TL; PhD

- Ethereum will repeat its 2020 breakout setup to raise expectations for potential major gatherings.

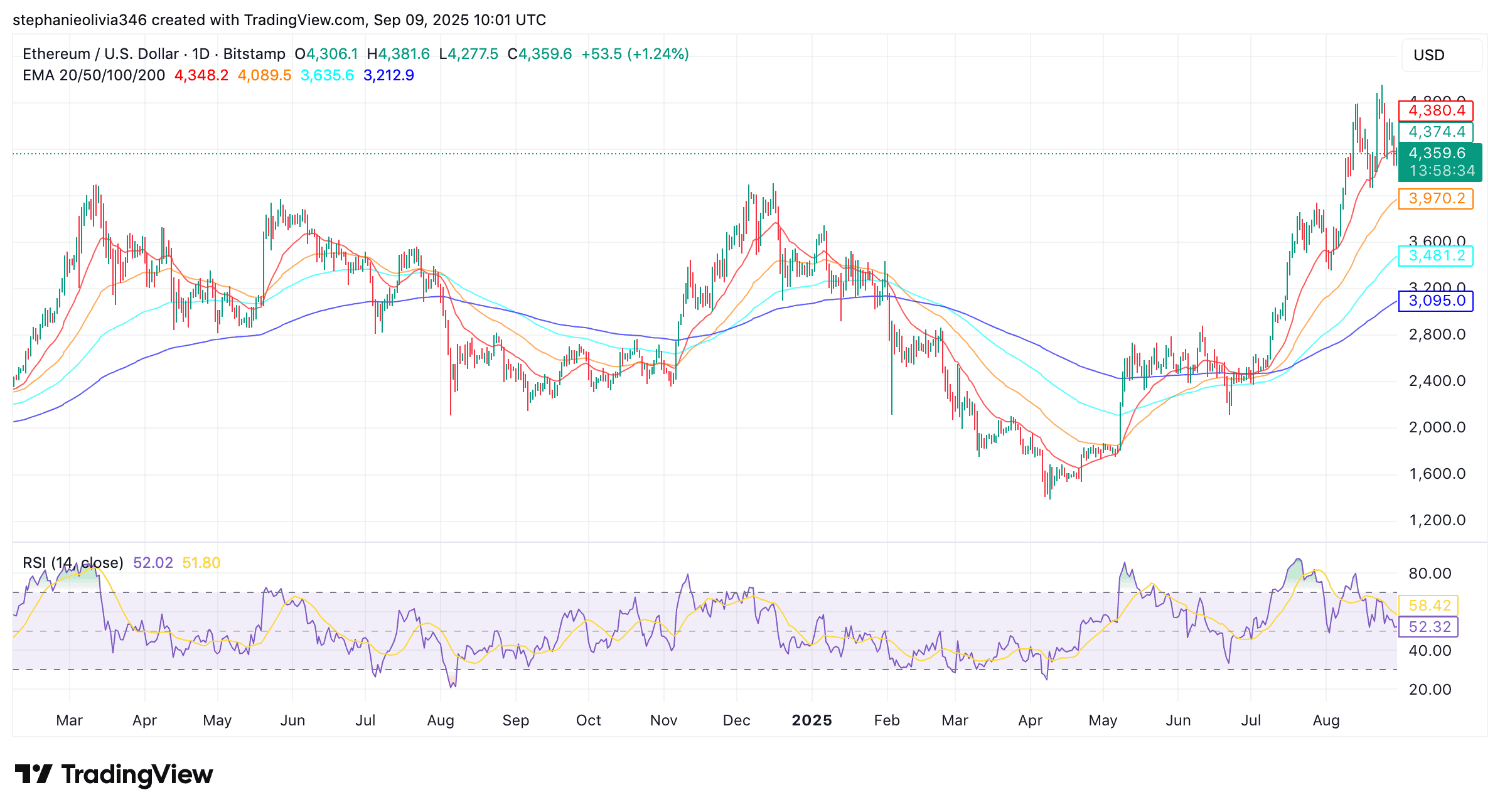

- RSI near the monthly MACD crossover and 52 shows ETH may have more room to climb.

- ETH defends the 50-day EMA for $4,164 and maintains strong support across all major moving averages.

Ethereum shows monthly MACD crossovers

Ethereum (ETH) printed fresh crossovers on their monthly MACD indicators. Some market analysts see it as a potential turning point. Crypto Trader Merlijn traders called the move “monster ignition” and pointed to the completion of the multi-year integration phase.

Ethereum is charging monster moves

Fresh MACD crossover.

The peak is three years’ shortened.

The monthly candles scream strong.Break $4,450, $eth doesn’t walk…it rips.

Don’t call it Hopium. Call it ignition. pic.twitter.com/kkgug4l34p-merlin the Trader (@merlijntrader) September 8, 2025

Surprisingly, monthly chart MACD crossovers are considered rare, especially after three years of aperture. This last happened before the 2020-2021 rally, with Ethereum rising sharply in a few months. ETH is currently trading near a critical level of $4,450, marking the top of its long-standing range of resistance.

Ethereum’s recent breakouts and pullbacks look similar to price action during the 2020-2021 cycle. At the time, ETH broke out from a long downtrend, retesting breakout levels, and then began steep climbs to new highs.

Chart traders shared by Merlijn show that Ethereum has once again broken past the downtrend line and is back to test previous resistances of nearly $3,650-4,000. The trader said, “2021 has given us a pattern. 2025 gives us a chance.”

Ethereum repeats history

2021 showed a pattern.

2025 shows us opportunities.Retest is where legends buy it.

A breakout is where property is created. $eth is not complete. I’ve just started. pic.twitter.com/81tvrnlp70-Merlin The Trader (@merlijntrader) August 29, 2025

Comparisons with past cycles provide a perspective, but Ethereum needs to see an additional intensity above $4,450.

ETH becomes stronger as momentum builds

ETH has recently bounced back from its 50-day exponential moving average and is now serving as support for around $4,164. Ability beyond this level indicates that the buyer is still active and is defending the key zone.

In particular, prices are positioned better than all other major EMAs (20, 50, 100, and 200), giving you a strong technical foundation. Holding these levels often reflects the stability of the trend and provides a structure for future movements.

Meanwhile, the daily relative strength index (RSI) is located at 52. This neutral zone shows that the market is well balanced and there is no strong trading pressure. In previous market cycles, similar RSI levels during uptrends allowed for a gradual price increase without the need for deep corrections.

At the time of reporting, the price of Ethereum was around $4,360. It has increased by 1% over the last 24 hours, showing a slight weekly decline. Past daily trading volumes were $30.36 billion.