Canary’s staked SEI ETF is currently listed in the DTCC’s “Active & Pre-Launch” category, marking an important operational step towards potential launch.

New U.S. regulatory guidance on staking ETFs reduces previous barriers and increases the likelihood that staking-based products like the SEI ETF will be approved.

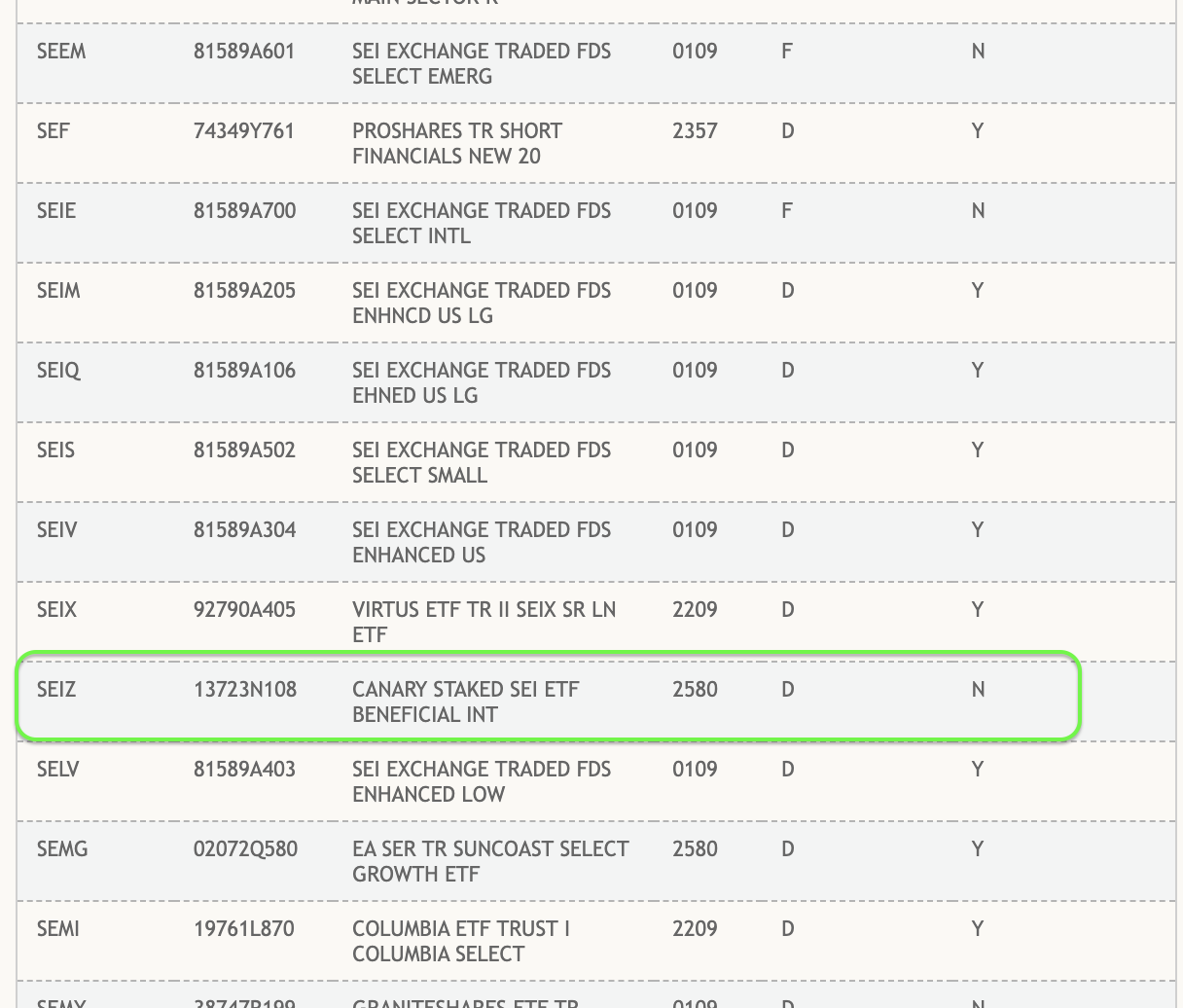

Canary Capital’s proposed staked SEI ETF (ticker SEIZ) has been officially listed on the Depository Trust & Clearing Corporation’s (DTCC) “Active & Pre-Launch” registry. This listing does not indicate approval by the U.S. Securities and Exchange Commission (SEC). However, listing on the DTCC signals that the ETF issuer has completed important operational steps toward listing.

Earlier this week, Nasdaq granted shares to the issued XRP ETF. Canary Capital Group Green light to start trading. Sei is one of many ETFs expected to launch soon and join the Bitcoin, Ethereum, Solana, and XRP ETFs. like before reportedDTCC also lists Chainlink ETFs. Along with Canary, both Rex-Osprey and 21Shares have filed for SEI-based funds.

“Active and pre-launch” SEI ETFs

According to DTCC records, the staked SEI ETF is currently “Active and pre-release” category. This means that the ETF is technically prepared for future electronic trading and clearing, subject to regulatory approval.

Other Canary ETFs on the “Active and Pre-Launch” list include SUI ETF, Trumpcoin ETF, Litecoin ETF, and more. Despite this progress, the fund cannot yet be created or redeemed, meaning it is not yet operational at this stage.

Still, this step is often interpreted as a sign of confidence on the part of the publisher. In the words of one analyst, DTCC manages back-end clearing operations for most U.S. stocks and ETFs. Once the SEI ETF appears on their system, it will be included in the normal onboarding flow before it is made available to potential intermediaries.

dawn

Canary Steked $SEI ETF listed on DTCC platform

DTCC handles the clearing and settlement of most U.S. stocks and ETFs behind the scenes.

This means that SEI ETFs are put into the regular pipeline before appearing on securities platforms.

When I went to the market… pic.twitter.com/BIhekveDtA

— Not telling you (@notttingyou73) November 14, 2025

ETF staking restrictions continue to be relaxed

Canary Capital is the first submitted The staked SEI ETF became a target earlier this year, at a time when the Securities and Exchange Commission (SEC) was cautious about staking mechanisms for publicly traded products. However, the regulatory hurdles are now less severe.

Recent updates by US regulators, including Treasury and IRS Revenue Procedures 2025-31, introduced a safe harbor framework for crypto ETFs that use staking and distribute staking rewards. Under the new guidelines, products must meet strict standards. This means holding only one digital asset and cash, using a qualified custodian, following SEC-approved liquidity rules, and limiting its role to holding, staking, and redemption of assets.

These rules also remove tax ambiguity regarding staking within ETFs and could pave the way for approval of products like Canary’s Staking SEI ETF.

Although a DTCC listing does not give approval for a transaction, it is a good sign that approval is likely.