Ethereum (ETH) fell below the crucial $3,000 level earlier today, spooking retail traders after a week of massive liquidations. On-chain watchers said the move led to an outflow of leveraged longs, but also triggered aggressive buying by large holders. According to Lookonchain, whales have purchased over 323,523 ETH worth $1.12 billion in the past two days.

ETH has since rebounded above $3,000 and is trading around $3,315 at the time of writing, suggesting that buyers defended the round number. This tells traders that the $3,000 floor remains important even in a weak US bidding environment.

ETH cycle shows distribution since August, hitting a high of $4,500

According to CryptoQuant analysis, ETH has completely completed a four-stage market cycle this year, from decline to accumulation, markup, and distribution. After peaking above $4,500 in August, Ethereum price started to consolidate and eventually lost major support levels anchored in the major AVWAP, including the 2024 and 2021 highs.

Source: CryptoQuant

The recent bust has shifted the market balance from buyer-dominated to a neutral to bearish phase. Approximately $39 million in long positions were liquidated on Binance during this week’s selloff, the largest amount since early October.

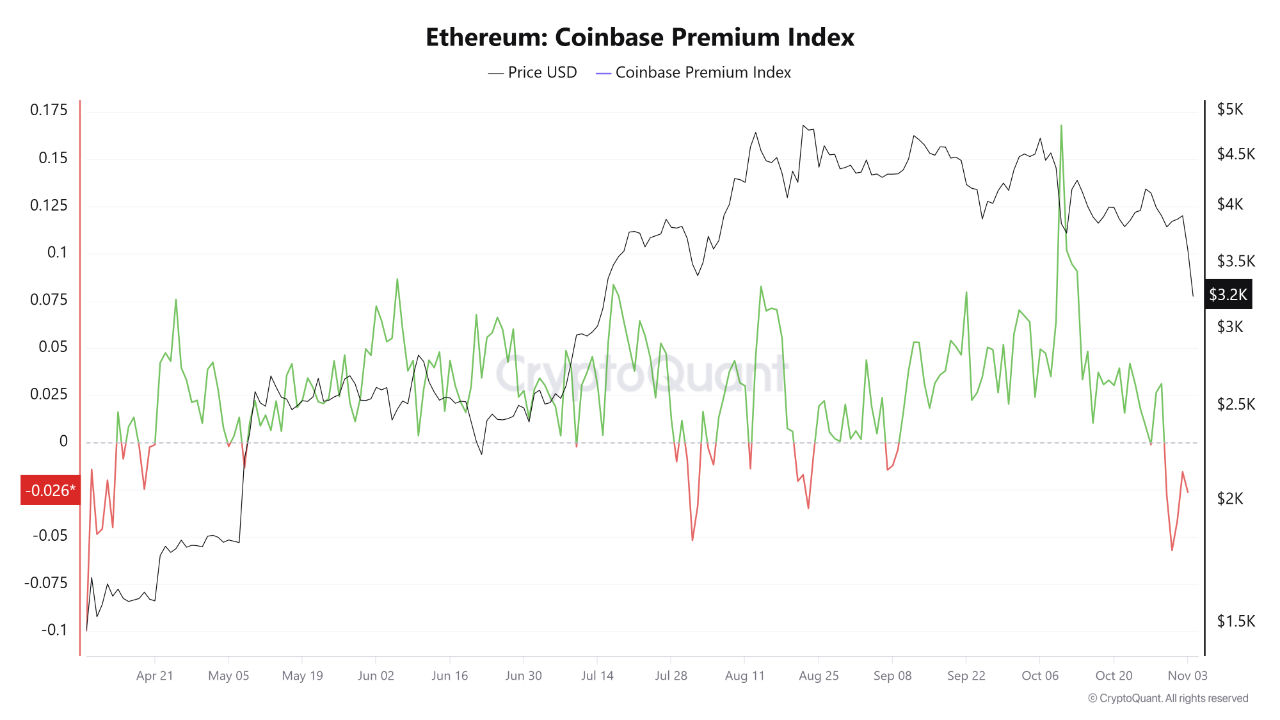

Coinbase premium turns negative as US buyers pull out

The Coinbase Premium Index fell to -0.057, its lowest level since April. This indicator compares US exchange prices (Coinbase) to global exchange prices (Binance), and a negative premium indicates weak demand from US investors.

During Ethereum’s mid-year rally, U.S. buyers paid a premium, but the recent turn to discount prices suggests domestic traders are now selling on strength or exiting risk exposure.

Source: CryptoQuant

Analysts say that for a sustained recovery, the Coinbase premium, which measures U.S. accumulation, needs to return to positive territory. Until then, ETH’s recovery momentum is likely to remain near the $3,250-$3,400 resistance zone.

Related: Solana vs. Ethereum: Analyst says SOL is ‘winning’

Sentiment washout could indicate regional bottom

Santiment data shows that Ethereum’s social sentiment has turned sharply bearish, marking its second negative day in the past six months. Historically, these fear spikes have coincided with local price troughs.

😱 As Bitcoin falls to $98.9,000 and Ethereum to $3.09,000, your timeline may show other traders in disarray. But social data shows there’s still plenty of confident buy-in. Let’s take a look at the sentiment on $BTC, $ETH, and $XRP after the disaster. 👇https://t.co/smG1LYyI77 pic.twitter.com/SdEusnzXUv

— Santiment (@santimentfeed) November 5, 2025

Strong reversals have been preceded by similar extreme sentiment during past economic downturns, including October’s Trump tariff collapse. This increased pessimism, coupled with whale accumulation, could suggest that the market’s downside is nearing exhaustion.

If ETH is able to regain $3,200 with continued buying volume, the next major resistance level would be around $3,600 to $3,800. However, failure to maintain the $2,900-$3,000 support zone could pave the way for further correction near $2,700.

Related: Ethereum price prediction: Trend line breaks down due to ETF outflow

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.