White House AI and crypto kingpin David Sachs has hit back at the New York Times over a report detailing how his role as a government advisor benefits his investors and aides.

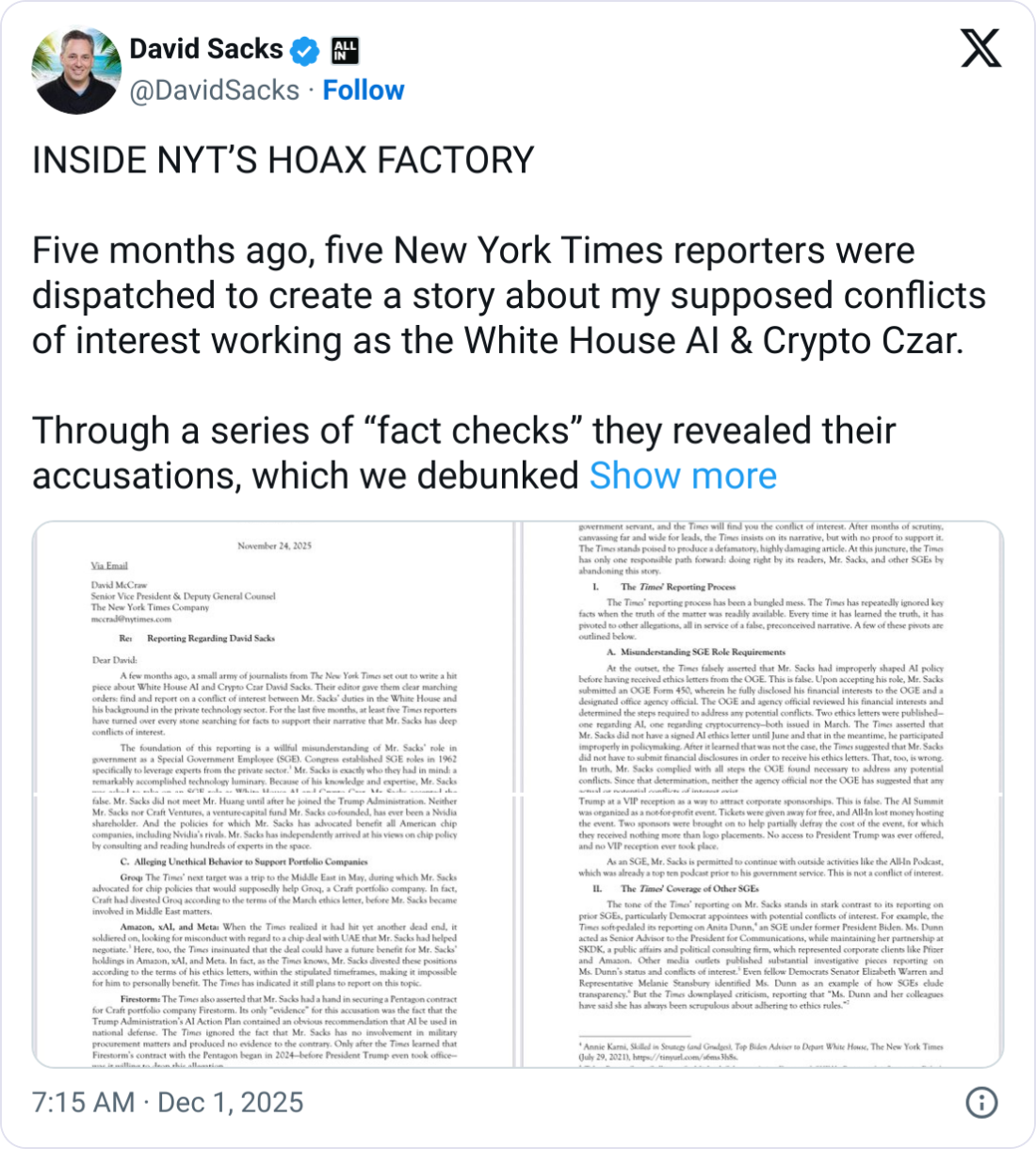

In a post to X, Sachs said that despite “debunking in detail” the Times’ reporting over the past five months, the newspaper continued to publish his alleged conflict of interest article on Sunday.

“Today they obviously just threw up their hands and released this nothing burger to the public,” Sachs wrote. “If you read the article carefully, you’ll see that they’ve pieced together a lot of anecdotes that don’t support the headline.”

Sachs, a co-founder and partner at the venture firm Craft Ventures, has come under scrutiny in the past for his role as a special official in the White House, with Democratic Sen. Elizabeth Warren saying in May that he is “financially invested in the crypto industry and stands to potentially benefit from changes in crypto policy in the White House.”

sauce: david sax

Before he became crypto czar, Sachs & Kraft sold over $200 million in crypto and crypto-related stocks, at least $85 million of which was owned by Sachs, who retained interests in several illiquid investments in “private equity of digital asset companies.”

Sachs holds 20 crypto investments, the Times reported.

The Times reported that an analysis of Mr. Sachs’ financial disclosures found that he held 708 technology investments, 449 of which were related to AI and 20 related to cryptocurrencies, all of which could benefit from policies supported by Mr. Sachs.

In one example of a perceived conflict in Sachs’ role, the outlet said Craft Ventures is investing in BitGo, a crypto infrastructure company that offers stablecoins as a service.

BitGo filed to go public in September, and regulatory filings show Craft owns 7.8% of the company.

The Times noted that Sachs is a leading supporter of the GENIUS Act regulating stablecoins, which was signed into law earlier this year. Many cryptocurrency commentators said this would encourage the use and uptake of tokens by institutions.

Related: ALT5 Sigma, linked to Trump, shakes leadership amid WLFI surveillance

Other examples cited by the paper included Mr. Sachs and Mr. Kraft’s ties to AI companies, whose values soared as the White House and Wall Street bet on the technology’s potential.

The Times noted that Sachs’ ethics waiver, shared in March, included selling his interests in AI and cryptocurrencies. However, they did not disclose when he sold the assets, nor did they provide details of the amount of his remaining investment.

Sachs says NYT created ‘false narrative’

In the

Sachs added: “It is very clear that the NYT intentionally misrepresented or ignored facts in order to support a false narrative.”

Jessica Hoffman, a spokeswoman for Mr. Sachs, told the Times that he complies with special public service rules, and the Office of Government Ethics has said that Mr. Sachs should divest his investments in certain types of companies but not others.

Sachs’ term as a special public official is limited to 130 days, and Democratic lawmakers in September questioned whether he had served longer than his appointment allowed.

However, Sachs is reportedly carefully managing his days as a special civil servant to stay within limits.

AI eye: Why AI is not good at freelance work and real-life work