21 capitals, Bitcoin

The contribution led by Tether as part of the existing arrangement, bringing 21 total ownership to over $5 billion at current prices, positioning it as the third largest company Bitcoin Treasury, behind MicroStrategy and Tesla.

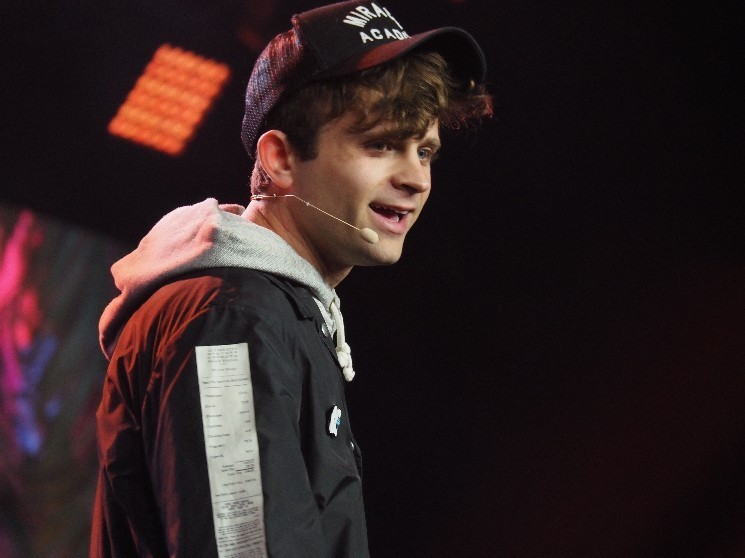

Two CEOs Jack Mullers, who also lead Bitcoin-centric payment app Strike, tied their accumulation strategy to a fixed supply of Bitcoin in an interview with Bloomberg TV on Tuesday.

He said price rise could accelerate as institutional and sovereign buyers compete for limited supply.

“If you need more Bitcoin, don’t go to Bitcoin Factory. You have to raise the price,” he said. “Is 120,000 enough bitcoin? No, okay. 130k, 140k, 150k?”

Mallers suggested that increasing demand from ETFs and possibly increased demand from nation-states could force rapid price discoveries.

“Bitcoin is not flexible in demand,” he said, adding that market participants “find the supply they are looking for, they need to get it at a higher price.”

The company will also introduce a “Bitcoin per Bitcoin” metric to allow investors to track their holdings directly, not through revenue.

Tether and Bitfinex remain the majority owners of 21 since the listing, and Softbank holds minority shareholders. The shares are expected to trade under the ticker “XXI” upon completion of the transaction, with restrictions and shareholder approvals.

The company says all possessions will be auditable in real time via on-chain spare proofs.

Read more: Donald Trump’s “The Golden Age of Crypto” comes into play in the White House Working Group Report