unlock the potential of an energy portfolio previously built to support mining and serve the emerging HPC/AI market.

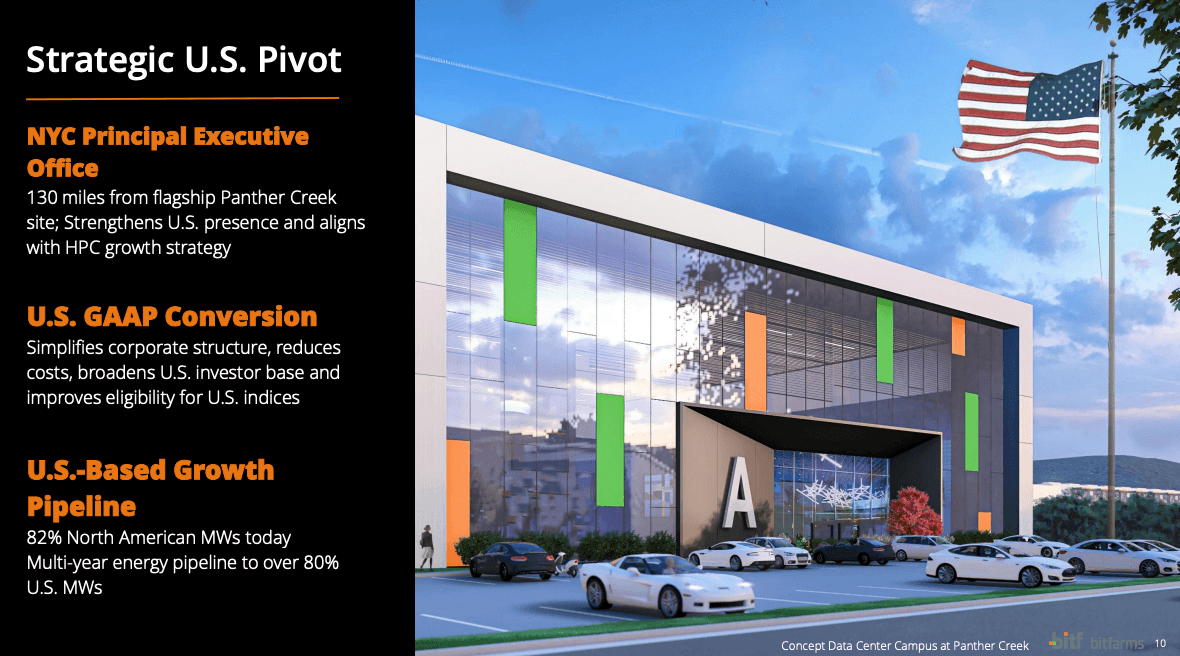

Bit Farm’ Geographical footprint We also shifted to support this strategy. When Gagnon became CEO, only 45% of the company’s footprint was in North America. Today, that number is 82%, almost everything Future growth By November 11, 2025, it shows the decisive pivot to become a US-focused platform, focusing on Latin America, particularly Argentina, from the final exit from Latin America, and especially Argentina.

Screenshots from BitFarms presentation.

In North America, the company currently has a 1.2 GW power pipeline. Important SitesIncludes businesses established in Panther Creek, Pennsylvania, Quebec, and footprint growth in Washington. These sites are available Near the main fiber optic corridorenabling support for data center workloads across North America and potentially across the Atlantic. With favorable power economics and improved power usage (PUE), BitFarms believes it can provide a higher calculation rate per megawatt that gives it a significant edge in the HPC market.

This evolving story of today’s mining, tomorrow’s infrastructure, is consistent with investors’ feelings. The market clearly shows that it prefers long-term, stable revenues from AI infrastructure hosting.

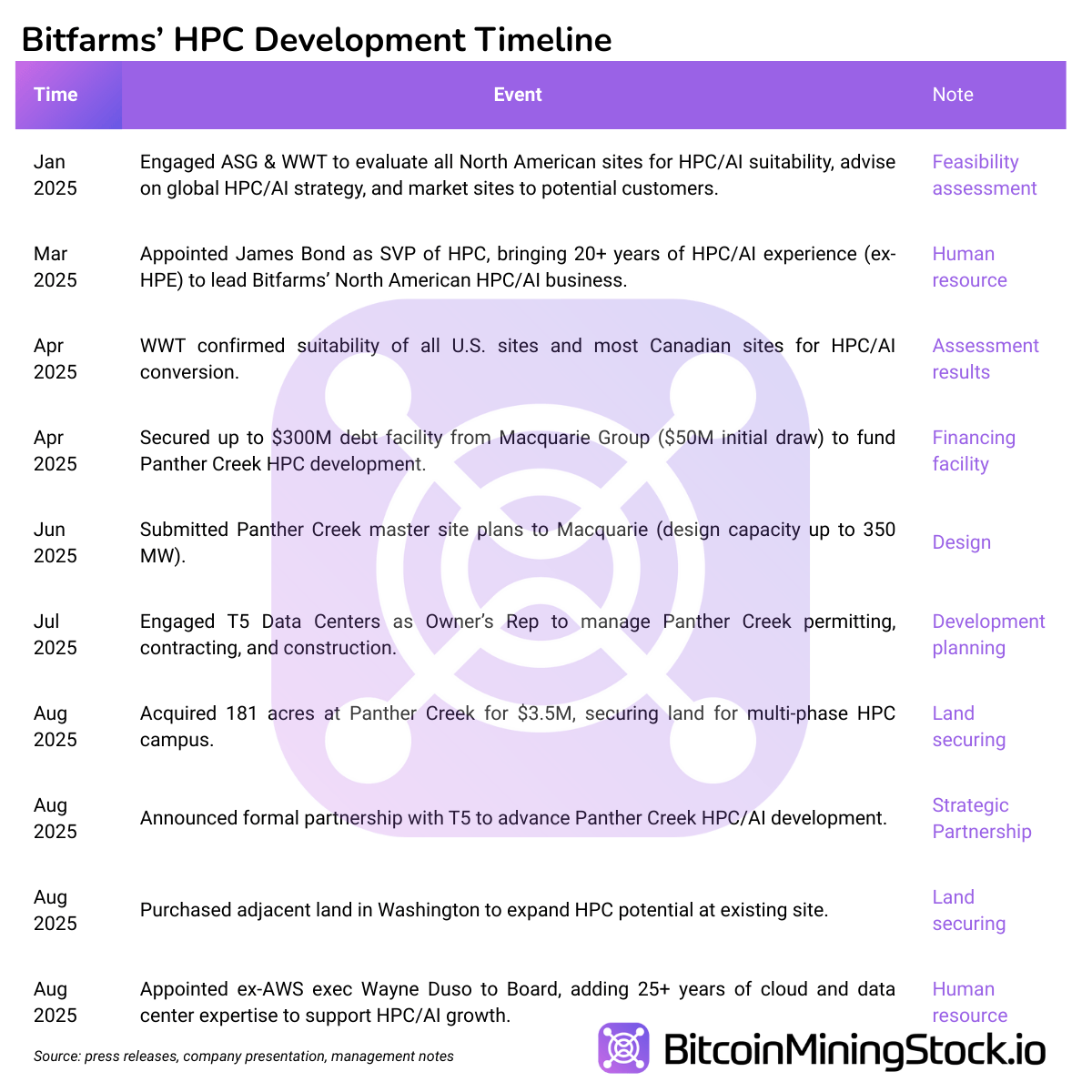

Bitfarm HPC Development: Hype or Real Advances?

BitFarms HPC development is Start taking concrete formsalthough it remains in the early stages. Over the last quarter, the company has started Site-level feasibility assessmentprotected permissions and capacity, I strengthened my team Related expertise and establishment Strategic Partnerships To sell the site to potential customers.

Many people have been criticized for a long time. Acquisition of the baseonce considered a high, it turned out to be a strategic asset. With this acquisition, BitFarms has provided a large, scalable footprint for Pennsylvania, an emerging hub for AI and HPC data center development. This increases the chances of attracting future AI and HPC clients.

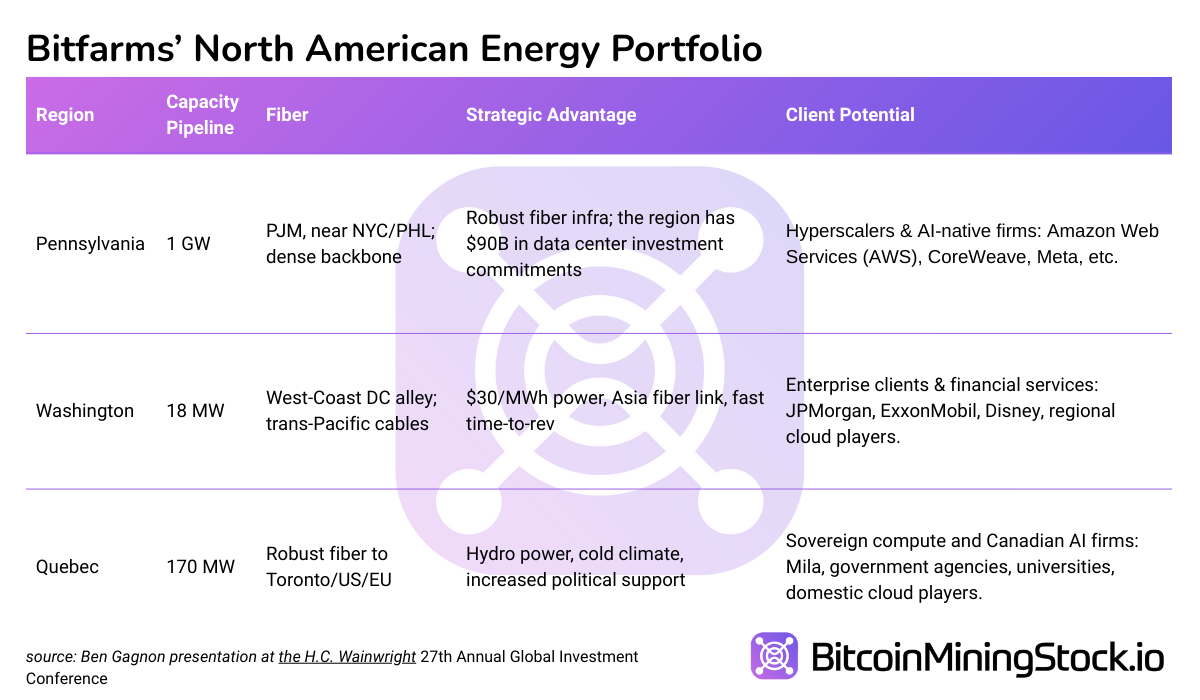

In fact, Pennsylvania, part of the PJM interconnection, is a major region for AI/HPC buildout BitFarms (the company has a 1GW energy pipeline). According to that Latest Investor PresentationsBitFarms is positioned to meet the demand for HPC and AI with cost-based infrastructure from the coast. East (Pennsylvania), West (Washington) and North (Quebec).

Screenshots from BitFarms presentation.

Together, these fiber-connected sites allow BitFarm to provide potential susceptibility workloads on both US coasts and link them to Europe. This network architecture is Important differentiators The company pivots towards the HPC infrastructure.

The following table summarizes the characteristics of each area.

In short, BitFarms has laid a meaningful foundation for HPC and AI pivots, but the initiative remains firmly in place. Pre-profit stage. The next few quarters will be important in determining whether this strategy will mature into a scalable revenue engine or instead become a capital-intensive distraction that will burden your balance sheets without short-term rewards.

Pivot funding

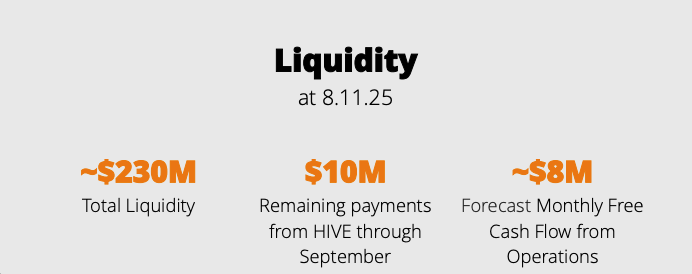

BitFarms funds the transition to HPC through a combination of internal cash flow, asset optimization, and a new credit facility. Part 17.2 EH/S mining fleet generates$8 million per month FCF In the current market. Management continues to sell Bitcoin to fund CAPEX and OPEX, while retaining 1,005 BTC on its balance sheet. By November 11, 2025, Bitfarm’s exit in Argentina will unlock approximately $18 million due to lease releases, liability reductions and the sale of recently imported S21+ miners.

As of August 11th, the company was held ~$230 million liquidity (Cash Plus Encumbered BTC), an additional $10 million is expected from Yguazu/Hive sales and pending miner sales.

Screenshots from BitFarms Fluidity Position Company presentation).

Additionally, BitFarms has secured a Up to $300 million credit facility from Macquarie Funding the Panther Creek Site. The first $50 million was drawn to support early development. The remaining $250 million is tied to construction milestones. Once activated, the structure is converted to non-licors project debt. The facility 8% interest rateIt includes a warrant, a minimum $25 million cash requirement, and a BTC price link agreement. The next tranche is expected for the fourth quarter of 2025 and is subject to progress permission.

Such a funding structure Save flexibility and limit dilutionthere is a timing gap to manage. HPC revenue remains quarterly apart (potentially since 2026). Meanwhile, fellow members like Core Scientific, Terawulf and Applied Digital have already onboarded boarding clients. Running speed, cost management and customer acquisition are key to filling the gap.

Final Thoughts

BitFarms is actively pivoting from global Bitcoin miners to North American energy and computing infrastructure companies. Its US site is close to major textile lines, providing technical viability to support AI hosting workloads from coast to coast* And even Hypotheticallyto Europe for low power costs and favorable geographical locations.

*The “coast to coast” reaches a convincing sound, but requires some grounded perspective. BitFarms’ West Coast presence in Washington only has an capacity of 18 MW. Its North (Quebec) site, although quite large, is subject to regulatory approval before being reused for HPC workloads. This will leave the East as the company’s only HPC-enabled asset with a clear roadmap for now.

However, the transition is early. The company is either ready for purpose-built data centers or has not landed material HPC transactions. Until then, many of the benefits remain ambitious. But insider behavior adds some confidence: the company Share the buyback program CEO Bengangon has it He increased his personal holdings.

For investors with a 12-24 month horizon, BitFarms may present an opportunity for asymmetrical due to their appetite for early-stage infrastructure growth at a deep valued entryway. From advanced recruitment to fiber-enabled properties and incremental funding, its development provides specific reasons to revisit the paper.

Ultimately, it’s your appeal whether or not you want to revalue your stock. However, if BitFarms provides even part of the infrastructure story, the upward case may look quite different from typical Bitcoin mining play.