Coin Metrics’ latest State of the Network Report reveals that amid the risks of geopolitical supply chains, the balance between stable revenues from hardware upgrades and renewable energy adoption with sustained fee pressures through hardware upgrades and renewable energy adoption.

China tariffs, Texas renewable energy, and AI: 2025 transformation of internal bitcoin mining

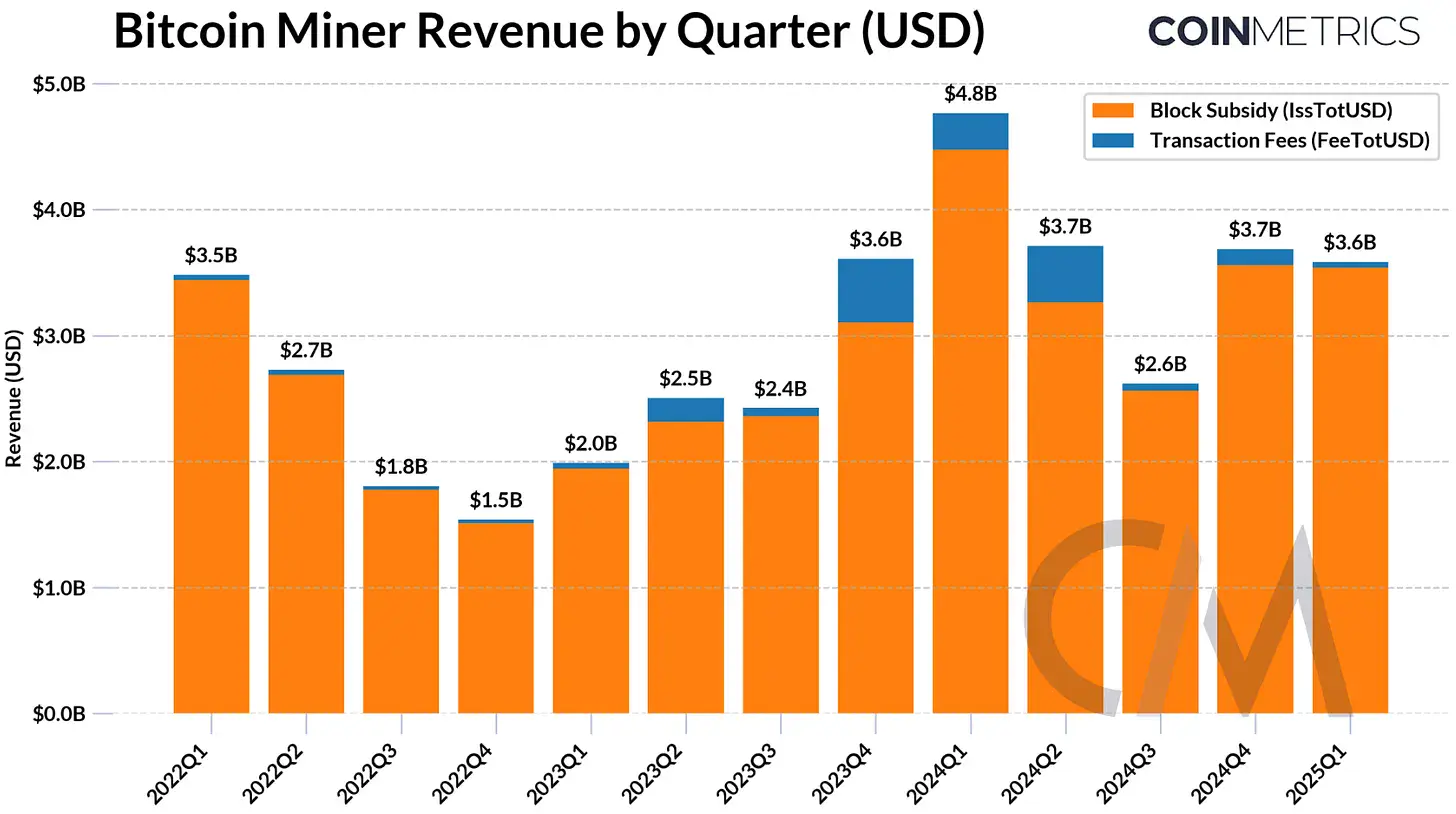

The state of the Coin Metrics ‘Q1 2025 Network Report highlights stable Bitcoin mining revenues, following half of 2024, but under 2% of total revenue, it may challenge long-term incentives, but despite sustained low trading fees, miners’ total revenue reached $3.7 billion in the fourth quarter of 2024. This is a quarterly increase of 42% due to increased operational efficiency and a recovery in Bitcoin prices. Coinmetric data shows that the average 30-day hashrate rose to 807 EH/s in early 2025, reflecting sustained network growth.

The report notes that mining operations are increasingly adopting energy-efficient ASICs and relocating to areas with cheap renewable energy, such as Texas, Africa and parts of Latin America. Large, capitalized companies diversify revenue streams, and Coinmetric cites examples such as Core Scientific pivots using 200 MW of existing infrastructure.

The report notes that mining operations are increasingly adopting energy-efficient ASICs and relocating to areas with cheap renewable energy, such as Texas, Africa and parts of Latin America. Large, capitalized companies diversify revenue streams, and Coinmetric cites examples such as Core Scientific pivots using 200 MW of existing infrastructure.

Coin Metrics’ research highlights concerns about hardware centralization, with Bitmain manufacturing ASICs, including the S19 series, estimated between 59% and 76% of Bitcoin’s hashrate. This trust creates supply chain vulnerabilities that are exacerbated by geopolitical friction. Details of the report illustrate the risks associated with delays in the shipment of bitmain hardware to US miners in early 2025 due to Chinese import duties, and intensive manufacturing.

The use of Bitcoin as a medium of exchange remains limited per coin metric, and its role is increasingly skewed into valuable applications. However, Layer 2 (L2) solutions such as sidechains such as Lightning networks and stacks are aiming to revive transaction utilities. The report states that Lightning Network Channels fell to 52,700 in the first quarter of 2025, while stable channel liquidity (4,500-5,000 BTC) suggests an increase in efficiency.

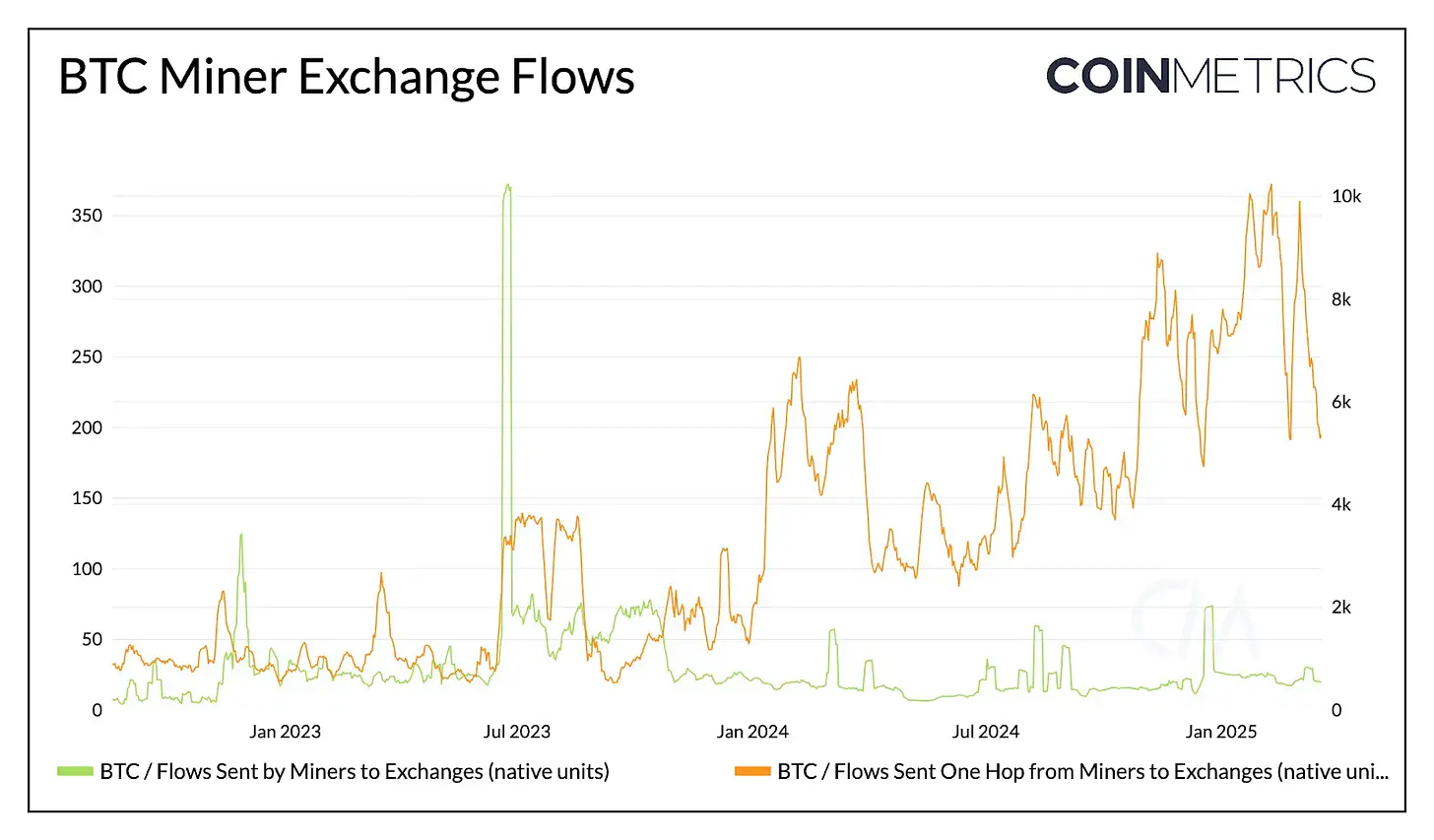

Coinmetric Exchange Flow Data shows a transfer to exchanges that remained gradually rising due to stable (0 hop) transfers from miners. Smaller miners appear to be liquidating their holdings in stages, but larger operations optimize financial management amid volatility.

The report concludes that as block rewards decrease, it is likely that higher transaction fees will be required by L2 recruitment and block space competition to maintain miners’ incentives. Coin Metrics highlights the continued risks to hardware centralization and network decentralization from geopolitical disruption, encouraging continuous adaptation of the entire mining ecosystem.