On May 24, 2025, Bitcoin (BTC) was driving along at $109,273, reflecting a considerable rating amidst the aggressive trading session. Its market capitalization was $2.17 trillion, with a 24-hour trading volume of $466.6 billion, and its price vibrated between its peak of $107,156 and $109,840.

Bitcoin

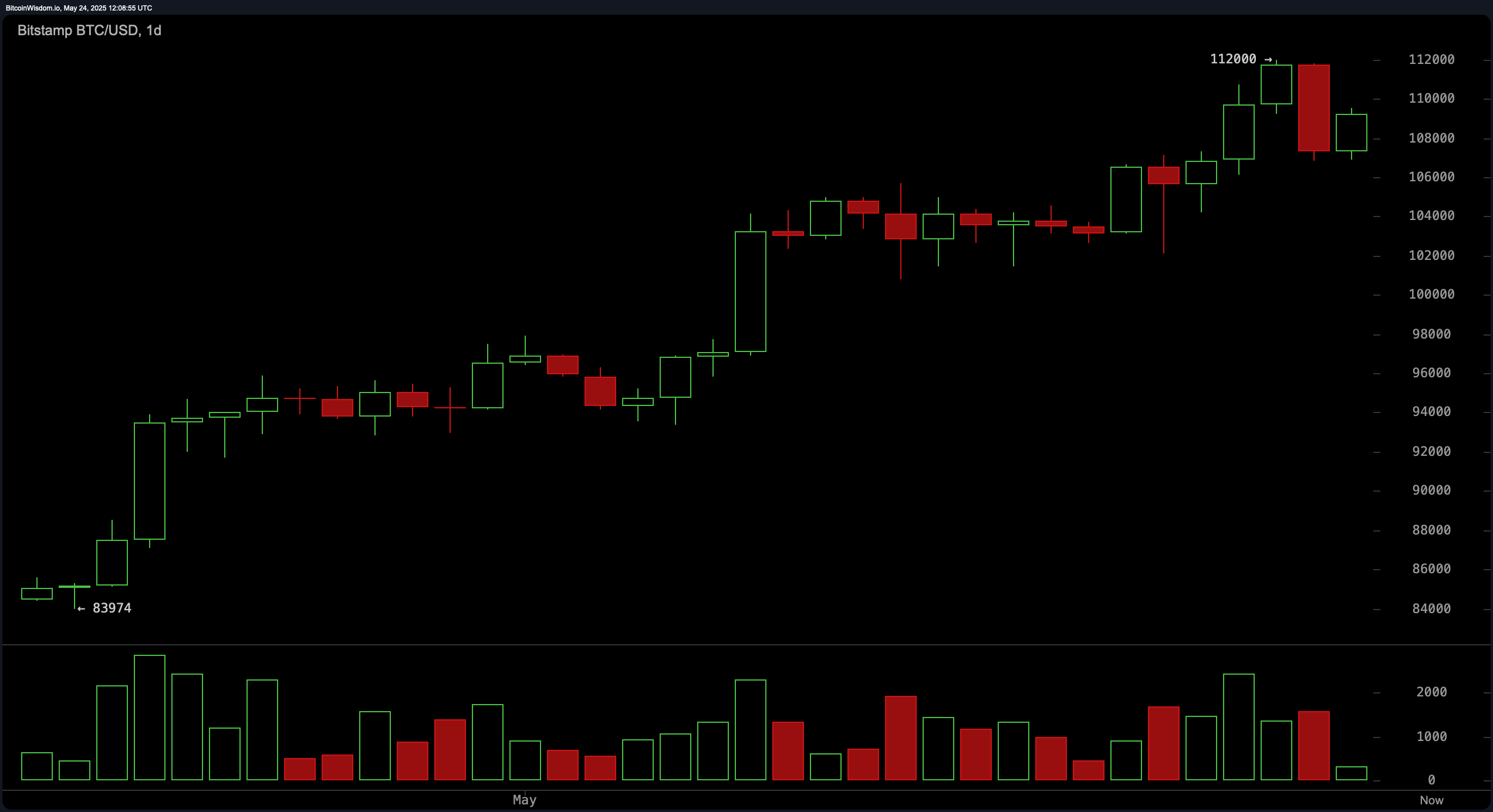

On the daily charts, Bitcoin (BTC) is in a bullish trend despite a retracement from the recent local highs from $112,000. The support zone, which ranges from $98,000 to nearly $100,000, remains important, backed by historic demand earlier this month. Resistance is clearly defined at $112,000, a level where significant sales pressure was generated. The green candles in the first half of the rally were supported by volume, while the red candles on the top signify caution. If Bitcoin prints bullish surveillance candles beyond the $106,000-$107,000 range, traders may consider this a strategic entry point, but the fatigue signal will guarantee an exit of nearly $112,000.

BTC/USD 1-Day Chart via BitStamp on May 24, 2025.

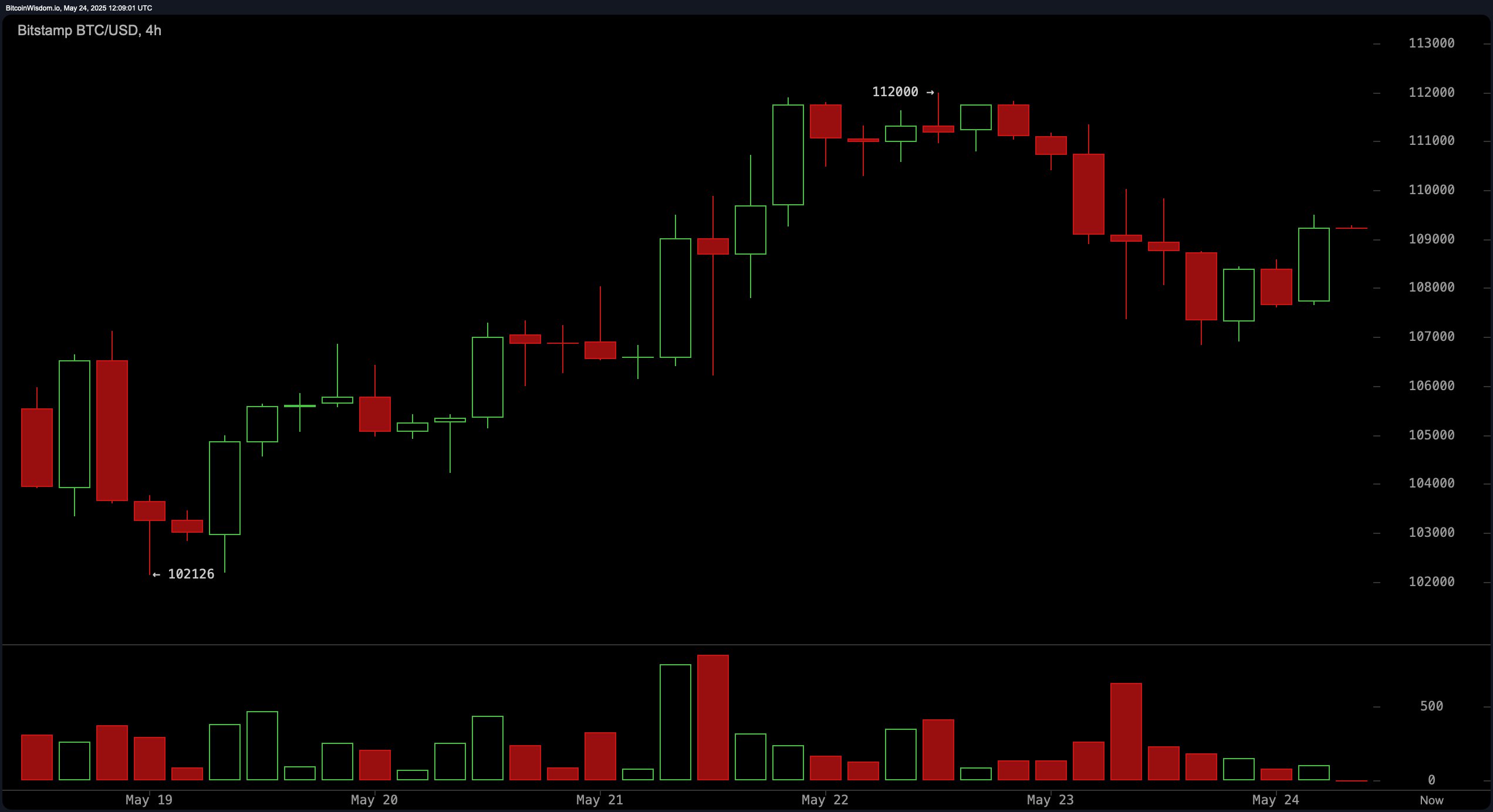

The 4-hour chart presents a story of local corrections and tracks the descending channel after peaking at $112,000. A recovery of over $109,000 is followed by a panic-driven decline, but signal a potential reversal. If Bitcoin exceeds $110,000 and exceeds $110,000 per volume, the technical pattern suggests an upside break. Conversely, if the strengthened bearish threshold below the $108,000, it could indicate a return to the $106,000 level, potentially reintroducing market attention.

BTC/USD 4-hour chart via BitStamp on May 24, 2025.

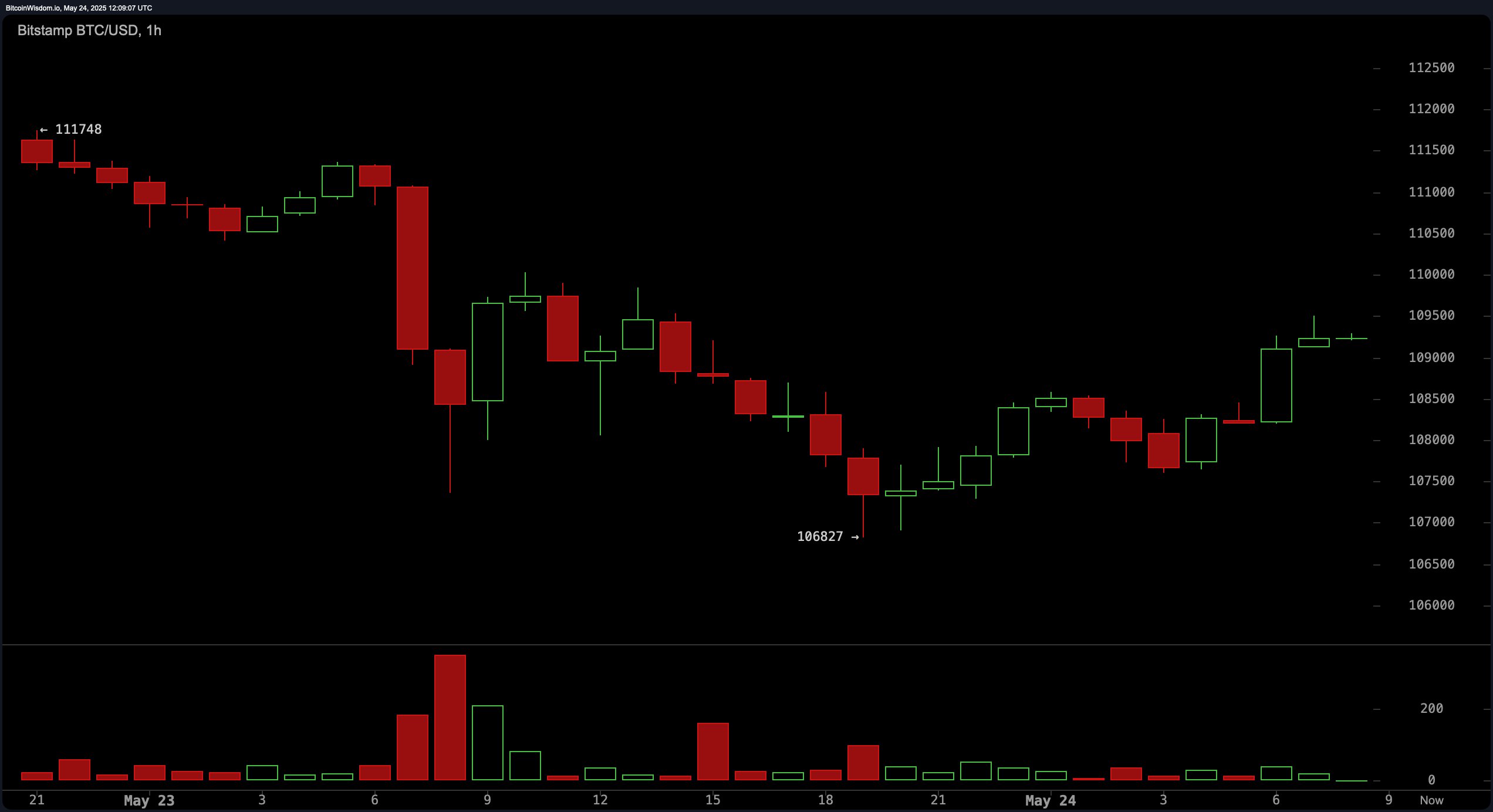

The short-term price action for the 1-hour chart rapidly declines from $111,748 to $106,827, followed by a gradual rebound. The new reverse head and shoulder pattern, characterized by right shoulder formation, supports bullish recent outlook. Breakout confirmations range between $109,500 and $110,000. If Bitcoin falls below $108,000 in prominent sell-side activity and falls below $108,000, this negates the pre-reversal premise and suggests a new bearish momentum.

BTC/USD 1-hour chart via BitStamp on May 24, 2025.

The oscillator measurements are mixed, suggesting a market in equilibrium. A mean directional index (ADX) for 66 relative strength index (RSI), 77 probabilistic, and 33 signals neutrality. However, a momentum oscillator of 5,747 and a moving average convergence divergence (MACD) of 4,016 exhibit bullish bias, while a commodity channel index (CCI) of 113 flashes the sell signal, meaning excessive conditions. A great oscillator supports a wider neutral sentiment.

Moving averages paint a strong, bullish background. All short-term to long-term exponential moving averages (EMA) and simple moving averages (SMA) show positive conditions, from 10-period EMA to 107,056 Emma to 200-period EMA at $89,495. This alignment suggests that the overall trend remains upward despite short-term corrections. The confluence of bullish signals across multiple time frames affirms investor confidence and affirms Bitcoin for further profit if the main resistance level is destroyed with a strong confirmation.

Bull Verdict:

Bitcoin’s price action remains supported by strong technical support and consistent purchase signals across all major moving averages. If the volume check exceeds $110,000, the stage will be set above the $112,000 resistance and potentially beyond resistance. The broader trend is bullish, and momentum indicators suggest continuous continuity.

Bear Verdict:

Despite the general bullish structure, caution is required. Failure to maintain support above $108,000, especially with increasing selling volume, could result in a deeper pullback to under $106,000. Mixed oscillator signal and $112,000 overhead resistance enhance the risk of short-term fatigue and reversal.