This week, traders have entered a shortened holiday session with fewer catalysts but a handful of meaningful macro data points. U.S. stock market takes early break for Christmas, but upcoming GDP releases, consumer confidence surveys, and unemployment claims still carry enough weight to make an impact cryptocurrency market. In such low trading volume situations, even small changes in risk appetite can be affected. ethereum price We will decide on a direction by the end of the year.

Ethereum price prediction: current market structure

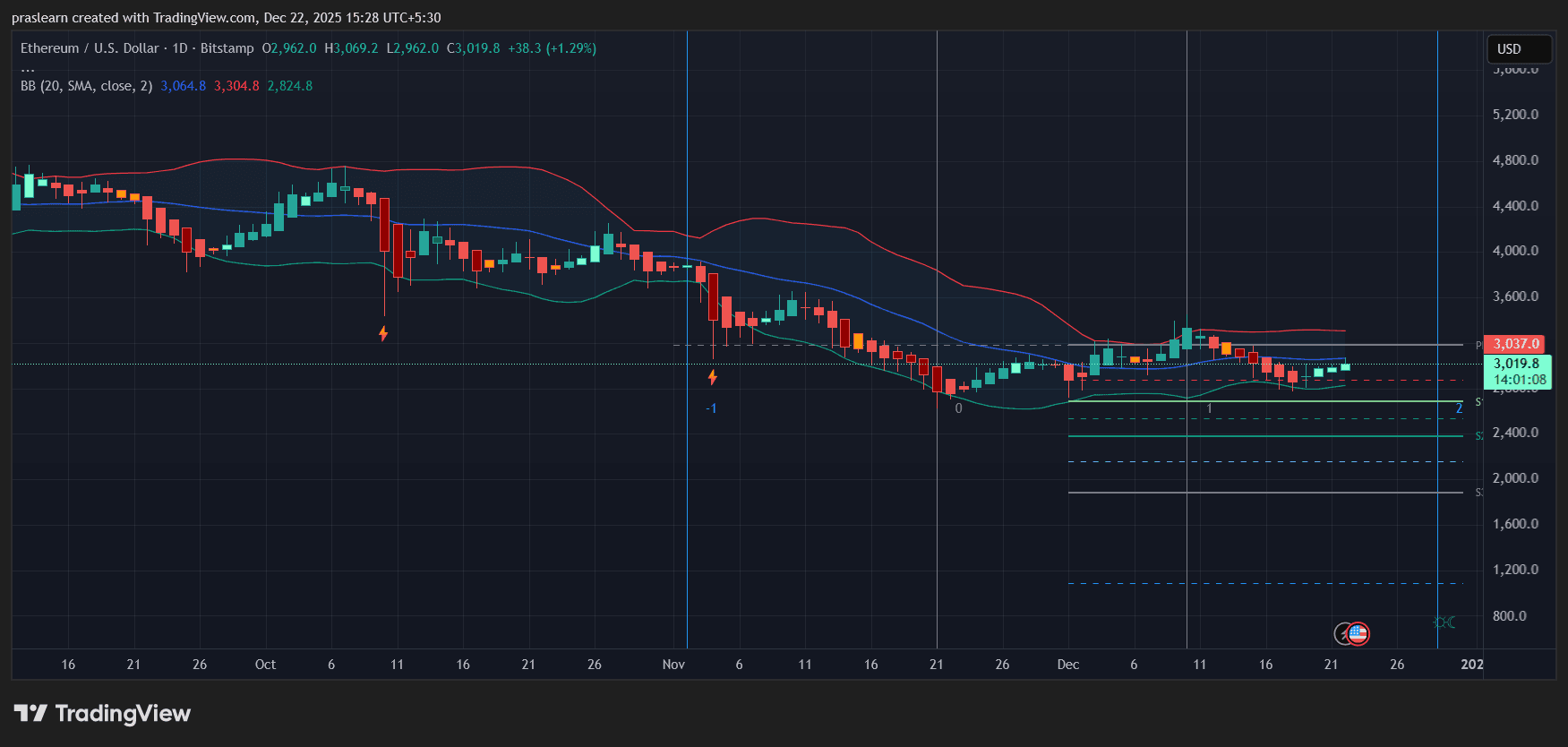

ETH/USD daily chart- TradingView

Ethereum price is fluctuating $3,019rose about 1.3% on the day. The chart shows that ETH is consolidating nearby. lower bollinger bands It was early December, but it is now recovering towards early December. Middle band approx. $3,064. This zone has acted as both a short-term resistance and a psychological barrier over the past two weeks. Key Takeaways: ETH price is trying to regain stability from the recent downtrend, but upward momentum remains tentative.

The Bollinger Bands have narrowed slightly, suggesting that volatility is shrinking. Historically, such squeezes have often preceded moves in a larger direction. If the bulls are able to close the daily candlestick above $3,100which could lead to short covering and a push into the market. Upper band around $3,300. However, if it cannot sustain above $3,000, there is a risk of further decline. $2,850 and potentially $2,700aligns with the support zone from early December.

Macro catalysts: GDP and sentiment data

of Third quarter GDP report and Consumer confidence in December The numbers will test investor sentiment. Robust GDP growth increases optimism about the economy’s resilience, which could indirectly support risk assets like ETH. However, if consumer confidence or jobless claims indicate weakness, traders could return to a defensive stance.

During holiday weeks with low liquidity, macro headlines often cause unusual reactions. Better-than-expected GDP statistics could give ETH a temporary boost, as traders are betting on sustained demand for digital assets amid steady growth. Conversely, any signs of economic slowdown could trigger risk-off moves in both stocks and cryptocurrencies.

Ethereum price prediction: technical indicators and next moves

Recent candlesticks in Ethereum price indicate that some buying interest is returning, but volume remains thin. of 20-day SMA in $3,064 serves as a pivotal level, above which the bullish trend will strengthen in the short term. The next hurdle is $3,304coincides with the upper Bollinger Band and resistance in late November.

below, $2,820–$2,850 zone Demonstrates a strong support cluster. If it falls below that range, the ETH price will be exposed to even greater losses. $2,600 And even more $2,400as you can see from the dotted support level in the chart.

This week’s highlights

Given the slowdown in volume over the holiday season, ETH price is likely to continue to fluctuate. $2,950 and $3,100 Until new liquidity returns next week. A definitive close above $3,100 would set the stage for a short-term breakout rally. Range from $3,250 to $3,300On the other hand, rejection at that level may confirm an ongoing sideways structure.

Macro data can determine the tone. If GDP shows an unexpected rise, ETH price could test the upper Bollinger Bands before the end of the year. However, if sentiment weakens, the coin could revisit the lower end of the range nearby. $2,850.

ethereum price prediction: Merge before next move

Ethereum price looks more stable than it did a few weeks ago, but there is still a lack of conviction. The chart suggests a consolidation rather than a trend reversal. The most likely scenario this week is for it to remain range bound, followed by an even stronger move after the holiday as traders reposition their positions heading into January.

If $ETH ends the week above $3,100, it could gain momentum and climb above $3,100. $3,300 – $3,400 In early January. However, a break below $2,900 will result in another test of the lower support band before a meaningful recovery.

So while the next few days may feel quiet, behind the scenes Ethereum price is swirling toward its next big move.