James Wynn, one of the well-known traders of high lipids, deposited a total of $1.288 billion on high lipids to protect his position in a turbulent month, losing almost all of his funds for liquidation.

James Wynn has maintained his high-lipid, dangerous position, costing him a total of $1.28 billion over the past month. During the market turbulence in July, Winn had to post additional collateral to avoid a complete liquidation.

Nevertheless, Wynn has been liquidated on most of his BTC longs and was made to peak prices for BTC. The position was closed after 27 minutes of high lipids Stop API and order form.

Chain data collected by Arkham Intelligence shows that James Wynn is very active in moving funds, and high lipids are very active as one of their main destinations. Winn went around $32K From the high lipids, deposit the binance in the form of USDC.

James Wynn has deposited $1.28 million in high fats this month and lost everything

James Wynn deposited a total of $1.28 million in high lipids during July, then lost everything, withdrawing his final balance of $32.93K.

James Wynn was liquidated last night at his $2.99m…pic.twitter.com/voyuu8mmlo

– Arkham (@arkham) July 30, 2025

Wynn also interacts with Binance, as well as a 1-inch aggregator for decentralized meme trading. High-risk traders have some high-risk longs in BTC and ETH, and are actively sharing their social media positions.

In addition to trading blue chip tokens, Winn shilling meme tokens on Telegram and competes in small meme deals.

James Wynn loses Pepe’s bet

Following some BTC and ETH liquidation, James Wynn cut his attention to Pepe. Early meme token, Pepe, won 16.3% in July, but was unable to go vertically.

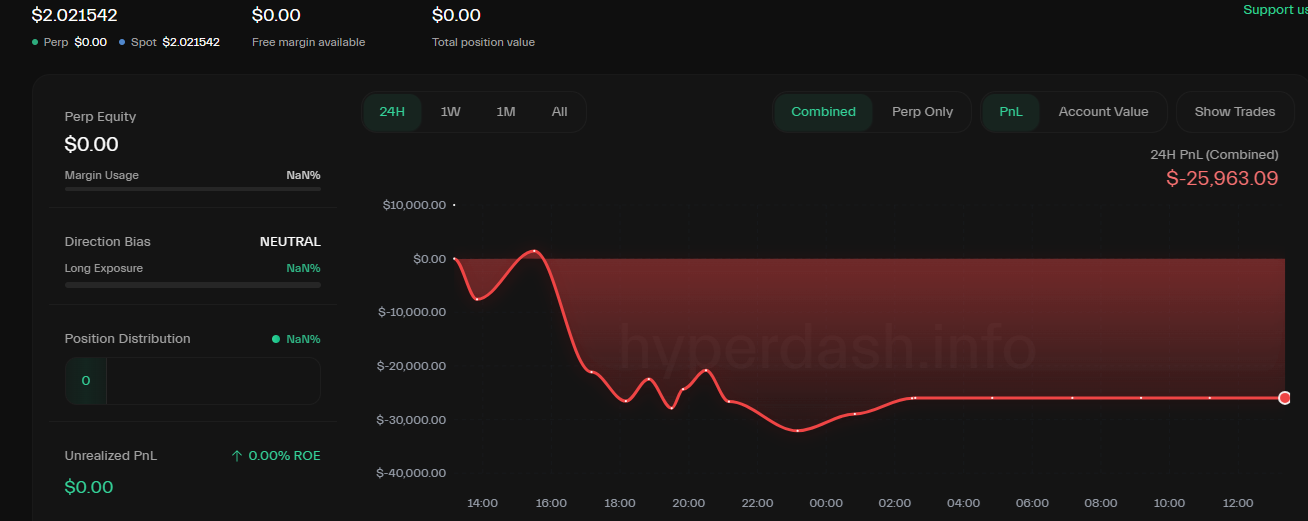

James Wynn was partially liquidated nine times in a row in Pepe’s position before closing for a long time. |Source: Hyperliquid

Pepe slides later in the month and is trading for $0.000011. The lack of a critical assembly led to multiple partial liquidation. Chain data reveals that James Wynn has been liquidated in Pepe’s position in a total of nine times, losing another $25,000.

Pepe’s position was relatively minor compared to previous bets on the direction of BTC and ETH, but James Wynn tried to boost the social media profile of meme tokens. Traders have a long history with Pepe, becoming an early adopter, and tokens had a market capitalization of $600 million.

High lipids still attract star whales

Star whales like James Wynn and Aguila trades are key to Hyperliquid’s success. James Wynn’s model is also copied with White Whale, a top-ranked high-lipid trader. In addition to opening public positions, White Whale is active on social media, which has a potential impact on asset prices.

At that moment, you realize that alone you are 15% of all oi of the sol on high lipids. I think it makes sense why prices are being suppressed. I don’t know who needs to hear this, but you’re not going to shake my conviction and trick me into selling me before I was good and ready.

– July 29, 2025, White Whale (@thewhitewhalehl)

Dex’s permanent futures expand open interest to over $15 billion, of which $800 million will be directed towards Blue-chip assets, with the rest extending to new hot tokens. Hype is one of the most active markets, but high lipids quickly garnered whales for new lists like pumps.

Hyperliquid’s open interest was driven by the Altcoin influx and increased vertically. Open interest is over $15 billion, the highest ever. |Source: Hyperliquid

Despite the latest BTC sliding to $117,000, Hyperliquid managed to hold on. The hype has slumped from its peak of just under $50, stabilizing around $43.07. For now, Hype has not managed to organize gatherings to triple-digit prices and has not been able to clear the $50 barrier, but has risen by more than 8% in July.