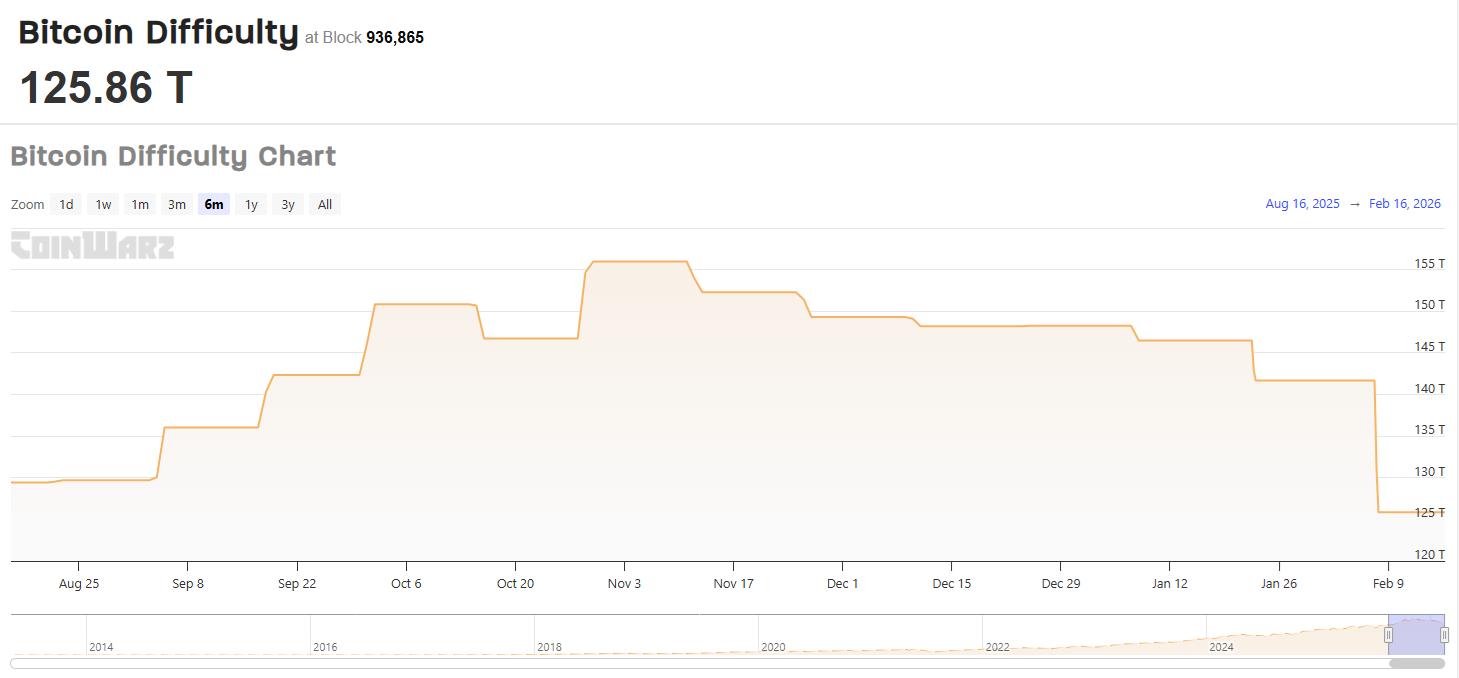

The recent mining slowdown has led to the largest decline in mining difficulty in six months. This shift gives current miners some breathing room. $BTC Still below $70,000.

$BTC After the latest recalculation, mining showed the largest single decrease in difficulty. Difficulty has fallen to its lowest level since August 2025, the biggest drop in six months.

Latest $BTC Difficulty calculations deteriorated sharply, reflecting seasonal shutdowns and unviable miners leaving the market. |Source: CoinWarz.

The decrease in difficulty is a combination of seasonal shutdowns and unprofitable shutdowns and decisions by some miners not to mine. Difficulty metrics are still relatively close to all-time highs, and some miners are struggling.

For now, most of the large pools are showing solid activity, but mining companies with older data centers have not slowed down their hashrate. The slowdown also reflects a weakening $BTC The market price remained at $68,841.76.

intention $BTC Do miners still support the network?

$BTC There are enough miners to overcome the current difficulty level. So far, neither of the more difficult two-week periods has slowed the chain. Unlike smaller networks like Bitcoin Cash, the main $BTC Chains do not require short-term difficulty re-evaluation.

some pools, mara(.)comthe hashrate did not drop at all and remained at 61.7 EH/s. The biggest gainer was Foundry USA, which aggregates hashrate for US-based miners.

After difficulty recalculation, some data shows a V-shaped recovery in mining. Current changes in mining conditions have the potential to eliminate small-scale operations and place even more influence in the hands of professional miners.

According to recent data $BTC Mining is still difficult because the output price is higher than the market price. hash ribbon The situation indicates a historic price bottom. The current period of mining recession is the longest since the 2021 market correction.

why $BTC Is the price impossible to mine?

At the current price range, miners can sell some of their older holdings that were mined at lower prices. $BTC Mine reserves fell from 1.89 million to 1.8 million, with short-term selling also putting pressure on prices $BTC.

Average cost to mine one $BTC Depending on the methodology, they range from $74,000 to $87,000. In addition, the full cost may include the cost of depreciation and credits for the new machine.

Based on a rough estimate of mining activity, the cutoff price miners will suffer is $35,000 per transaction. $BTC.

Nevertheless, stocks like IREN reflect the future expansion of AI data centers. IREN is trading at $42.22, close to its highs in recent months. MARA has recovered from recent lows to $7.92. Riot Platforms and Hut8 also maintain their positions.

$BTC Mining is once again being questioned as a tool, especially after the further halving. Currently, network fees are too low to cover the cost of mining, creating long-term network security issues.