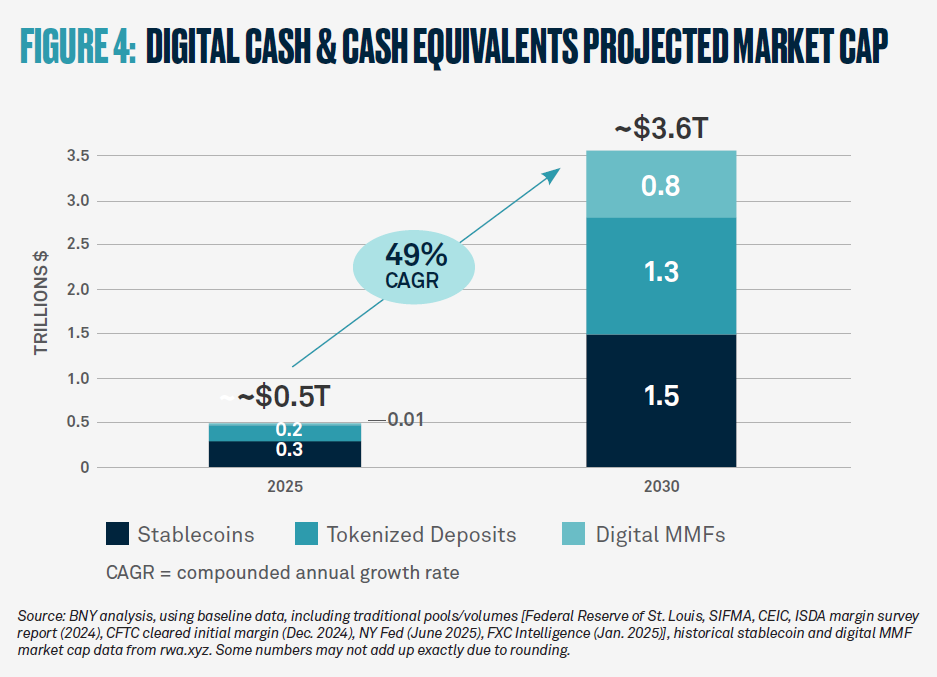

Stablecoins and other forms of tokenized cash could grow to $3.6 trillion by 2030, according to a new report released by financial services giant BNY.

The financial services giant said on Monday that stablecoins alone could reach a market capitalization of $1.5 trillion by the end of this decade, with tokenized deposits and money market funds contributing the rest.

These products, collectively referred to as digital cash equivalents, were seen as tools to enable faster settlements, reduce counterparty risk, and improve the liquidity of collateral across markets.

Stablecoins, tokenized deposits, and digital MMFs market size projected to reach $3.6 trillion (BNY)

The report highlighted that tokenized assets such as US Treasuries and bank deposits could help financial institutions optimize collateral management and streamline reporting processes. For example, pension funds may one day use tokenized money market funds to margin derivatives contracts almost instantly, but BNY says this scenario could become more common as the system evolves.

The report notes that regulation remains an important factor. The bank pointed to the EU’s MiCA bill and ongoing policy activity in the US and Asia-Pacific region as signs that the regulatory environment is maturing in a way that can support both innovation and market stability.

“We are at a powerful tipping point that has the potential to fundamentally change how global capital markets function and how participants transact,” said Carolyn Weinberg, chief product and innovation officer at BNY.

She envisioned a future where blockchain worked alongside traditional rails, rather than replacing them. “The combination of traditional and digital has the potential to be powerfully key for our customers and the world,” she added.