ETH government bonds are considered the most influential reserve, as corporate purchases account for nearly 5% of the total supply. ETH could provide not only passive income but also governance rights to DAT companies.

Digital Asset Treasury (DAT), which accumulates ETH, may be the most influential entity. Towards the end of 2025, DAT companies will hold nearly 5% of the ETH supply, a much higher share compared to other types of government bonds.

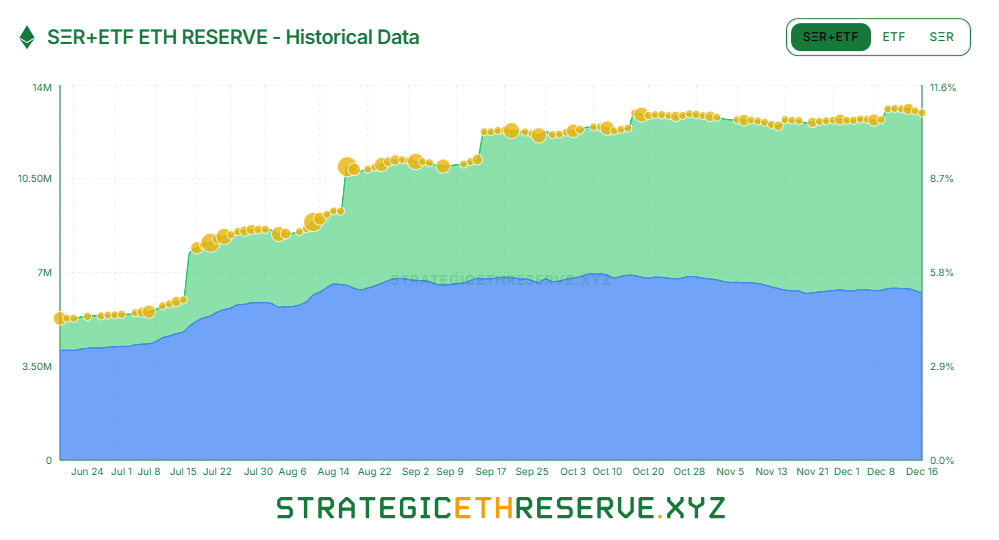

Although the growth of the ETH treasury is slow, it could become highly influential as the token is used for liquid staking. |Source: Strategic ETH Reserve

Government bonds control 4.7% of supply and are expected to increase further in the coming months. Approximately 70% of that supply is in Bitmine (BMNR) reserves. The main treasury itself aims to hold 5% of all ETH in circulation.

Bitmine remains a major ETH reserve purchaser

Bitmine continues to be the most regular purchaser over the past few weeks. The company recorded five large ETH purchases in the last month, expanding its treasury by 13.2%.

At the same time, past government bonds are also being sold. Status, one of the largest ICOs of 2017, sold 6.2% of its treasury while still holding 11.2K ETH.

Bitmine currently holds some of the largest concentrations of ETH, or approximately 3.78% of the supply. The company is ahead of exchanges and whale wallets when it comes to staking, liquid staking, or other wrapped ETH formats.

For now, Bitmine passively holds ETH, but the company recently shared that staking could start in 2026. Bitmine has run a high-profile validator and shared plans to build a US-focused staking network. As a validator, Bitmine could potentially extract even larger stakes of ETH under its influence.

Solana stakers will likely form a similar, albeit smaller, set of validators compared to ETH. Validators can then gain influence and provide additional passive income.

Unlike other treasuries, ETH and SOL treasuries have utility while also supporting network security.

ETH crashes below $3,000 as market remains scared

ETH is one of the least volatile financial assets. Nevertheless, in the short term, ETH is under pressure from selling and bearish expectations.

After a recent week of market weakness, ETH has once again fallen below $3,000 in the past few days. The token fell to a one-week low of $2,942.40.

Despite the accumulation by whales, ETH is also feeling selling pressure from ETFs and older holders. BlackRock was recently deposited $220 million Moving your ETH to Coinbase Prime could increase selling pressure.

Another large whale galore Ended His spot position is over 10,000 ETH. This sell-off offsets an additional $140 million in Bitcoin’s recent ETH purchases. Buying on the edge signals long-term confidence, but in the short term sellers can cause prices to crash and cause liquidations. ETH continues to trade with uncertain sentiment as the use cases and utility of cryptocurrencies are being re-evaluated.