Cyber Hornet has applied to register the S&P Crypto 10 ETF (CTX) with the Securities and Exchange Commission. The CTX Index seeks to provide exposure to the top 10 cryptocurrencies by market capitalization in the S&P Cryptocurrency Broad Digital Asset Index.

CTX index is performing well $BTC and $ETHAssign 69% to $BTC and from 14% $ETH. moreover, $XRP The holding exposure is 5%, Binance Coin 4%, Solana 2%, TRON 1%, Cardano 0.5%, Bitcoin Cash 0.4%, Chainlink 0.3%, and Stellar 0.2%.

Balchunas says CTX Basket could become the first S&P-linked spot ETF

Eric Balchunas, senior ETF analyst at Bloomberg, revealed that Cyber Hornet is applying for the S&P Crypto 10 ETF (CTX), which could become the first S&P-linked spot basket. Balchunas said the battle for crypto basket ETF supremacy is only heating up, a sign of increasing competition among issuers for diversified spot exposure products.

Cyber Hornet has filed for the S&P Crypto 10 ETF (CTX), which could (I believe) be the first S&P-linked spot basket. The battle for supremacy in virtual currency basket ETFs is intensifying.

Holdings breakdown: Bitcoin (69%), Ethereum (14%), $XRP (5%), Binance Coin (4%), Solana (2%), Tron (1%), Cardano… pic.twitter.com/bamvvf8MFA— Eric Balchunas (@EricBalchunas) January 23, 2026

CTX basket is generally advantageous $BTChas become a Bitcoin-dominated ETF. Highlights of this movement $BTC‘s control While it currently has a market capitalization of over $1.5 trillion and is the closest asset in the entire cryptocurrency industry; $ETHwhich will only make $356 billion. $BTC Current advantage is up 59%, followed by $ETH At 11%. The remaining cryptocurrencies hold a cumulative 29% share of the market.

At the time of publication, $BTC On the weekly chart, the stock fell 5.97% to trade at $89,449, giving it a market cap of $1.79 trillion. $ETH On the weekly chart, the stock was down 10.24% and was trading at $2,953 with a market cap of $356.4 billion. The third largest token by market capitalization to date is $XRPwith a market capitalization of $116.5 billion. of $XRP The token fell 7% on the weekly chart, trading For $1.91.

According to Cryptopolitan reportspot crypto ETFs typically offer the most direct exposure to cryptocurrencies by holding them. $BTC, $ETHand $XRP. The value of a spot ETF moves in correlation with the real-time price of the underlying token, with minimal deviation.

BlackRock’s IBIT ETF leads spot $BTC ETF space

At the moment, BlackRock’s iShares Bitcoin Trust (IBIT) ETF is one of the biggest spots $BTC ETF. Additionally, there’s the VanEck Ethereum ETF (ETHV), which provides exposure to Ethereum, and Solana’s REX Osprey SOL Plus Stacking ETF (SSF).

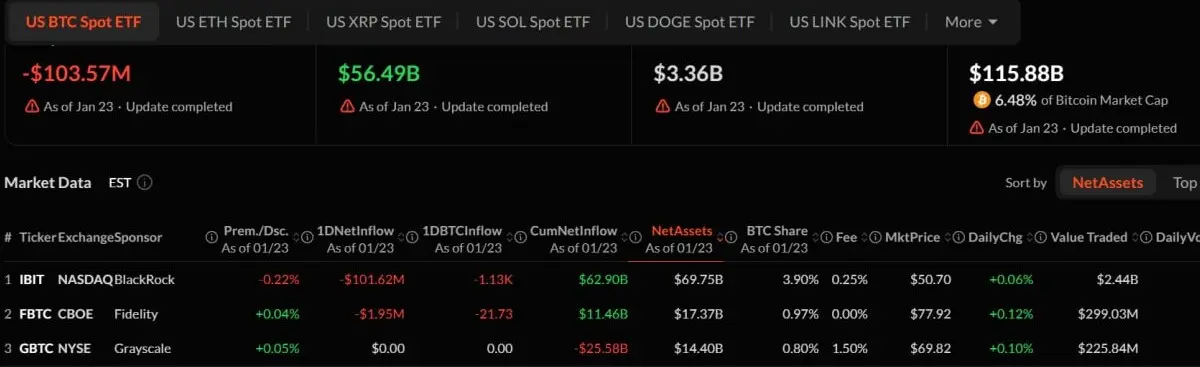

On the other hand, tracking virtual currency ETFs is $BTC Holds approximately 1,502,560 pieces $BTCaccording to on-chain data. This equates to a total of approximately $134.5 billion, or approximately 7% of the total. $BTC supply. The IBIT ETF dominates this space with a total net asset value of $69.75 billion, followed by the Fidelity Wise Origin Bitcoin Fund (FBTC) with a total net asset value of $17.37 billion.

us $BTC Breakdown of spot ETFs. Source: SoSoValue.

Grayscale Bitcoin Trust (GBTC) is the world’s third largest spot crypto ETF. $BTCwith a total net worth of approximately $14.4 billion. At the time of publication, the IBIT ETF had cumulative net inflows of $62.9 billion, FBTC had $11.46 billion, and GBTC had lost approximately $25.5 billion due to withdrawals.

Investors are showing interest in ETFs due to regulatory oversight that provides greater transparency and protection. ETFs are easily accessible, just like regular stocks traded on U.S. stock exchanges. CTX ETF achieves risk diversification by holding multiple crypto assets. This strategy tends to spread the risk across, so even if one asset in the basket underperforms, other assets can perform better and balance the portfolio.