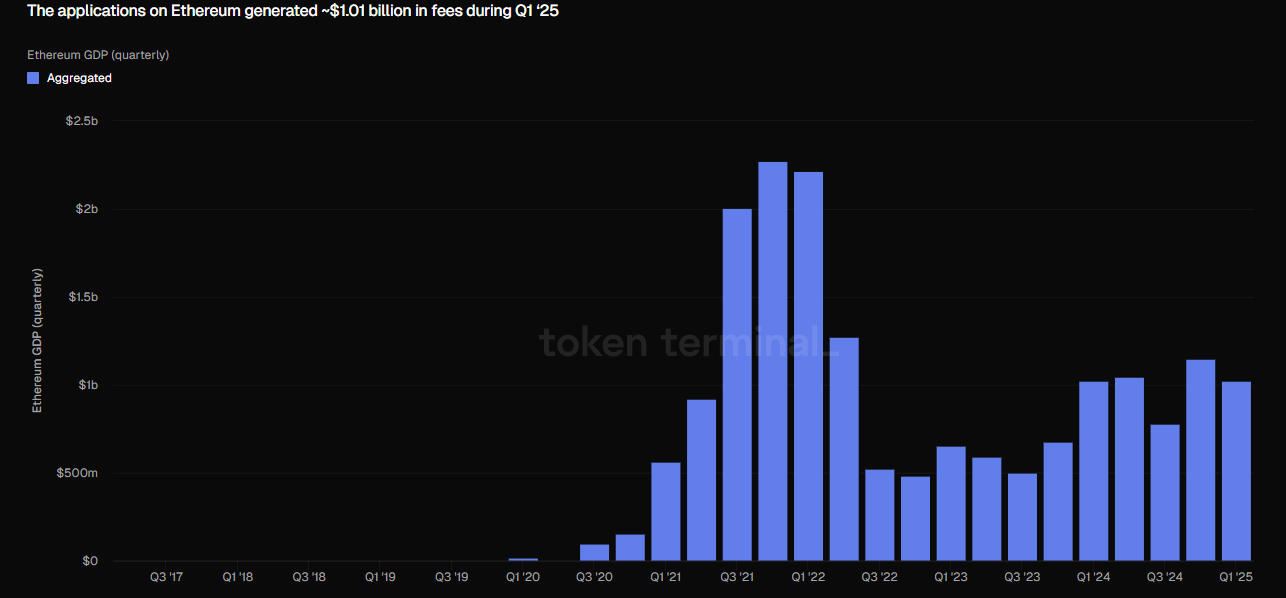

Ethereum Dups led the pack in the first quarter of 2025, generating more than $1 billion in fees, far surpassing competitors such as bases, BNB chains and arbitrum, highlighting Ethereum’s continued dominance in decentralized application revenue.

Ethereum Dup surpasses base and BNB chains in quarterly rates

According to Token Terminal, Ethereum continues to solidify its position as a major platform for distributed applications (DAPPS) (DAPPS).

Much behind Coinbase’s Layer 2 chain, the class took second place at $193 million. The BNB Chaindap continued closely, collecting $170 million, bringing the Arbitrum ecosystem to $73.8 million. Avalanche’s C-chain concluded the top five, with its Dapps generating a fee of $27.68 million.

Source: Token Device

This data highlights Ethereum’s continued leadership in user engagement and transactional activities within distributed finance and Web3 application spaces. Although Layer 2 and alternative chains have acquired positions, Ethereum’s established infrastructure and robust developer ecosystem remain important drivers of its market strength.

As DAPP usage and fee generation emerged as key indicators of network utilities and adoption, Q1 results show that Ethereum still sets the pace of the expanding blockchain ecosystem.