The Cryptocurrency narrative, which is a major feature of the current market cycle, is similar to investors’ sentiment from the late 1990s and early 2000s. According to Ray Youssef, founder of the peer-to-peer lending platform, Notes App, the stock market has sunk by about 80%.

The same enthusiastic investor psychology that led to overinvestment in early internet and tech companies during the Dotcom crash has not disappeared due to the presence of financial institutions in crypto, Youssef told Cointelegraph. He said:

“Dotcom is an innovative phenomenon in emerging IT markets, and alongside major companies with serious ideas and long-term strategies, the competition in investment capital has attracted enthusiasts, opportunists and dreamers.

Today, global financial markets are driven by ideas of cryptocurrency, decentralized finance and the Web3 revolution,” he added.

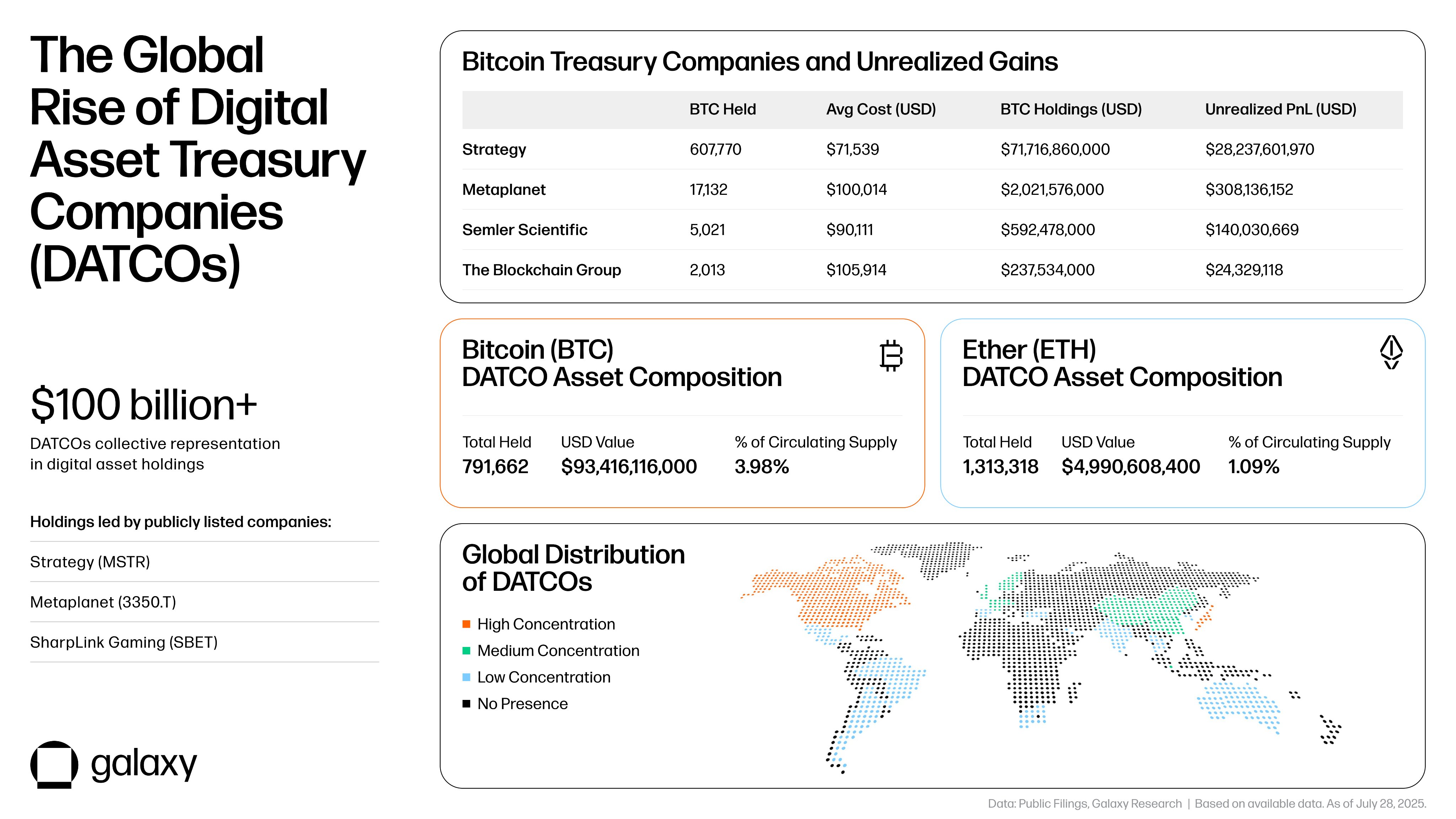

Overview of the Digital Assets Finance Sector. sauce: Galaxy

He predicted that the majority of the Cryptocurrency would be diverged and forced to offload their holdings and create terms for the next crypto bear market, but that the selected few would survive and continue to accumulate crypto at a massive discount.

The Crypto Treasury controls headlines during the current market cycle. This dominates the headlines during the current market cycle as it is touted as a sign that Crypto has matured from a niche phenomenon to the global asset class sought by nation-states and businesses.

Related: The crypto market is declining, but corporate proxies are much worse

Not all cryptocurrency companies are destined. Responsible management can reduce recession

Cryptocurrency companies can even mitigate the impact of market slump and thrive when responsible treasury and risk management are practiced.

By reducing the debt burden on a company, significantly reducing the likelihood of bankruptcy, in contrast to the company’s debt, companies that issue new shares are more likely to survive the recession as their shareholders do not have the same legal rights as their creditors.

This is paramount if a company chooses to fund crypto purchases, end debts, or space each debt tranches when it has to pay back.

For example, if a company knows that Bitcoin (BTC) tends to operate over a four-year cycle, it can build debts in five years so that they don’t have to pay off the loan when crypto prices drop.

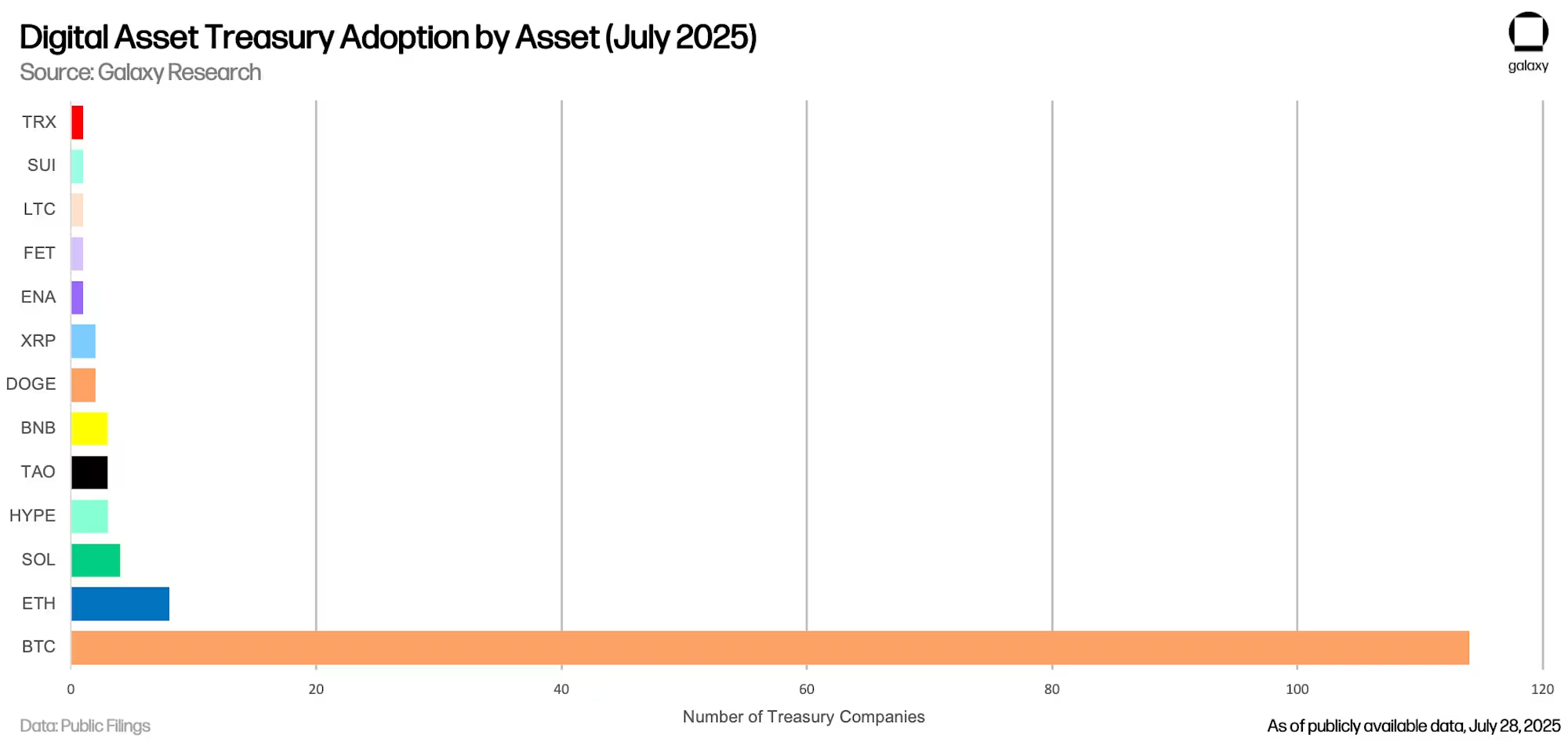

A breakdown of digital assets adopted by companies for financial purposes. sauce: Galaxy

Businesses can also lose up to 90% during the market cycle, and sometimes they don’t recover.

Finally, companies that have acquired sales operations are better positioned than pure Treasury Departments that do not have the revenue purchases.

magazine: How Ethereum Finance Companies Can Cause “Defi Summer 2.0”