Ethereum remains firm on its footing near $3,317, while traders are looking to see if the rally will extend further up on the four-hour chart. Show of recent price trends Ethereum The price is regaining momentum after clearing a major resistance band around $3,300-$3,320.

This move helped confirm the setup for a short-term bullish continuation, with higher highs and higher lows forming throughout the latest swing. In addition to the breakout, Ethereum is trading above major moving averages, which traders often treat as a signal that buyers are still in control of the trend.

Ethereum Breakout hold above major technical zone

Ethereum rose above the $3,300 area and held that level as support during the recent pullback. Therefore, the $3,305 to $3,315 range is currently serving as the first line of defense for the bulls. The EMA cluster is also below the price and continues to hold as dynamic support. Additionally, the supertrend indicator remains bullish, supporting the case for follow-through profits.

A shallow decline was also noticeable in recent times. Therefore, this move indicates a steady decline in demand and limited profit-taking pressure. if Ethereum If the price sustains above $3,300, traders may continue targeting the next rising band.

Ethereum Price dynamics (Source: Trading View)

Ethereum It now faces immediate resistance between $3,350 and $3,380, where sellers were defending recent highs. Furthermore, a solid break above this zone could pave the way to $3,405-$3,450. This area coincides with the high of a major previous range and is consistent with extension targets on many short-term charts.

Related: Bitcoin Price Prediction: ETF inflows and spot outflows collide as price stalls…

However, prices could still stall if buyers fail to absorb supply near the top of the current range. Traders will be keeping a close eye on the momentum near $3,380 as it could determine the next direction.

Beware of derivatives and spot flow signals

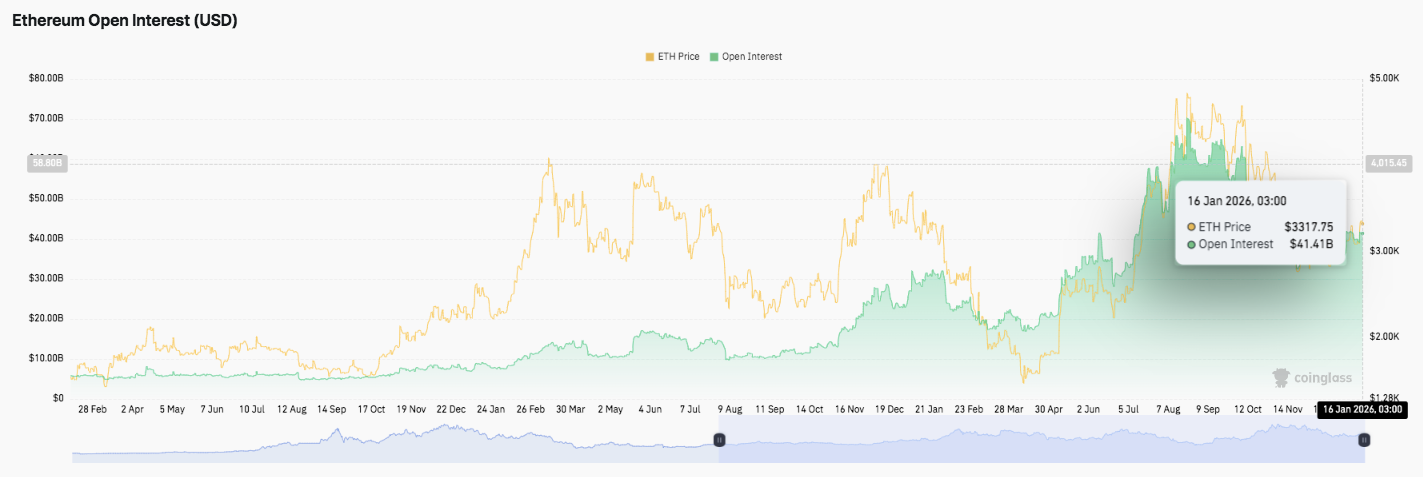

Source: Coinglass

Ethereum’s open interest trend continues to rise, suggesting increased participation in derivatives. Notably, the open interest is close to $41.41 billion and the price is trading around $3,317. This level shows that leverage remains elevated even after a slight cooldown. Therefore, sudden volatility can still occur if a trader exits a position quickly.

Spot inflow and outflow data also show a calm tone. Net outflows have been mostly negative for several months, with the latest figures showing modest net outflows of nearly $34 million. Additionally, outflows have slowed compared to previous spikes, suggesting a decline in sales intensity.

Related: Shiba Inu price prediction: Burn rate collapses by 87% as there are only 550,000 Shiba Inu…

Technical outlook for Ethereum price

Ethereum’s key levels remain well-defined as price stabilizes above recent breakout support.

Noteworthy upside levels include the first resistance zone at $3,350 to $3,380. A clean break could open room for $3,405 and $3,450, in line with the previous range high and Fibonacci extension.

On the downside, immediate support lies between $3,305 and $3,315, with previous resistance turning into demand. Below that, $3,190 to $3,200, which combines EMA support and the 0.618 Fibonacci level, exists as an important confluence zone. Deeper support lies around $3,040 to $3,080.

Technical conditions suggest that Ethereum is consolidating within a bullish continuation structure after retrieving major moving averages. This compression phase often precedes volatility expansion.

Will Ethereum go up?

The short-term bias hinges on whether buyers defend the $3,300 area while building momentum towards the $3,380 resistance. Stronger inflows and sustained leverage could accelerate the move towards $3,450.

However, failure to hold $3,190 risks weakening the structure and increasing risk. Ethereum A deeper pullback towards the $3,080 zone. For now, Ethereum is trading in a definitive range, the confirmation of which will shape the next leg.

Related: Internet Computer Predictions for 2026: Mission70 to reduce inflation by 70%, AI integration targets $8-12

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.