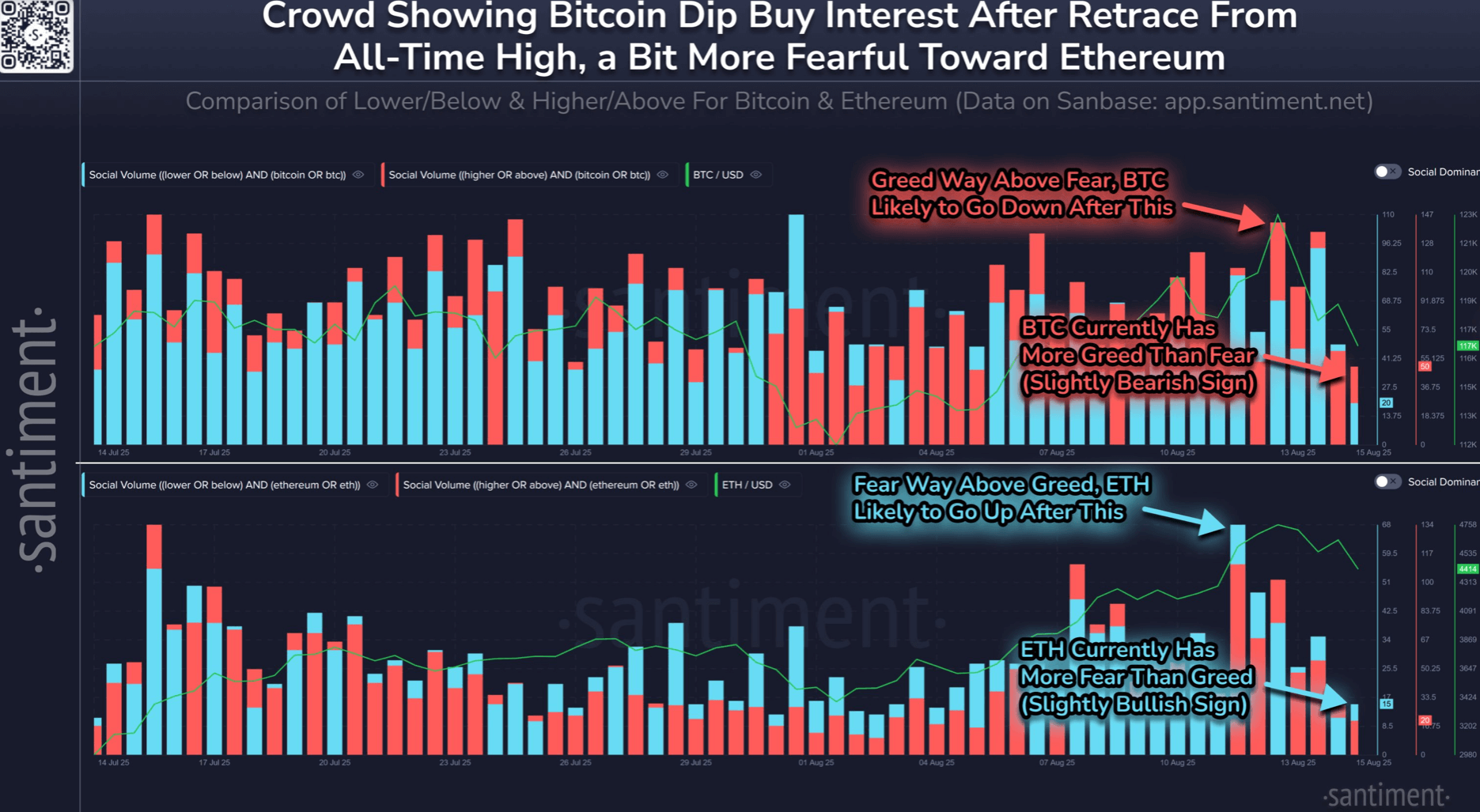

Ether holds a slight edge over Bitcoin in the short term, as social media chatter around cryptocurrency isn’t too hot, says Santimento, a sentiment platform.

“The $ETH crowd hasn’t shown much bullish despite significantly better performance over the past three months,” Santiment said in the X-Post in its ETH/BTC ratio on Friday.

Ether was not about recovering the 2021 history high

“The current outlook shows Ethereum’s slightly bullish path as it lacks interest in dip purchases compared to Bitcoin,” Santimento said.

Santimento shows data suggesting that the crypto community is more interested in purchasing Bitcoin dip than ether dip. sauce: single

Bitcoin and ether were pulled back from when Bitcoin hit a new all-time high of $124,128 and the ether approached reclaiming its 2021 record high of $4,878.

According to CoinMarketCap, Ether has fallen just 1.94% since recovering its 2021 record high.

Meanwhile, Bitcoin is down 5.10% from its all-time high of $124,128 on Thursday, trading at $117,939 at the time of publication.

Bitcoin chatter was bubbled at ATH level

Santiment said social media posts have become very bullish for Bitcoin at this price level. “We see that the surge in greed at BTC is in perfect alignment with Ass and the local top,” Santimento said.

Analysts have raised their recent etheric target amid a surge in facility purchases and the acceleration in adoption of stubcoin after the recent changes in US regulations.

Ether has increased by 32.94% over the past 30 days. sauce: coinmarketcap

Crypto Trader Yashasedu said on Tuesday that if Bitcoin makes a highly anticipated move to $150,000, the ether could rise to more than $8,500, based on past bull market trends, with Bitcoin reaching 35% of Bitcoin’s market capitalization.

Yashasedu said that if Bitcoin reaches $150,000, ETH could skyrocket to $8,656.

Meanwhile, Standard Chartered raised its ether price forecast to $7,500 in 2025 from its previous $4,000 target.