According to the hot chain data, the Etherum MVRV ratio has recently been noted for noteworthy. According to history, this means the price.

The Etherum MVRV ratio has recently fallen to a relatively low level.

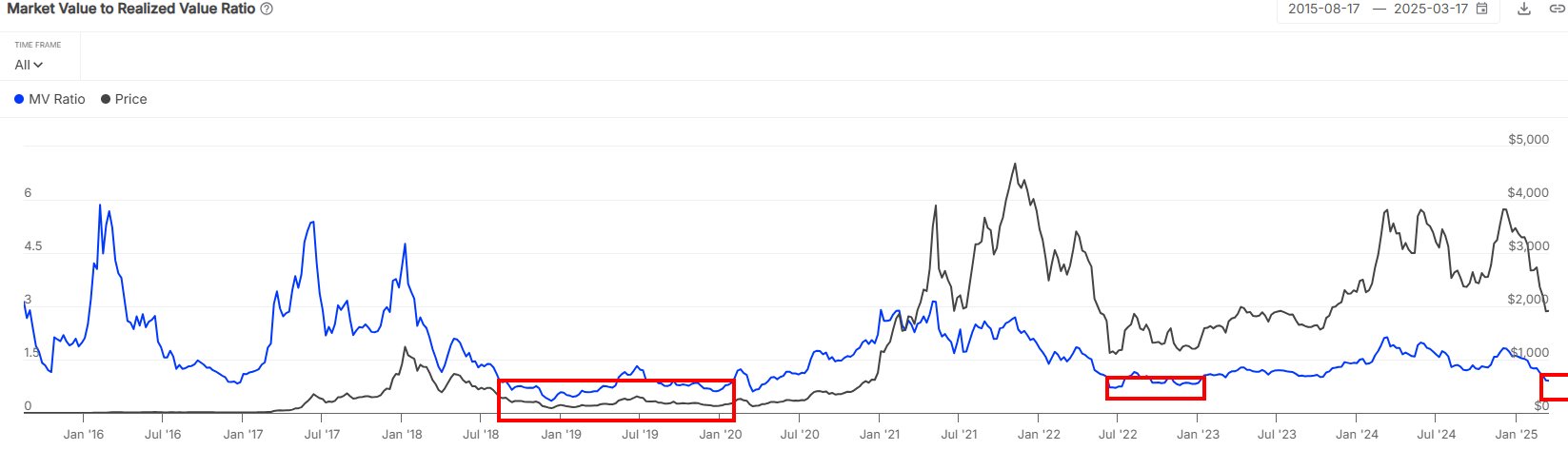

In X’s new post, Market Intelligence Platform Intotheblock discussed the latest trends in the market value of Ethereum’s MVRV (realization value) ratio. The MVRV ratio represents a warm -chain metric that measures the ratio of the market cap and the realized ETH.

In short, this indicator tells us that the value of investors is a way to compare with investments made to buy coins at first.

If the MVRV ratio is greater than 1, the average holder can be assumed that it has a net profit. On the other hand, the indicators under the cutoff suggest that the entire market is in hand.

Now there is a chart on the indicator shared by the analytics company. This shows Ether Lee’s value trend over the last decade.

The value of the metric appears to have been sliding down in recent days | Source: IntoTheBlock on X

As you can see in the graph above, the Ether Leeum MVRV ratio has recently fallen and has fallen below one point, suggesting that ethical investors are currently in net losses. The reason for this change in the market is that the cryptocurrency naturally faces the overall recession in the entire sector.

Currently, the value of the ETH MVRV ratio is 0.9. INTOTHEBLOCK pointed out that indicators do not often get this level and usually only forced bare markets to be forced.

Interesting patterns come from the period of the indicators sitting at the lowest level when viewing the price trajectory of the past. Analytics Firm said, “Historically, the ratio of MVRVs of less than 1 was consistent with ETH’s favorite entrance point.

However, it is noteworthy that the MVRV ratio that falls into this area has actually proved to be optimistic of Etherrium, but its effect is not immediate, and cryptocurrency tends to stay for a long time before rebound.

In other news, INTOTHEBLOCK pointed out how the main warmth support block for ETH exists between $ 1,843 and $ 1,900 in another X POST.

The cost basis distribution across the various price levels | Source: IntoTheBlock on X

In the warm chain analysis, the strength of all support levels is measured according to the last purchase by the investor. The price range mentioned above is especially dense in terms of supply, and the asset’s 35.6 million tokens were purchased at 464 million addresses in it.

The analyst said, “This accumulation suggests strong support, but when it slides under this range, the risk of surrender increases as demand is significantly weaker than this level.

ETH price

Ether Lee is currently testing the chain support area with a price of about $ 1,877.

Looks like the price of the coin has gone stale recently | Source: ETHUSDT on TradingView

DALL-E, INTOTHEBLOCK.COM’s main image, TradingView.com chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.