Cryptocurrency investment products recorded outflows for the third consecutive week, but the pace of selling slowed significantly as digital asset prices stabilized after a sharp decline.

CoinShares reported Monday that crypto exchange traded products (ETPs) recorded $187 million in outflows this week, down sharply from $3.43 billion in the previous two weeks.

The slowdown was triggered by Bitcoin (BTC) falling to its lowest level since November 2024, hitting $60,000 on Coinbase last Thursday.

“Fund flows typically move in line with crypto prices, but changes in the pace of outflows are historically more informative and often signal inflection points in investor sentiment,” said James Butterfill, head of research at CoinShares.

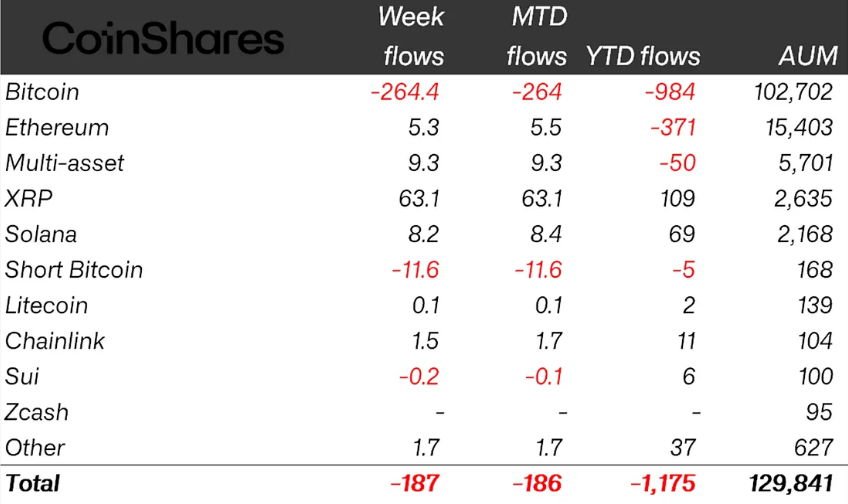

Bitcoin ETP will only record large losses, $XRP Lead inflow

Bitcoin investment products were the only group of ETPs to suffer significant losses last week, with outflows totaling $264.4 million.

$XRP ($XRP) fund led the inflows, collecting $63 million, while other altcoin ETPs tracking Ether (ETH) and Solana (SOL) posted modest gains of $5.3 million and $8.2 million, respectively.

Weekly crypto ETP flows by asset (in millions of USD) as of Friday. Source: CoinShares

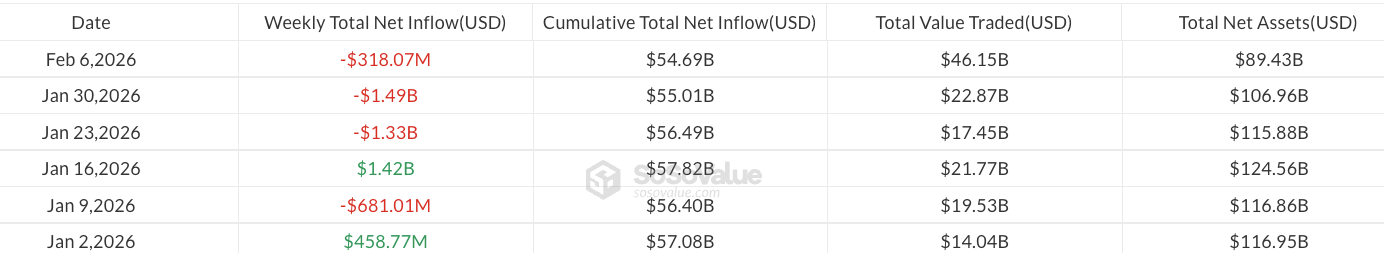

Spot Bitcoin exchange-traded funds (ETFs) accounted for the majority of Bitcoin ETP outflows last week, amounting to $318 million, according to SoSoValue data.

ETP volume reaches record high of $63 billion in weekly trading

Referring to last week’s slowing in outflows, Butterfill suggested that “we may have reached a potential market bottom,” suggesting that an ETP bottom may have formed.

Despite the easing in capital outflows, last week marked a milestone in trading activity. According to Butterfill, ETP trading volume reached an all-time high of $63.1 billion, surpassing the all-time high of $56.4 billion set in October last year.

Related: Amid the Bitcoin Crash, BlackRock’s IBIT Hits a Single-Day Trading Volume Record of $10 Billion

Bitcoin ETP assets under management (AUM) stood at $102.7 billion by the end of the week, while ETF AUM was below $90 billion.

Weekly Bitcoin ETF flows year-to-date. Source: SoSoValue

Meanwhile, global crypto ETP AUM declined to $129 billion, the lowest level since March 2025, Butterfill noted.

Due to three consecutive weeks of outflows, crypto ETPs have suffered a total loss of $1.2 billion since the beginning of the year, while Bitcoin ETFs have lost $1.9 billion.

In other industry news, major cryptocurrency fund issuer 21Shares last week filed with the U.S. Securities and Exchange Commission for an ETF tracking Ondo (ONDO).

magazine: How will cryptocurrency law change in 2025 and how will it change in 2026?