Freight Technologies Inc., a cross-border transportation logistics company, has announced it is offering $20 million in stake to buy Micro Strategic Treasury’s Trump Meme Coin.

The company’s justification for this move has little to do with Trump or ciphers. Instead, we focus on imminent US tariffs that could have a substantial impact on our business.

Cargo technology is investing in Trump

Since it first came to the scene, Trump’s meme coin with the same name has sparked a lot of controversy. A significant portion of the president’s net worth is tied to crypto, with experts and former regulators worried about Trump’s potential corruption.

The recent decision to decide on a $20 million Trump Treasury in cargo technology has fueled these concerns.

Specifically, Freight’s press release sheds light on why he is investing $20 million in Trump. We will briefly explain the company’s interest in AI and Web3 development, and explain how freight organizes these purchases.

However, in most cases, the press release outlines how Trump’s tariffs affect the company’s revenue.

“At the heart of (our) mission is to promote productive and aggressive commercial transactions between the US and Mexico. Mexico is the top US commodity trading partner. We believe it is an effective way to advocate Trump token official, balanced, free trade.”

Cargo technology is deeply involved in cross-border delivery with Mexico. That AI experiment is related to optimizing this transaction.

In short, a trade war with US southern neighbours could significantly undermine the company’s ability to continue functioning. But President Trump has already approved several tariff sculptures for certain businesses.

To be clear, the cargo statement did not expressly appeal to Trump for such sculpture. However, reports say some crypto companies have claimed that they received direct or indirect legal benefits from donating to the inauguration.

According to lucksome companies acquired this after a low donation of $100,000. Will $20 million attract his attention?

It is difficult to make concrete claims, but freight actions regarding Trump’s transactions seem unusual. Almost all of that reasoning for this purchase revolves around US-Mexico trade relations.

The company’s press release calls Trump a “great way to diversify the Cryptocurrency Department,” but this is the only justification for non-tariffs.

Still, if the cargo tries to petition the president, they may wish that Mexico’s tariffs will be removed entirely. While the tariffs remain, there is nothing to suggest that it wants sculpture.

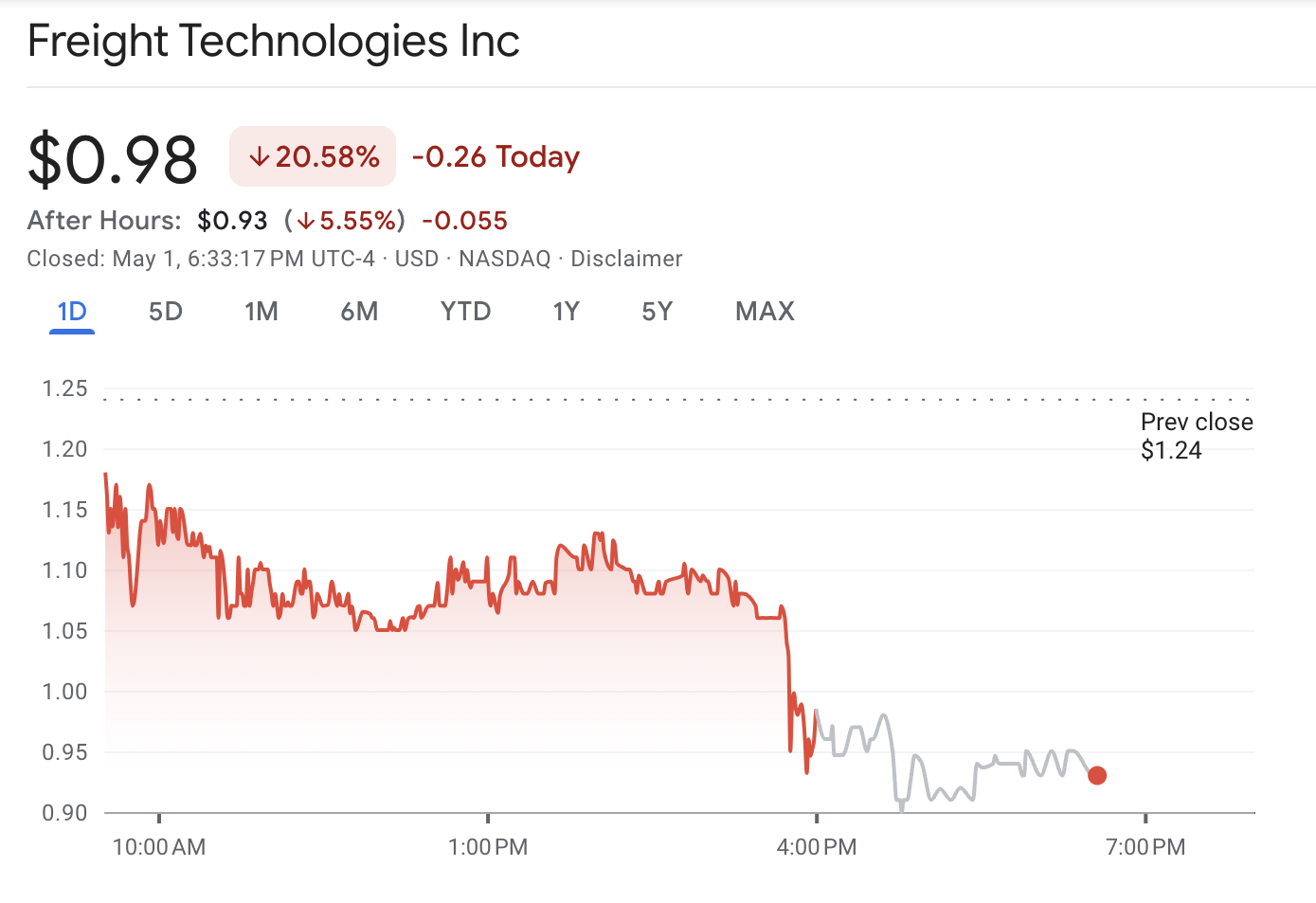

Either way, this Trump purchase could backfire due to the freight stock price. The company first released the press release on April 30th, but began circulation on the afternoon of May 1st via crypto-centric social media.

As news spread across these circles, freight technology stocks fell by more than 20%.

Cargo technology stock price. Source: Google Finance

As we move forward, it’s important to keep an eye on this story. The company has begun to develop micro-strategic style plans for assets like Solana. Cargo technology is to do it first with Trump, but it may not be the last.