table of contents

What does the Perp DEX situation look like now? What is Aster and how does it work? What is Aster aiming for? What is holding it back? So can it happen?

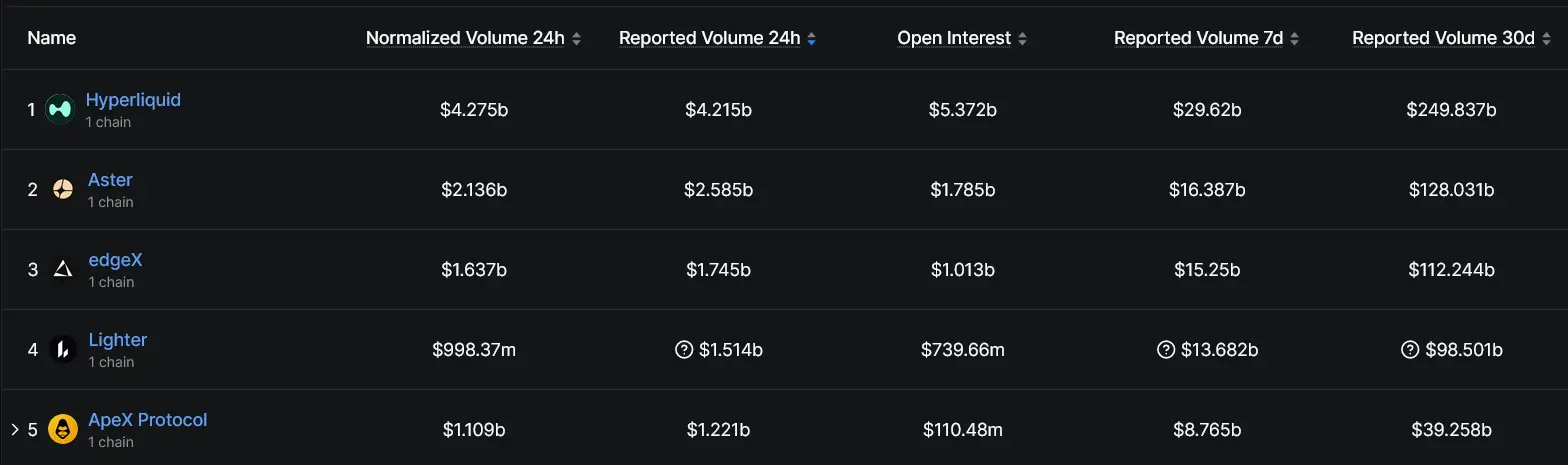

aster is the second-largest perpetual futures DEX by daily volume, and it’s not slowing down. With a normalized 24-hour volume of $2.136 billion and a multi-chain strategy that puts CZ in the corner and sets it apart, Aster has a solid shot at the top spot. However, Hyperliquid still maintains a comfortable lead at $4.275 billion per day, leaving questions about the sustainability of trading volumes. It’s here >What is the current status of Perp DEX?

The decentralized perpetual futures market has serious consequences. Total 24-hour volume across all protocols is $19.121 billion and open interest is $13.41 billion as of February 20, 2026.

superfluidity dominates the list with daily trading volume of $4.275 billion and open interest of $5.249 billion. Aster follows in second place with a daily value of $2.136 billion and an open interest of $1.771 billion. Behind them, edgeX ($1.637 billion), Lighter ($980 million), and ApeX Protocol ($1.19 billion) round out the top five.

Aster’s 24-hour trading volume represents approximately 11% of the total PERP DEX market. Weekly trading volume reached $16.387 billion, which is still behind Hyperliquid’s $29.62 billion, but shows consistent upward momentum. Cumulative transaction value overall exceeds $4 trillion, and daily fees have ranged from $13 million to $100 million in recent months.

This platform has already upset Hyperliquid many times to take the top spot. In October 2025, Astor recorded a 24-hour trading volume of $41.7 billion. In November, it again reached $12 billion in a single day. These spikes are not sustained, but prove that the infrastructure can handle the load.

Perp Volume Top 5 (defillama.com)

What is Aster and how does it work?

Aster was launched in late 2024 through the merger of yield protocol Astherus and perpetual trading platform APX Finance. Works across the entire range $BNB Chain, Ethereum, Solana, and Arbitrum offer both spot and perpetual trading with up to 1001x leverage.

3 trading modes

The platform runs three trading modes. Perpetual mode (Pro) offers an orderbook interface with abundant liquidity and low commissions of 0.01% maker and 0.035% taker. 1001x mode provides on-chain MEV-resistant perpetual trading with one-click execution for high leverage trades. Spot mode handles cross-chain spot transactions.

One of the standout features is Aster’s privacy-focused Hidden Orders, designed to prevent liquidation hunting and MEV extraction. The protocol also supports yield-producing collateral, allowing users to earn while trading.

defletokenomics

tokenomics Lean deflation. $ASTER has a fixed maximum supply and 80% of platform fees go towards buybacks and burns. To date, 177 million tokens (9% of post-write supply) have been burned. Daily buybacks regularly reach between $400,000 and $500,000, and token scarcity is directly related to platform usage.

User numbers look solid on paper. According to the project’s Dune dashboard, it has 9.3 million cumulative users, $1.1 billion in TVL, and $1.8 billion in open interest.

What is Aster aiming for?

Aster’s path to the top rests on several key pillars. It has high-profile backing, a multi-chain strategy that few rivals can match, and a roadmap that continues to give traders a reason to stick around.

CZ factor

The biggest name in Aster’s corner is Zhao Changpeng. CZ provides product and technology advisory support through YZi Labs, in which it holds a minority stake. He personally purchased about $2.09 million. $ASTER The average price is around $0.91, and Aster has publicly stated that it is a “very strong project” that is profitable. $BNB chaineven though they are technically competing Binance.

His involvement moved the market. $ASTER It was launched at approximately $0.08 during the TGE period in September 2025 and hit an all-time high of $2.42. The community widely views the project as “Binance’s DEX,” with CZ’s X posts and appearances on Spaces consistently causing 20-35% rallies.

Multi-chain edge and its next development

Beyond CZ, Aster’s multi-chain approach is a real competitive advantage. Hyperliquid runs on a single chain. Aster supports four types of support to leverage users across $BNB Chain, Ethereum, Solana, Arbitrum. This is important for traders who don’t want to deal with bridging or who already have assets on those networks.

The team continues to ship. Sealed Mode recently reduced entry and exit fees for privacy-focused high-leverage trades to 0.03%, and new equity PERPs like GOOGL and WDC operate with up to 50x leverage, expanding Astor’s commitment to traditional equities alongside cryptocurrencies.

Aster Chain, which will appear in the future, Layer 1 blockchain The mainnet goal is March 2026, which is the next big catalyst. The testnet went live in early February with over 50,000 participants. This focuses on privacy and efficiency, and is in line with CZ’s recent comments that privacy is the “missing piece” of cryptocurrencies. If the chain does well, 24/7 inventory perks could become a core part of the platform’s identity.

Whale accumulation, Coinbase’s listing roadmap, and continued incentive programs like Aster Harvest are keeping the momentum going.

What is it that holds Aster back?

Aster’s numbers look impressive, but dig a little deeper and there are real concerns that could slow its rise.

Questions about volume and quality

The biggest question mark is the quality of the volume. Some of Aster’s numbers can be inflated by airdrop incentives, point farming programs like Rh and Au, or wash deals. In October 2025, DefiLlama temporarily delisted Aster’s PERP trading volume data after discovering a near-perfect 1:1 correlation between Aster’s trading pairs and Binance’s permanent trading volume. The data was later relisted, but there were gaps in historical records and unresolved validation concerns. True adoption metrics such as retention rates and organic growth in open interest remain the numbers to watch.

Hyper liquid moat

Hyper Liquid also has a deep moat. The company’s open interest ($5.249 billion vs. Aster’s $1.771 billion) suggests more stable capital and serious trading activity. Hyperliquid consistently records billions of dollars in daily trading volume without similar spikes or declines, making it a more difficult target than the raw numbers suggest.

$ASTER It is currently trading at about $0.70, down about 71% from its all-time high, and the recent unlocking of 78 million tokens on February 16th (valued at about $58 million) has added new supply pressure. Broader market conditions could further weigh on trading volumes.

There’s also the issue of positioning. Aster targets a different audience than Hyperliquid. This is essentially a CEX-like experience without KYC, but Hyperliquid leans more toward pure DeFi. They may end up coexisting, rather than one replacing the other.

So will it happen?

Aster has backing, technology, and trajectory. If the Aster Chain mainnet delivers on its privacy promise and drives organic adoption, it is not impossible to switch Hyperliquid by mid-2026. However, “can” and “do” are two different things. Sustained organic volume, rather than incentive-driven spikes, will be what separates the real No. 1 from the temporary No. 1.

source:

- DefiLlama Perps Dashboard — Perp DEX protocol volume, open interest, and market share data

- Aster documentation — Protocol details, trading modes and technical features

- Yahoo Finance — YZi Labs, Multi-Chain Strategy, and $ASTER Purchase details

- coin market cap — Aster Platform Overview, Specification Leverage, and Roadmap Milestones

- crypto briefing — Aster Chain Mainnet March 2026 Timeline and Testnet Details

- influential person in the financial world — CZ personal stuff $ASTER Purchase and price implications

- aster dune dashboard — Cumulative user metrics and on-chain activity data