Ethereum (ETH) shows an increase in indications of sales pressure as record numbers of wallet addresses move towards profits.

The assets are already below $4,500, with some analysts hoping for further revisions, while others maintain ETH’s optimistic long-term outlook.

Ethereum whales begin to make profits within historical profitability levels

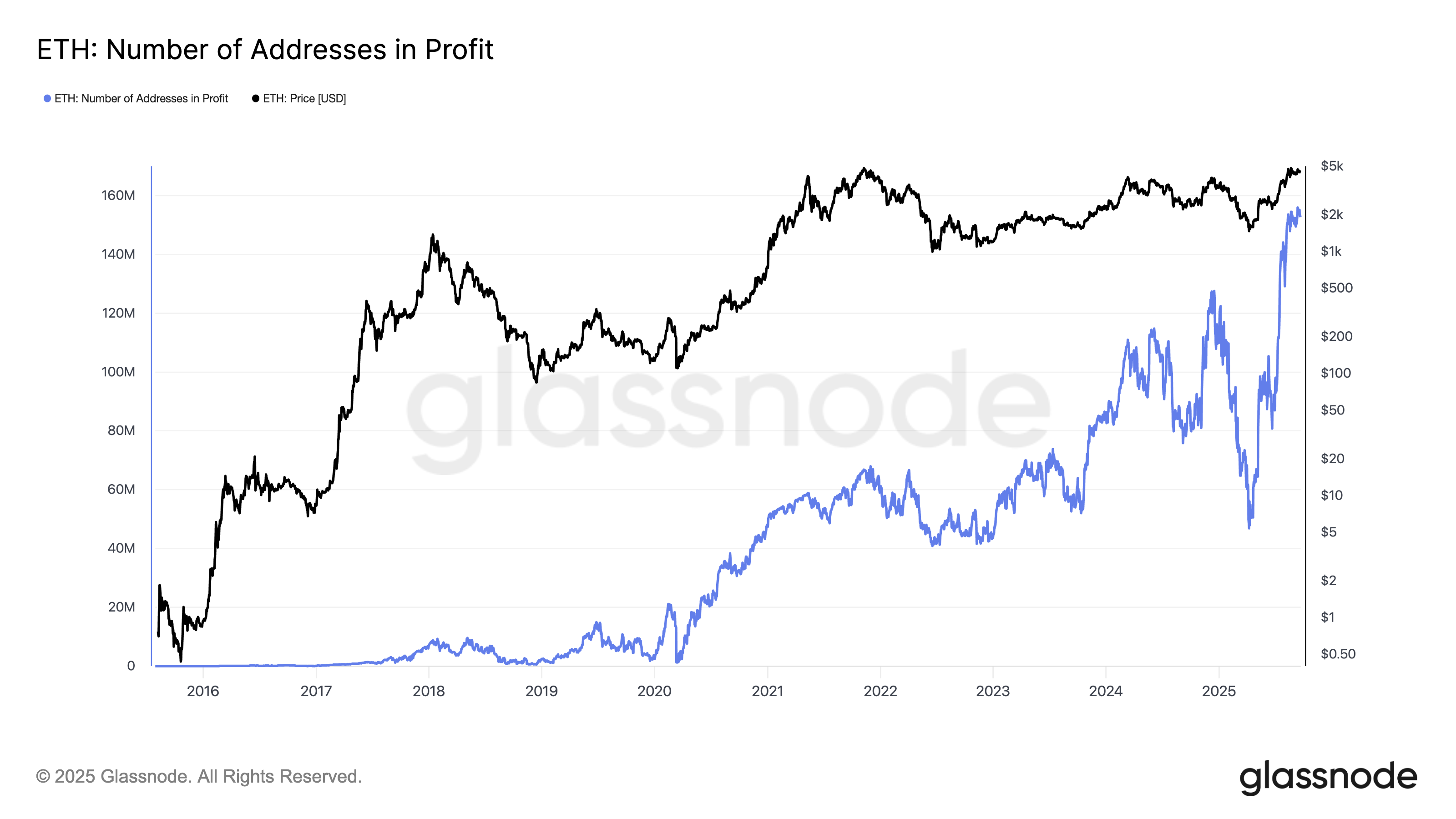

According to GlassNode data, the number of profitable ETH addresses exceeded a record high of 155 million in September.

“The highest profit address in history is profitable from over 155 million ETH wallets, marking the fastest rate ever,” Coin Bureau said.

Ethereum address of profit. Source: GlassNode

This record highlights the long-term strength of the assets and the participation of a wide range of investors. However, as profitability increases often precede sales, the risk of short-term volatility also increases.

On-chain activity appears to reflect this risk. Blockchain analytics firm Lookonchain reported that a trend study has moved 16,800 ETH, worth around $72.88 million, to Binance.

The move encourages speculation of a change in outlook, and some view it as a preparation for sales in safe profits.

“Is the trending research about to start selling ETH again? The newly transferred ETH is part of the 43,377 ETH purchased in early September. After purchasing in early September, I held a total of 152,000 ETH, with an average cost of around $2,869,” analyst Embercn added.

It has also been seen to make profits among other whales. The address (0xB04) sold 3,000 ETH for $13.14 million. Despite the sale, the whale still holds 9,804.32 ETH, worth around $4,257 million.

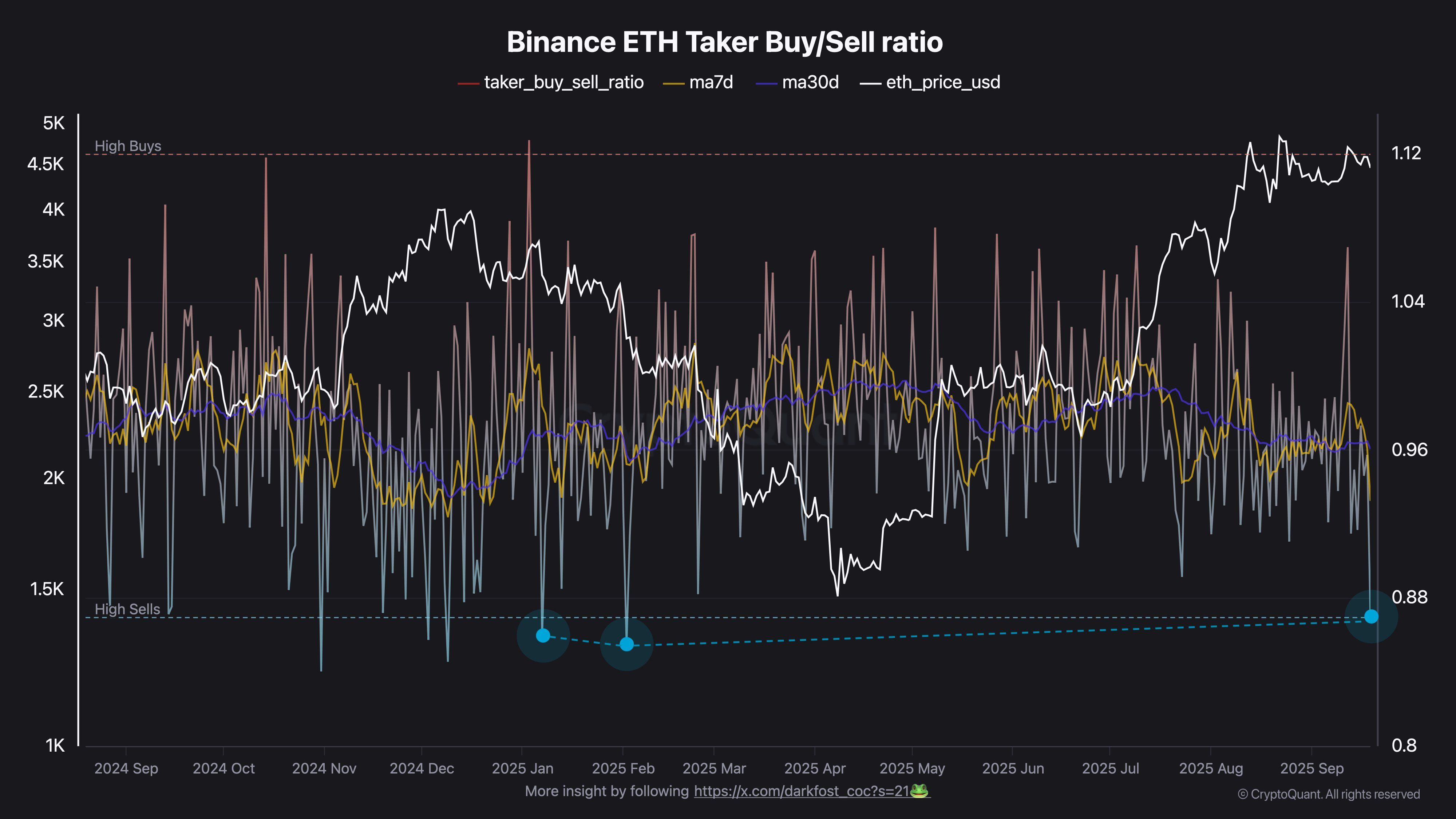

The derivatives market reinforces bearish sentiment. Analysts say Binance’s Eth Traders has become violently negative. Taker’s buy/sell ratio fell below 0.87 on September 19th.

“This has only dropped in the third time this year. In January and February, the ratio reached 0.85, coinciding with the bearish trend that pushed ETH below $1,500. Currently, the seven-day average is 0.93, marking the lowest level of the year,” DarkFost said.

Ethereum Taker trading rate. Source: darkfost_coc

Why ETH prices are below $4,000

Among these signals with increased pressure, the price action of ETH reflects distortion. Data from Beincrypto Markets showed that Altcoin has declined by 10.5% over the past week.

The price decline follows the Federal Reserve’s recent 25-bar rate cut, but ETH has subsided its recent peak and maintains a rally at $5,000. At the time of writing, the second largest cryptocurrency was trading at $4,153.

Ethereum (ETH) price performance. Source: Beincrypto Markets

Meanwhile, some market analysts believe ETH could drop further, falling below the $4,000 price level.

“ETH could once again reach the $3,900 to $4,000 range. There’s no one nice wave. I don’t think this cycle has reached $6,000,” writes Trader Philakone.

$ eth

Currently peaks at the bottom of the triangle ⚠️

Waiting for daily closure. Closed inside can bounce back and further consolidate.

Close the bottom and you can find the measured target https://t.co/cytjtxu6dj pic.twitter.com/e7fx2kcti3 that may continue on the downside

– Nebraskangooner (@nebraskangooner) September 22, 2025

Analyst Ted Pilows also highlights that ETH does not fill the CME gap in the $3,000-$3,500 range.

“Most CME gaps are filled before big movements, so fixes can occur.” Added pillows.

Despite these headwinds, long-term optimism persists. In another post, analysts said that Coinbase’s stock chart, which is often a key indicator, points to potential fixes that follow a new high that ETH could reflect.

“Global M2 Supply currently projects ETH between $18,000 and $20,000 per cycle top. Even if $ETH pulls half of that, it trades over $10,000. I’m still bullish on Ethereum for the long term, and I think a $4,000 liquidity zone sweep could happen before the reversal,” predicted Pillow.

$ETH is still integrated above 4K resistance levels.

Some people are now weakened by ETH and are currently seeking 3K dollars.

They miss the first rally and the next rally too.

IMO, 3.8k-$4k soaking soaking is very likely followed by a new ATH. pic.twitter.com/yttiqoaony

– Bitbull (@akabull_) September 21, 2025

So, while short-term risk is looms, Ethereum trajectories support an overall bullish trajectory in the long run.

Post Ethereum is facing pressure as profitable addresses reach new peaks.