Ethereum (Eth) Validators have not generated a large number of Treasury Departments, but other groups are running into the ETH verification ecosystem. This imbalance may indicate mixed emotions in large ETH wallet segments.

$7 billion packed in the Ethereum validator queue

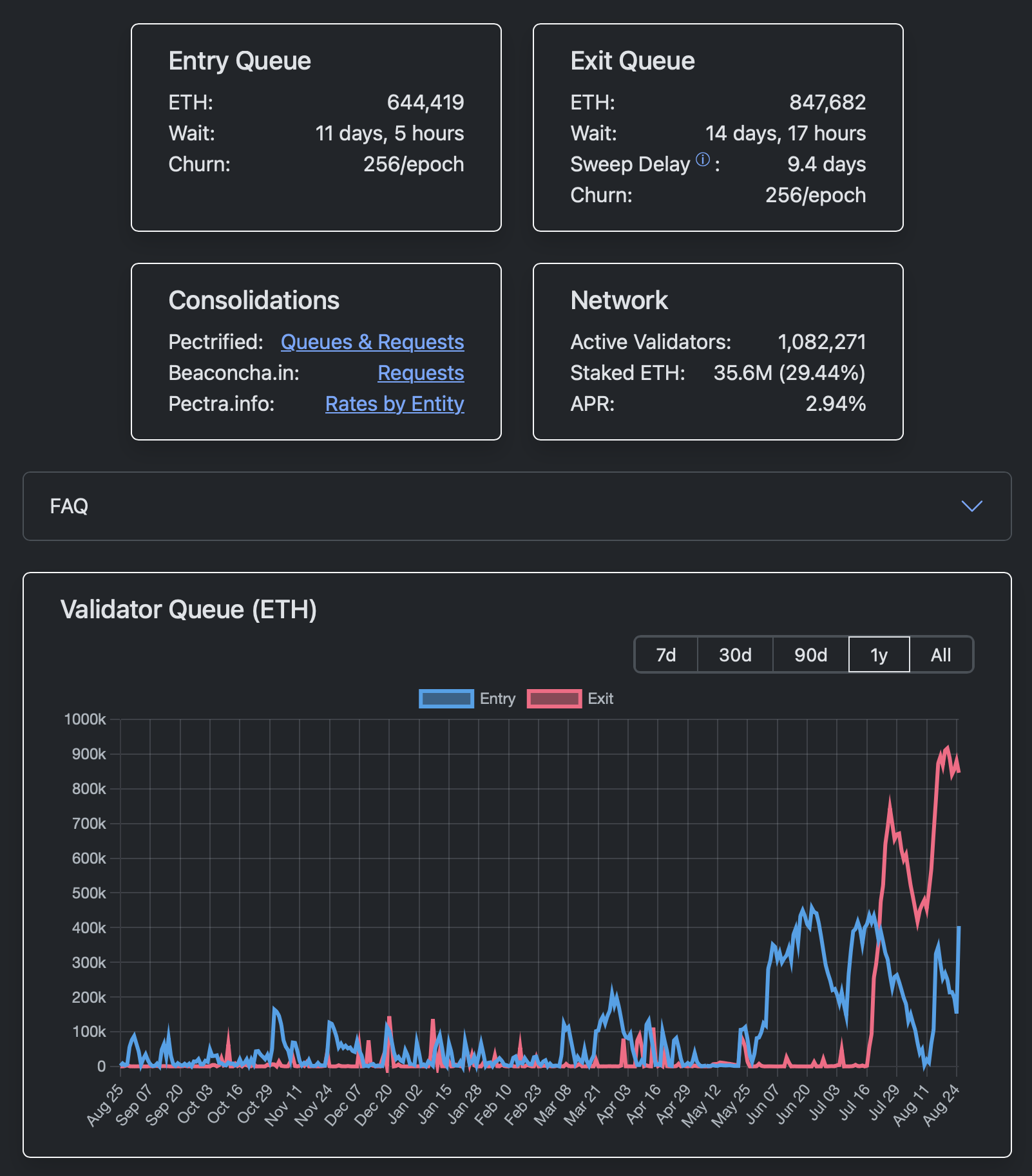

The Ethereum (ETH) Validation Entry Queue – a list of potential validators interested in staking stocks to earn regular rewards – began to surge rapidly. In just two days, it added over 400,000 ETH, reaching a high of over 644,000 ether.

As a result, it currently takes more than 11 days. Such an increase in staking period was last observed over two months ago.

At the same time, following its peak on August 20, 2025, the unstable line of Ethereum (ETH) began to settle.

In total, about $7 billion in liquidity is waiting to join or leave it in the ETH staking mechanism. It shows mixed expectations among large ETH market participants.

The Ethereum (Eth) community is optimistic after discussion

Interest in withdrawal is most likely related to opportunities to correct profits at current price levels. In contrast, interest in locking ETH to validators is a signal that they grow optimistically about their price performance.

Due to the saturation of the ecosystem, the annual Etheric (ETH) staking reward was below 3% compared to the normally observed 4%.

In some cryptocurrency exchanges, Ethereum (ETH) prices hit a new all-time high last Friday, as previously covered by U.Today.

At the same time, Coingecko and Coinmarketcap do not confirm that the previous ATH of 2021 has been destroyed at ether prices.