Ether Lee is once again trading at a decisive level after returning the $ 4,000 mark, the area that traders and analysts are closely watched. Bulls defended the $ 4,100 area, showing a few weeks of volatile price change. However, the amount of exercise remains weak and the ETH is required to promote more than a higher resistance level to confirm that the trend is in progress. Without such a failure, the risk of new integration remains on the table.

Despite the uncertainty of price behaviors, warm chain data provides more constructive views on the market. Fresh figures show that whales keep accumulating ETH while wider emotions are shaken. This steady capital inflow from large -scale holders enhances the idea that Ether Leeum’s long -term outlook and the recent modifications can show opportunities rather than weaknesses.

This accumulation has been preceded during the historically renewed intensity, as deep -fixes investors tend to build positions at the stage of market doubt. If ETH can maintain more than $ 4,100 and build momentum, whale activities can provide the support needed to create more powerful recovery. Currently, all gaze remains in the ability to maintain this important level and challenge higher resistance zones.

Whale activities indicate trust in Ether Leeum

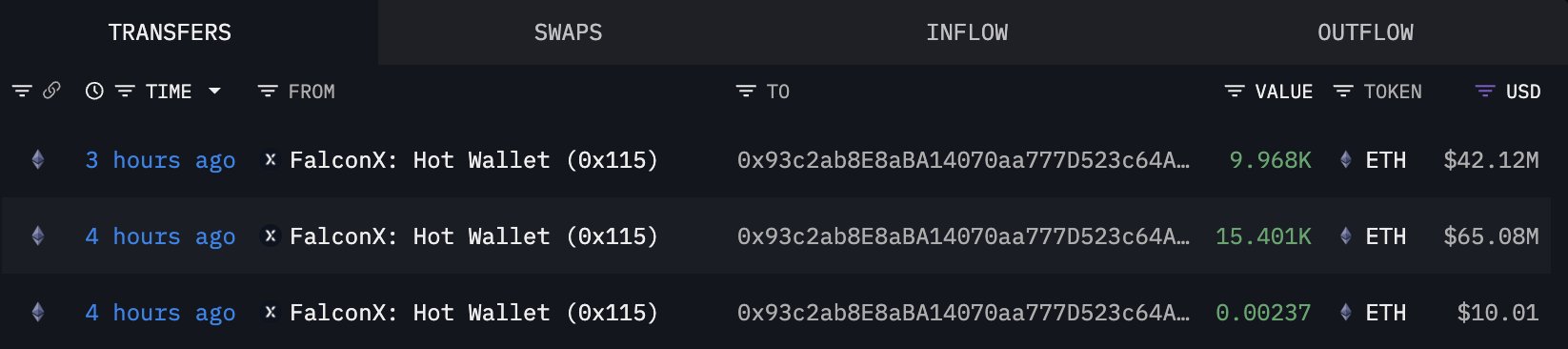

Ether Lee’s recent price behavior is uncertain, but whale behavior tells different stories. According to Lookonchain’s chain data, large -scale holders continue to accumulate ETH despite the recent decline. In the last few hours, two major transactions have emphasized this continuous trend.

0x93C2, a newly created wallet that analysts can belong to Bitmine, received 25,369 ETHs of about $ 178.74 million from Falconx three hours ago. This large influx of fresh wallets suggests strategic accumulation and can be for long -term holding or staying rather than short -term transactions. At the same time, another new wallet, 0x6F9B, withdrew 4,985 ETH (about $ 21 million) from OKX one hour later. This movement is often considered optimistic because it reduces the supply of the exchange and limits immediate sales pressure.

This pattern emphasizes wider market mechanics. Retailers and small participants respond to short -term volatility, but whales seem to see modifications as an opportunity. Their accumulation not only shows the confidence in Ether Lee’s elasticity, but also signals preparations for future price audits. Historically, consistent whale inflows with fresh wallets coincide with the timing of structural support and final recovery.

ETH is having difficulty in reclaiming $ 4,200.

Ether Lee is traded near $ 4,138 after a lot of fluctuations, which was traded at less than $ 4,000 before the price was short of $ 4,000. The 8-hour chart emphasizes recovery attempts, but the ETH is now facing a significant resistance of about $ 4,200, where the average of 100-period and 200-period (red) moving average converges. This confluence creates a heavy supply area where the bull needs to overcome to check the bigger momentum.

Recently, the decline in the range of $ 4,600 to $ 4,800 has been weak in Ether Lee, and the pressure has been strengthened during the fall. Rebound shows elasticity, but price behavior keeps the emotion carefully due to overhead resistance. Returning the previous 50 -period moving average (blue) is having a hard time reversing the short -term weak momentum.

In the disadvantages, the $ 4,000 mark plays the first important role. The failure below that level can be exposed to ETH again for $ 3,800 or $ 3,600, wherein the demand may be more powerful. Currently, Etherrium transactions are traded at the integration stage, and the next decisive movement will depend on whether the bull can force a brake out of $ 4,200 or more. The higher the cleaner movement, the more you open the door for $ 4,400, and the risk of rejection will have a renewed downward pressure.

DALL-E’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.