Bitcoin prices today are trading nearly $101,200 after a volatile weekend session in which buyers defend a vital liquidity pocket of over $100,000. With the option expiration date approaching June 27th, price action reflects tightening of conditions as bulls and bears collide near major technology zones.

The wider structure remains in the range at the higher time frame, while the lower time frame reveals that it weakens the signs of bullish momentum and increased volatility.

What will happen to Bitcoin prices?

BTC price forecast (source: TradingView)

As of June 23, 2025, Bitcoin prices are under pressure following a denial from the $105,200 zone. This fits both trendline resistance and previous order blocks. Prices are just above $101,000 after sweeping out the key support cluster on June 21, with sellers remaining under $103,000.

BTC price forecast (source: TradingView)

The recent rejection marks a third unsuccessful attempt this month, exceeding $106,000. On the 12-hour and daily charts, the BTC structure remains neutral to baring, with price trading below all major EMAs (20/50/100/200). This alignment forms a bearish cluster that suggests that sellers continue to control short-term trends.

The current Bitcoin price action coincides with the massive sell-side liquidity seen at around $105,000-$106,000. If the price cannot retrieve this zone prior to the June 27th option’s expiration date, we cannot rule out additional downside pressure on a support base of between $98,000 and $100,000.

Bitcoin price action faces rejection with important resistance

BTC price forecast (source: TradingView)

The four-hour chart reveals a clear downward trend since its peak in mid-June. Bitcoin consistently prints low highs, with prices trapped under a drop trend line that has been tested multiple times without checking breakouts.

A series of order blocks between $104,200 and $106,400 serve as a powerful overhead resistance. The latest attempt to break through this zone failed, with a sharp core refusal back to $101,000.

Furthermore, the Bollinger bands in this time frame narrow down the expansion following expansion, a common precursor to strong directional movements. Price refusals in the upper band on June 21 suggest that sellers are actively defending the rally.

Momentum indicators show bearish pressure first

BTC price forecast (source: TradingView)

On the 2-hour and 30-minute chart, momentum indicators continue to support the bear. The RSI is broken below 40, remaining in the weak zone, with the MACD histograms for both time frames turning red, indicating bullish loss. The hidden bearish divergence of RSI can be observed when comparing its recent swing high of nearly $104,000 with previous peaks.

BTC price forecast (source: TradingView)

The 4-hour super trend remains in bearish mode, with resistance pinned at $105,207. The DMI indicator on the 4-hour chart highlights the dominant -DI intensity at +DI at 33.18 vs. 15.21 at 15.21, with ADX rising to 25, suggesting an increase in directional bearish momentum.

These signals are consistent with short-term traders’ concerns about future options expiration dates.

Exchange flow and optional data check for bearish bias

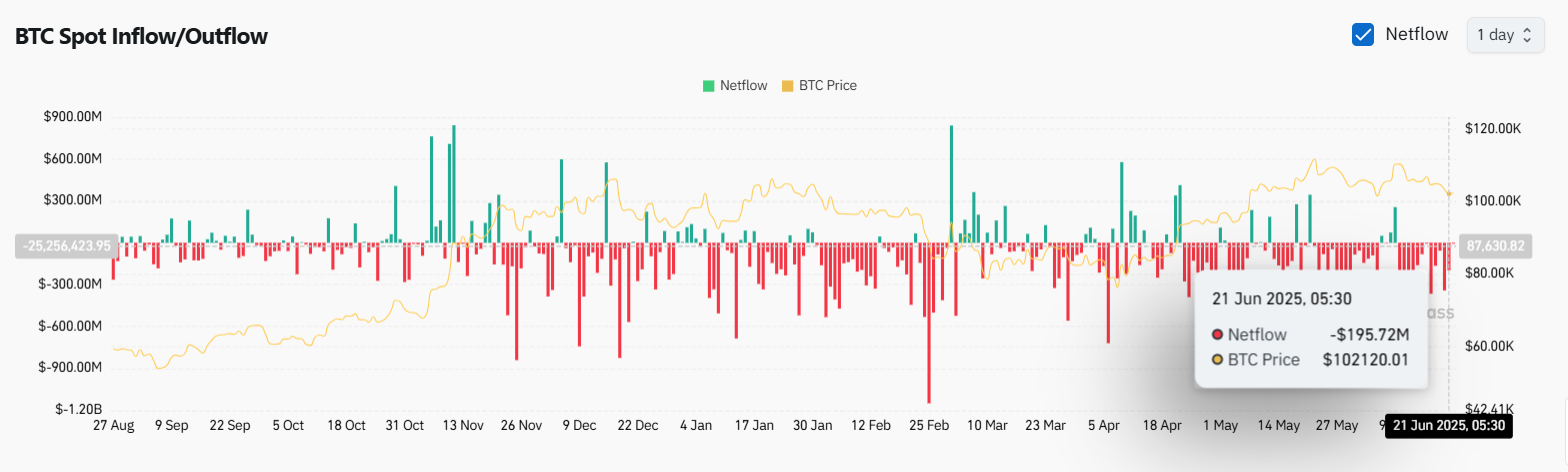

BTC Net Inflow/Outflow (Source: Coinglass)

On June 21, a net Bitcoin price leak was recorded in excess of $19,572 million, with BTC priced at around $101,200 at the time, according to on-chain exchange data. This negative Netflow reflects risk-off sentiment as it is likely to shift ahead of the expected volatility at the June 27th option expiration date.

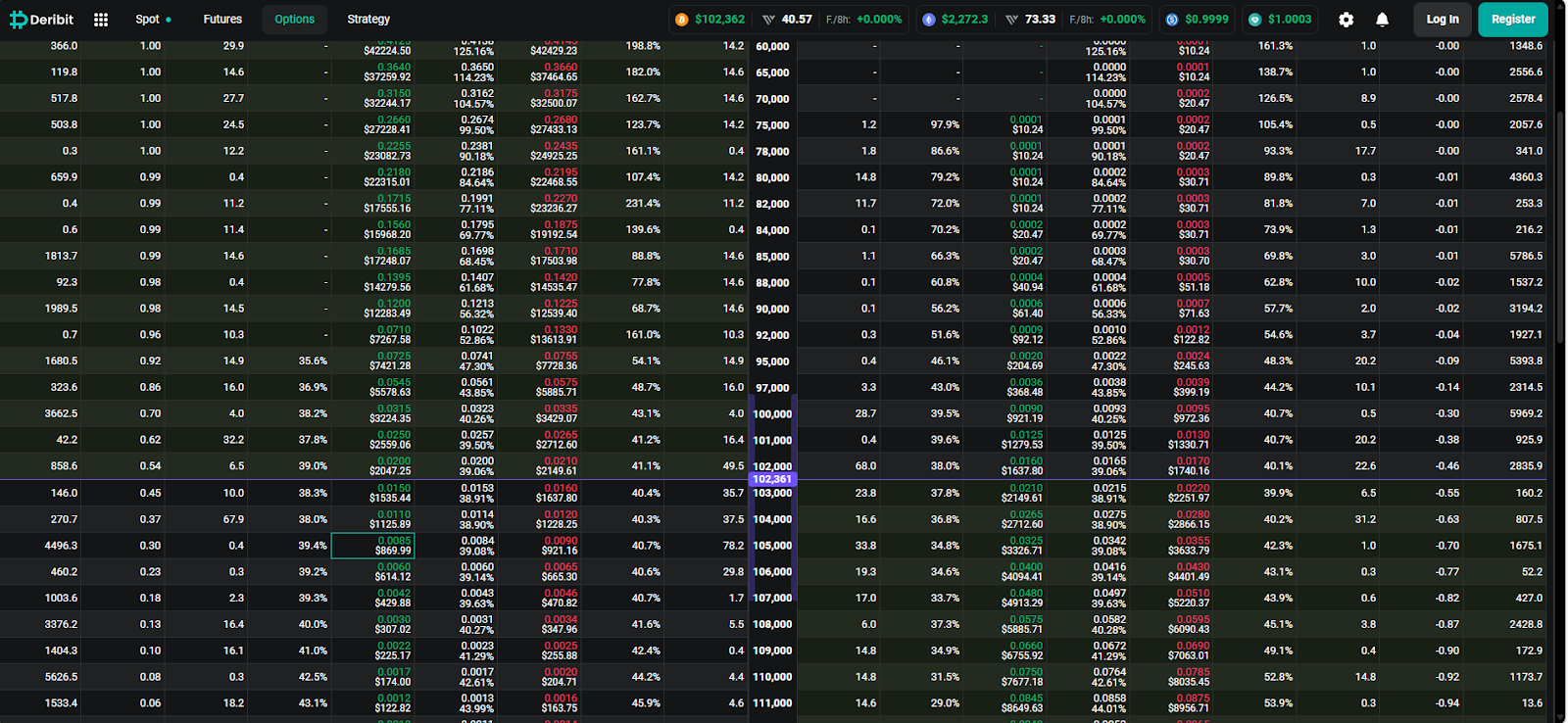

BTC option chain data (source: DELIBIT)

From a derivatives perspective, Open Interest remains heavily skewed towards Puts on a $100,000 strike, giving strong market forecasts for further downsides unless BTC can quickly recover its $105,000 zone. This adds pressure to the bull to set up a meaningful bounce early in the week.

Why is Bitcoin price dropping today?

BTC price forecast (source: TradingView)

Bitcoin prices today are declining due to several compounding factors. First, the technical resistance between $104,200 and $106,000 remains solid. Second, key momentum indicators such as RSI and MACD changed bearish over multiple time frames. Third, the June 27th option Expiry will introduce recent volatility and promote the position of risk aversion.

Finally, bearish domination over the flow of DMI indicators and negative spot exchanges adds weight to potential short-term pullbacks.

Until BTC is able to support $105,200, the rescue return could be met with new sales pressure.

Short-term outlook and technical forecasts

BTC must be decisively damaged beyond $105,200 and disable the bearish setup beyond trendline resistance. Otherwise, the negative side goal will remain at $100,000 and $98,400 play. A breakdown below $98,000 could open the door to retesting demand zones between $95,700 and $96,300. If a breakout occurs, the upward targets remain at $106,400 and $108,000.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.