Venture capital and institutional money is flowing back into digital asset companies in early 2026, with $1.4 billion committed across venture rounds and public market listings, according to industry data.

The largest deals include Visa-affiliated stablecoin issuer Rain, which raised $250 million at a valuation of $1.9 billion, and cryptocurrency management company BitGo, which raised more than $200 million in its IPO on the New York Stock Exchange in January.

While the crypto market remains under pressure after October’s massive liquidation that wiped out billions of dollars in leveraged positions across centralized and decentralized markets, institutional involvement in the space continues to intensify.

This edition of the VC Roundup features traditional venture funding, blockchain-focused funds, and notable on-chain credit transactions that mark a broader shift in how capital moves in the industry.

Related: VC Roundup: As funding for virtual currency ventures dries up, there are huge amounts of funds and almost no transactions.

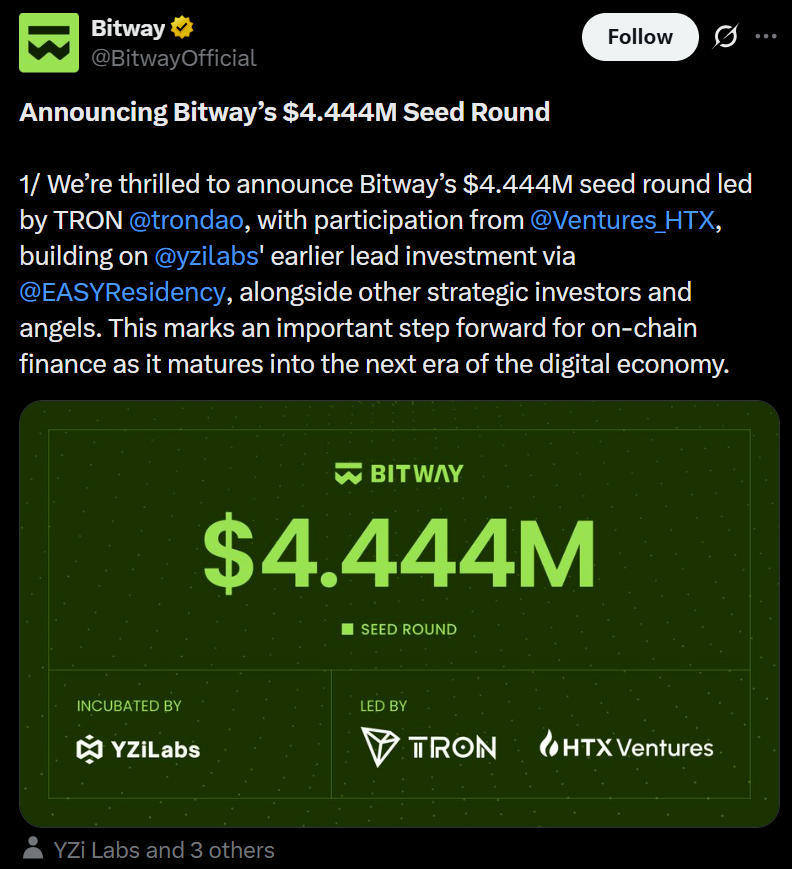

TRON DAO leads Bitway’s $4.4 million seed round

On-chain financial infrastructure provider Bitway has raised over $4.4 million in a seed funding round led by TRON DAO with participation from HTX Ventures. This round builds on previous investment from YZi Labs through its EASYResidency initiative, along with several strategic investors and angel backers.

Bitway said the funding will support its efforts to expand on-chain financial services, an area that continues to receive interest despite a widespread slowdown in trading activity.

sauce: Bitway

Everything closes $6.9 million funding round

Digital exchange platform Everything has raised $6.9 million in seed funding led by Humanity Investments with participation from Animoca Brands, Hex Trust, and WallStreetBets founder Jamie Rogozinski.

The company is building an integrated trading platform that combines perpetual futures, spot markets, and prediction markets in a single account structure. The company plans a gradual rollout, starting with a Telegram-based interface that will simplify retailer access to derivatives trading while limiting bot-driven activity through human verification tools.

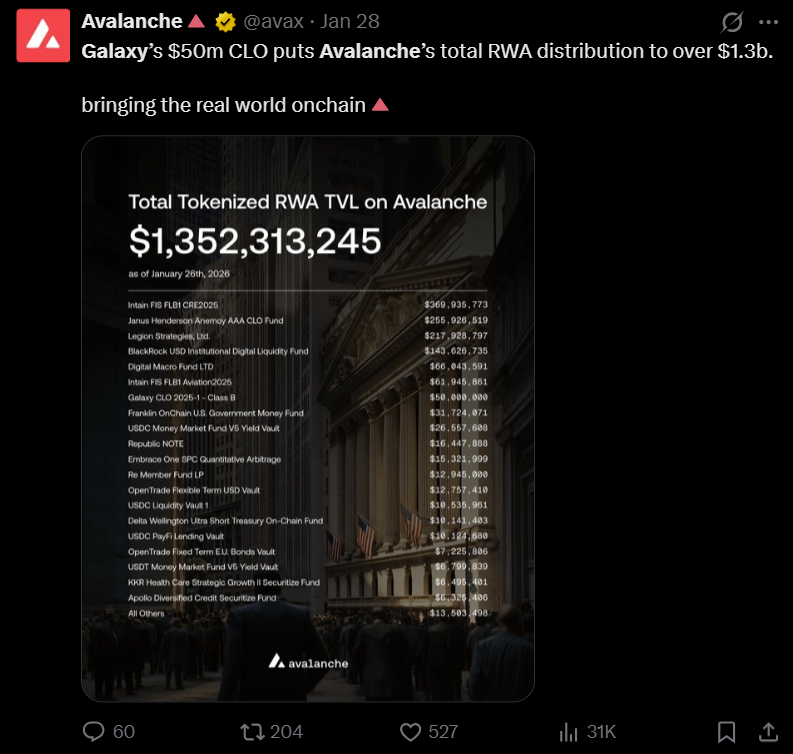

Galaxy completes $75 million in on-chain credit transactions with Avalanche

Galaxy has completed a $75 million on-chain credit transaction using the Avalanche blockchain, including a $50 million anchor allocation from institutional investors. The transaction packages private loans into digital securities, issued and managed on-chain rather than traditional back-office systems.

Although not a venture funding round, the deal is notable as Galaxy operates an active venture business and invests heavily in cryptocurrency startups. The deal signals organizations’ growing comfort with running core financial activities on-chain, a change that could impact where venture capital flows next.

sauce: avalanche

Veera raises $4M with on-chain finance targeting everyday users

On-chain financial services platform Veera has raised $4 million in a seed funding round backed by CMCC Titan Fund and Sigma Capital. This funding brings the company’s total funding to $10 million, following a $6 million pre-seed round completed in 2024.

Veera is building a mobile-first platform that aggregates on-chain financial services such as savings, investment asset exchange, and spending into a single interface. The funding will support product development and expansion as Veera works to simplify access to decentralized finance tools for non-technical users.

sauce: Villa

Promethium strengthens funding related to promotion of on-chain securities

Promethium, a US-regulated digital asset market infrastructure provider, announced that it has raised an additional $23 million from high-net-worth investors and institutions since the beginning of 2025. The Company operates an SEC-registered, FINRA member broker-dealer that provides custody, clearing, and settlement services for digital assets, including tokenized securities.

The capital will support the rollout of clearing services for U.S. broker-dealers and the development of on-chain securities products as Promethium works to integrate digital assets into traditional securities infrastructure.

Solayer launches $35 million ecosystem fund

Solayer, an infrastructure development company partnered with Solana, has launched a $35 million ecosystem fund to support early and growth-stage teams building applications on infiniSVM networks. The fund will target on-chain products with clear revenue models, including projects in decentralized finance, payments, consumer applications, and AI-driven systems.

The fund builds on the company’s accelerator program, Solayer Accel, and aims to attract developers to build applications that run on Solana at scale.

Related: From FTX fallout to new funding: former US Prime Minister raises $35 million for new exchange