Ethereum is currently trying to stabilize after pushing prices below the main level after a recent sale. The bullish trend structure is not completely broken in the higher time frame, but both price action and on-chain metrics show mixed signals that traders closely monitor.

Technical Analysis

By Shayan

Daily Charts

On the daily charts, ETH has lost its midline in the upward channel and is below the dotted trendline that has been supporting prices since August. The asset is currently testing a key level of $4,000 that closely matches the lower boundary of the channel, located at the $3,800 level and the 100-day moving average.

The RSI has also immersed near areas that are not too sold, but has slightly rebounded, and is now hovering at around 40, hinting at a possible local bottom if the buyer stepped into the volume. However, if assets fall below the $4,000 level, they would officially put the market in a downtrend situation as they would expect a deeper drop towards the $3.5,000 range.

4-hour chart

On the four-hour chart, ETH shows signs of a short-term rebound after reaching the purple demand zone around $3,850. Prices bounced very rapidly out of this zone and are now consolidating under $4K. This move forms a potential short-term bottom, especially as RSIs have ended the territory they sold and is now trending.

That said, as long as ETH is below the $4,200 level, the structure remains bearish. If buyers can regain that level, momentum could return in favor of bullish moves. Otherwise, drops into the $3,500 area would be very likely in the coming weeks.

On-Chain Analysis

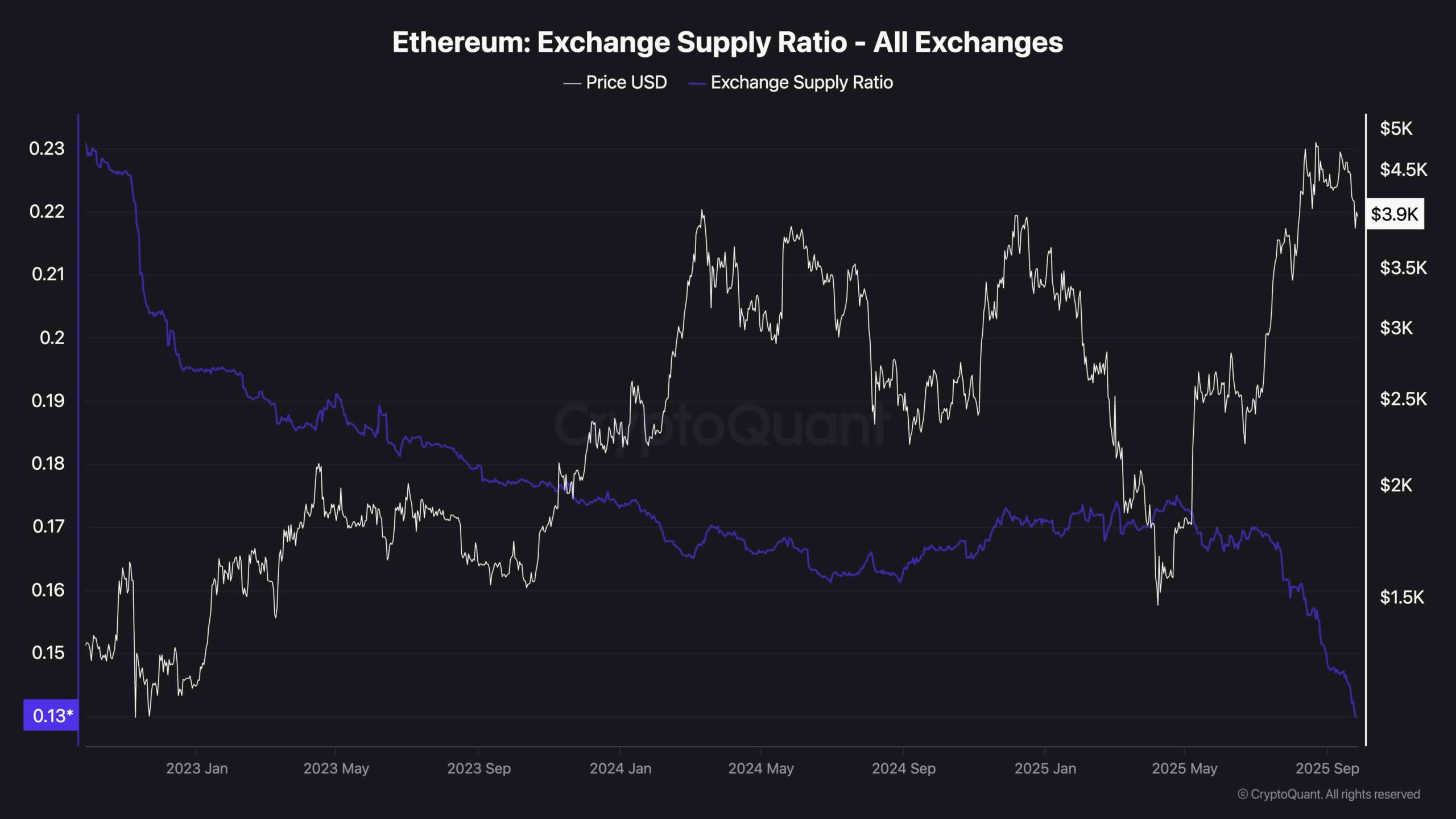

Exchange Supply Rate

In terms of data on the chain, Ethereum’s exchange supply ratio continues to be downwards, currently sitting at its lowest point at near 0.13. This indicates that the reduced portion of the total ETH supply is retained in central exchange, suggesting a strong long-term accumulation trend. Historically, this has been a bullish signal. Because that means fewer tokens are readily available for sale.

However, this accumulation trend is in contrast to recent price action. There are fewer ETHs sitting in exchange, but prices still fell sharply, perhaps due to short-term leverage wipeouts and wider market sentiment. In any case, this metric supports the idea that long-term holders are confident, and the bullish structure of the macro continues as it is, unless it suddenly reverses with an exchange inflow.