important notes

- Ether started the week above $3,000 following a sharp rise in trading activity.

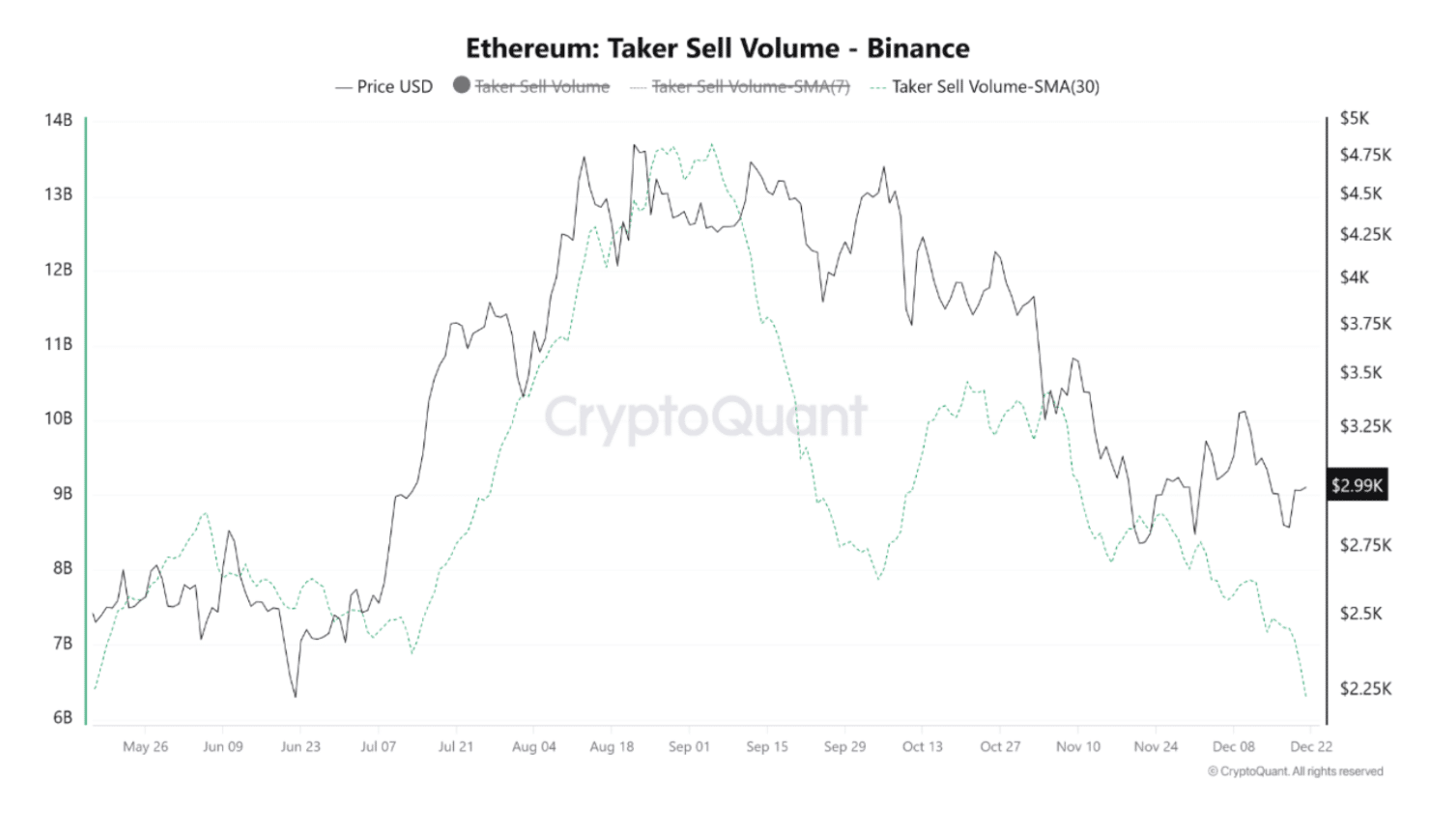

- The taker sell volume indicates that the pressure on the sell side is easing.

- According to analysts, a price move above $3,200 would signal a takeover by the bulls.

ether Ethereum $3,047 24 hour volatility: 2.1% Market capitalization: 36.834 billion dollars Vol. 24 hours: $1.729 billion After a shaky run, this week got off to a strong start. On December 22nd, the cryptocurrency regained the $3,000 level with a 100% spike in trading volume. Analysts expect a relief rally in the future as selling pressure subsides.

Data from CryptoQuant suggest The 30-day moving average of Ethereum taker sales volume has fallen to around $6.3 billion, the lowest level since May. This decline indicates that fewer traders are exiting positions out of urgency or fear.

Ethereum Taker Sell Volume 30-day SMA | Source: CryptoQuant

Tom Lee’s latest ETH purchase with Bitmine is New purchasing desire. According to Lookonchain data, the company acquired 13,412 ETH worth over $40 million on December 22nd.

It looks like Tom Lee (@fundstrat)’s #Bitmine bought an additional 13,412 $ETH($40.61M). https://t.co/m3WT8Jwh6x pic.twitter.com/DCpdDNp0U9

— Lookonchain (@lookonchain) December 22, 2025

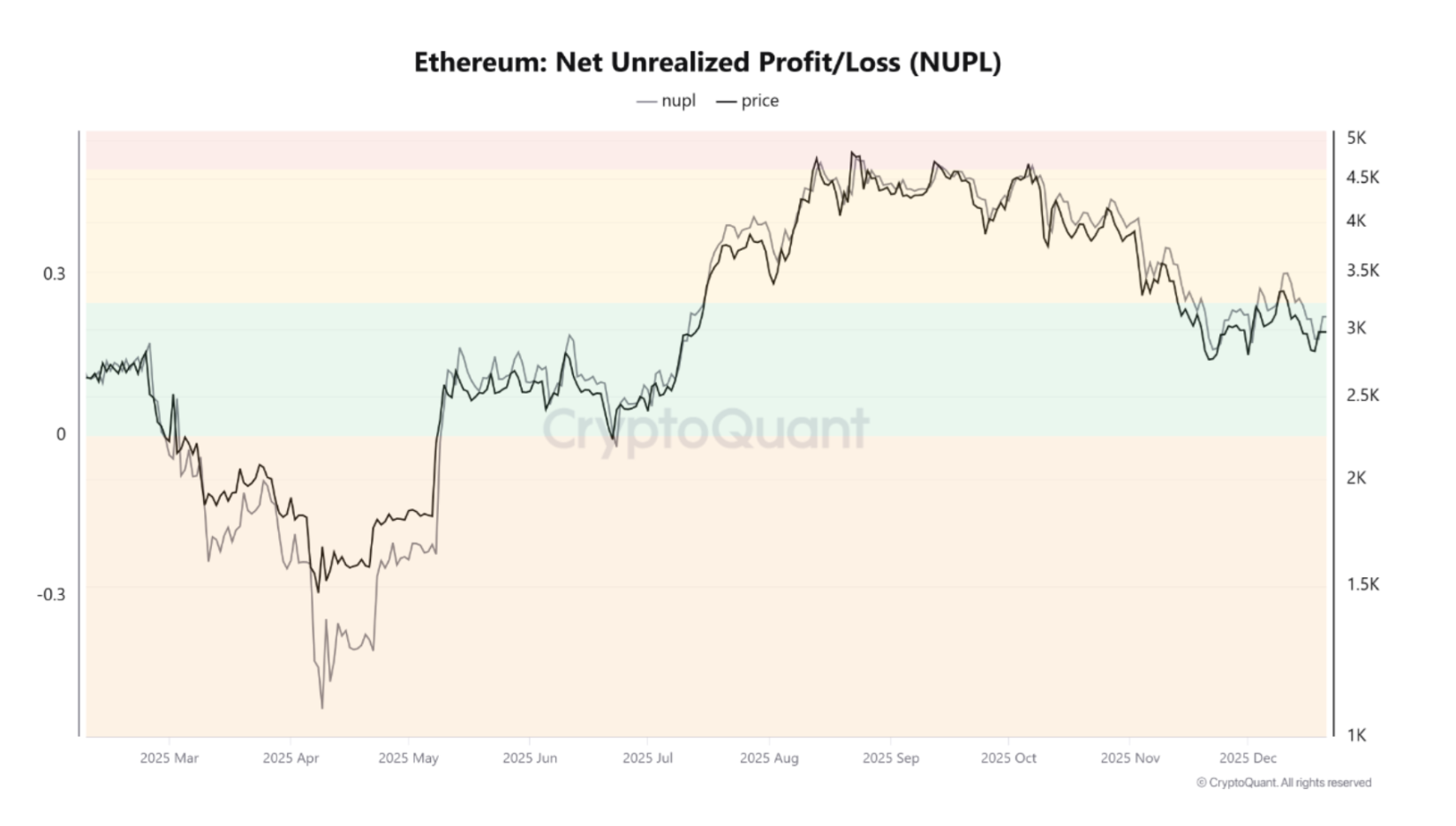

Additionally, Ether’s Net Unrealized Gain and Loss Index (NUPL) remains in positive territory around 0.22. this level show This means that the average ETH holder is still making a profit, although the return is moderate.

Ethereum NUPL |Source: CryptoQuant

Historically, this range indicates cautious confidence. This shows that the market is no longer driven by fear, but it is still far from the overheating seen near the top of the cycle.

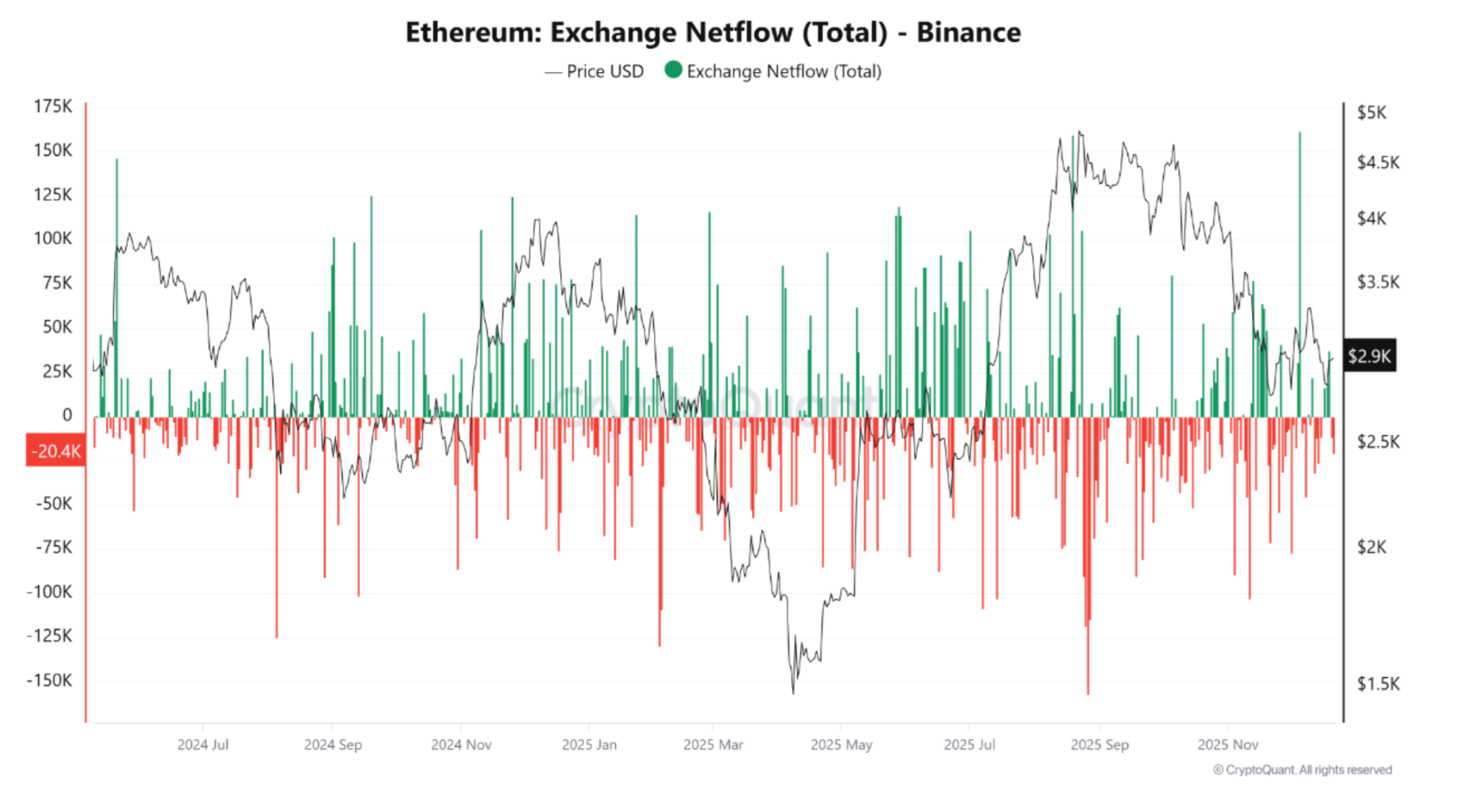

Meanwhile, Binance has recorded large net outflows of ETH, which means the short-term sell-off risk is low. Importantly, these exchange exits were despite moderate unrealized gains, suggesting that holders are in no hurry to lock in profits.

Ethereum Netflow on Binance | Source: CryptoQuant

Recent Ether price weakness still suggests caution

This easing of selling pressure came after a difficult week for Ethereum, where the price fell below $2,800. Last week, the Spot ETH ETF recorded a combined net outflow of $644 million, and none of the nine funds recorded inflows.

Popular crypto analyst CyrilXBT noted on X that although ETH has rebounded, it remains at a key resistance level. He explained that the $2,700 to $3,000 area is acting as fragile support for the top altcoin, and further decline could result in “rapid downward acceleration.”

Related article: Whale dump and Ethereum ETF expected to see $234 million outflow, ETH to watch at $2,800

However, he added that ETH could look “healthy” if it manages to break above the $3,200 to $3,400 level.he.

$ETH

ETH is basically in the same situation. So it’s bouncing, but it’s still below the main overhead level.

The orange band ($2.7-3.0,000) is the battleground. We will support you until that happens.

Beyond that, ETH would need to regain $3.2-3.4k for it to look “healthy” again.

Expectations: Hold $2.7–3.0k = Chop +… pic.twitter.com/8Lby8IOw6Q— CyrilXBT (@cyrilXBT) December 22, 2025

At the time of writing, ETH is trading It has risen about 2% over the past day to around $3,031. However, it remains 38% below its August high of $4,953.

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.