Bitcoin has broken above the ATH in the $125,000 region, showing strong momentum.

Nevertheless, the market is currently entering a decisive phase. At this stage, a consolidation or short-term retracement could form the next significant directional move.

Bitcoin price analysis: technology

by Shayan

daily chart

On the daily time frame, BTC has broken above a flag pattern that has seen limited price action since July, confirming the continuation of a strong trend. The move above the upper boundary coincided with a surge in momentum that carried about $124,000 to $126,000 into the previous supply zone to the previous supply zone where sellers began to show mild resistance.

The bullish structure remains intact and is supported by the golden cross between the 100-day and 200-day moving average, which continues to act as a dynamic support line. As long as the price stays above $120,000, the broader uptrend remains valid, and a clean daily closure above $126K could pave the way for $130,000 to $132,000 in the near term.

However, failure to break above $120K could trigger a healthy retracement to midrange support near $115,000, which coincides with the breakout structure and the 0.618 Fibonacci retracement.

4 hour chart

The 4-hour chart shows BTC recently increasing past the $118,000 decision point, turning into a breaker block, and quickly consolidating towards the ATH zone around $125,000 or so. The impulsive nature of this move created a clear imbalance where a potential retracement zone was identified between $115,000 and $113,000, cooperating with the Fibonacci confluence level (ranging from 0.618 to 0.702).

This zone acts as a short-term reaccumulation area, and holding above it confirms continued bullish control. The market is currently consolidating near an area of high liquidity density, suggesting a short pullback could attract fresh buying rights before the next leg moves higher.

If price does not adhere to the $118,000 breakout block and the $113,000 to $115,000 Fibonacci range, the next major demand will be around 109,000 to 110 kk, where the previously strong buy started the breakout.

sentiment analysis

by Shayan

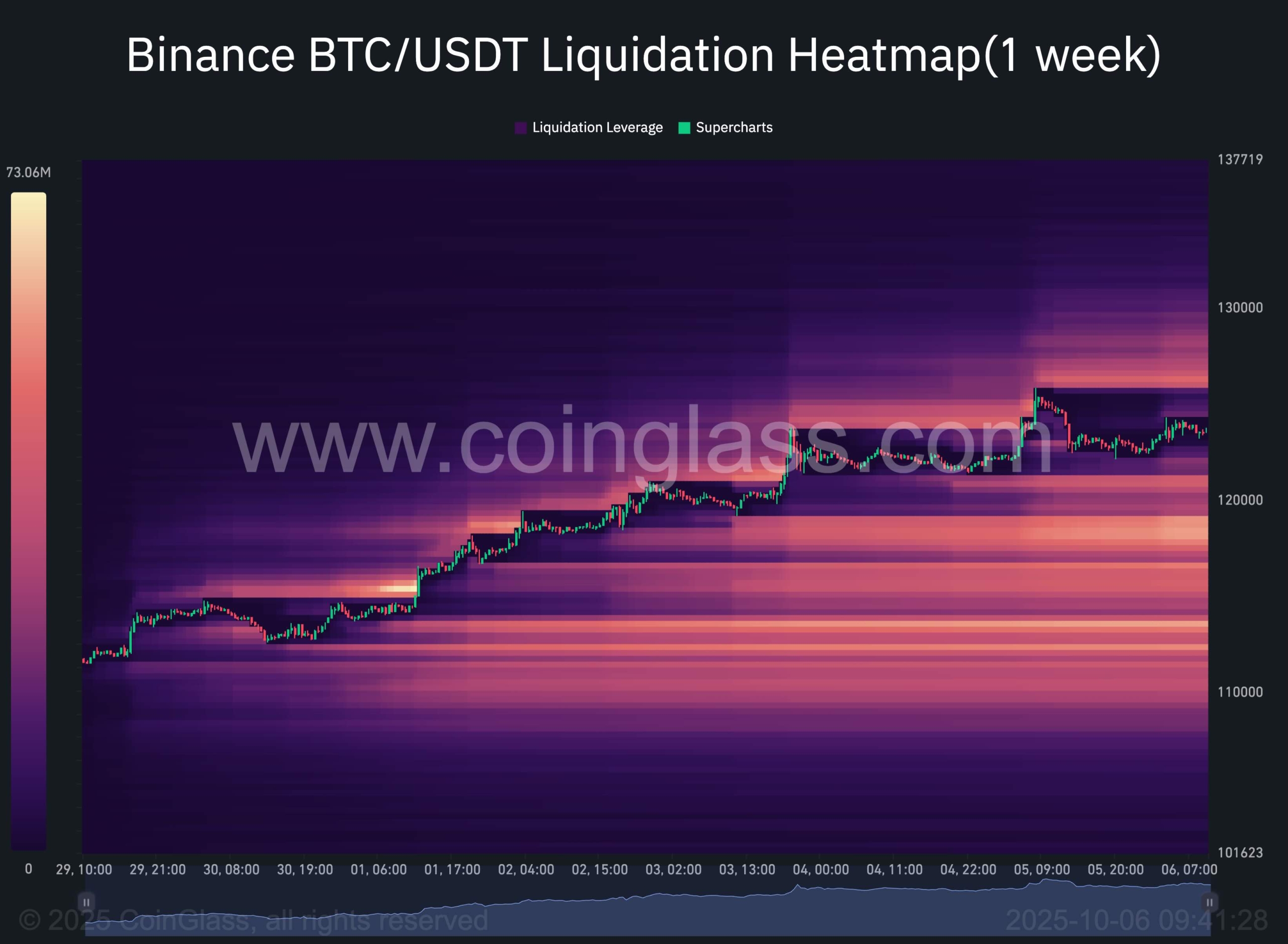

The latest week-long Binance liquidation heatmap reveals a significant accumulation of liquidity zones, with a particularly dense liquidation cluster forming around $128,000-$130,000. These areas of high density indicate where large amounts of leveraged short positions have accumulated, setting ideal targets for a potential price continuation or liquidity sweep.

From the recent rally through $110,000 to over $123,000, we can observe a steady absorption of upward liquidity with each upward impulse clearing previous short positions before consolidating. The presence of a major liquidation pocket below current prices, especially around the $120K region, highlights that downside risk is also in play in the short term, suggesting that the market remains poised for a pullback or correction before the next move.

This shift reflects a market positioning bias with late sellers entering shorts near resistance, allowing Bitcoin room to rise from $128,000 to $130,000 as those positions are forced to close.

If price maintains a foothold above $120K, we may see a short continuation of the squeeze into the upper liquidity band before a meaningful retrace occurs.