Ripple’s Swell 2025 conference in New York may have marked one of the most defining moments in the relationship between the digital asset industry and Wall Street. The XRP community in particular got some long-awaited validation.

Maxwell Stein from BlackRock’s digital assets team told the audience in his keynote that “the market is ready for blockchain adoption at scale” and that Ripple’s infrastructure could soon move trillions of dollars on-chain.

BlackRock Validates Ripple in Swell 2025 — Cheers to the XRP Community

Stein praised early industry builders like Ripple for proving the real-world utility of blockchain, not just as a speculative concept but as a functional layer of financial infrastructure.

“They’re already tokenizing bonds, bonds, stablecoins…that’s a start. But this is a rail for trillions of capital flows,” Stein said.

BlackRock executives publicly praised Ripple for helping prove blockchain’s real-world functionality, marking a milestone in a story that XRP holders have championed for years.

The comment came like a thunderclap for a community that has long argued that Ripple’s technology supports institutional liquidity.

The XRP community has long held to the belief that Ripple’s technology acts as a bridge between traditional finance and the decentralized economy.

Following Mr. Stein’s remarks, XRP supporters across Twitter viewed the remarks as a much-needed validation from the world’s largest asset manager.

🚨Breaking news: BlackRock exec on Ripple swell: “The market is ready — trillions of dollars coming on-chain” 💥

This might have been the most emotional moment of @Ripple Swell 2025.

Maxwell Stein, president of @BlackRock, took to the stage and spoke candidly about what everyone has been up to… pic.twitter.com/OpuysMrq47— Diana (@InvestWithD) November 4, 2025

“We have seen what the early adopters of cryptocurrencies have done. They showed us what is possible, and now the market is ready for broader adoption,” he added.

His statement highlighted a shift in tone from TradFi that blockchain is no longer an experiment. Rather, it is the new normal.

Legal caution and institutional clarity tempers the hype

But the ensuing excitement was tempered by legal caution. Bill Morgan, an Australian lawyer and prominent XRP supporter, was one of the first to question Stein’s comments. He wondered if they reflected BlackRock’s official position or were simply Stein’s personal opinions.

“Very interesting…but was he speaking in a personal capacity or on behalf of BlackRock?” Morgan posted on X.

What is at stake? This question resonated deeply. If Stein’s statement signals BlackRock’s strategic confidence in tokenized finance, it could be one of the clearest signs yet that institutional adoption is imminent.

Personally, this remains a strong but unofficial endorsement of Ripple and the direction of blockchain.

At the same event, Nasdaq President and CEO Adena Friedman said the digital asset market is clearly maturing. However, she also acknowledged that regulatory clarity is essential for serious institutional participation.

He noted that banks are already experimenting with tokenized bonds and stablecoin frameworks, and stressed that “we need regulatory clarity to allow banks to fully participate in the market.”

Together, Stein and Friedman’s comments painted a picture of convergence where TradFi, blockchain, and regulation work together.

Ripple’s “Swell 2025” conference, once an industry event primarily for crypto insiders, became the stage for some of the most influential voices in global finance to signal preparations for consolidation.

Despite these developments, Ripple’s price remains depressed as the network’s institutional trading expands and XRP’s adoption explodes.

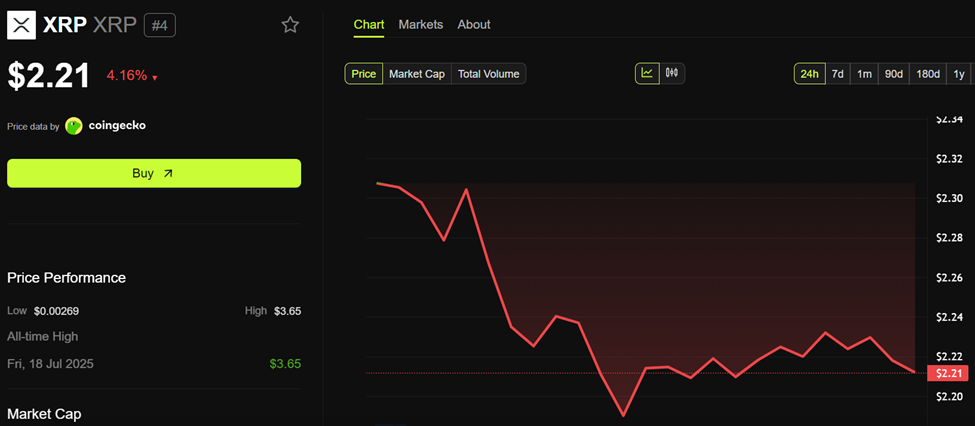

Ripple (XRP) price performance. Source: BeInCrypto

In the past 24 hours, XRP price has fallen by more than 4%. At the time of writing, it was trading at $2.21.

The post What BlackRock has in store for the XRP community appeared first on BeInCrypto.