Ethereum prices slipped nearly 5% today after hitting a new all-time high of $4,946.

summary

- After hitting an all-time high on August 25th, Ethereum prices have cooled down.

- Historical data suggest that September may be bearish for ETH.

- Technical portrays contrasting outlook as ETH trades within the upward channel of the daily chart.

According to data from Crypto.News, Ethereum (ETH) price rose above 21%, reaching a new all-time high of $4,946 on August 25th, settling at $4,713 as of press time. This price remains 26% higher than the beginning of August, 220% year-on-year.

The market capitalization in August suggests that despite the strong profits posted by Altcoin’s major Altcoin, historical data suggests that next month may likely be weakening against it.

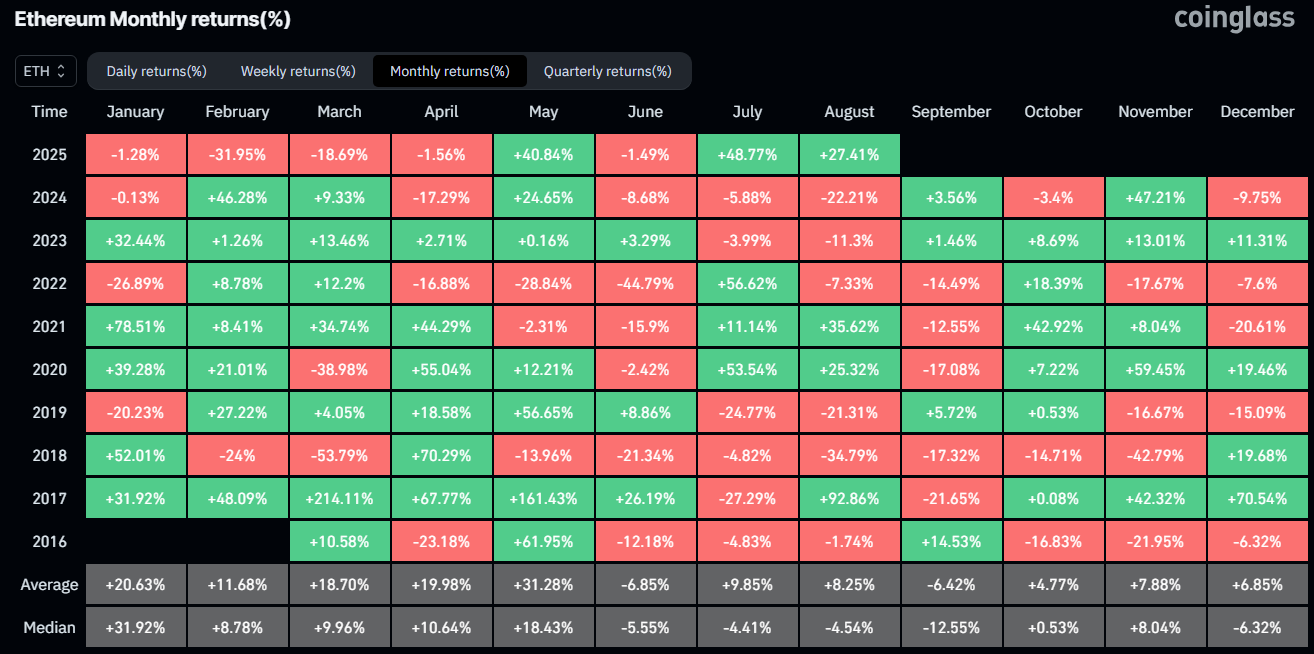

Looking at Coinglass data, it shows that since 2016, each time Ethereum recorded profits in August, fell in September. More specifically, ETH recorded profits of 92.86%, 25.3% and 35.6% in August 2017, 2020 and 2021, but a decline of 21.65%, 17.08% and 12.55% in September, respectively.

ETH Monthly Price Profit | Source: Coinglass

Such a scenario is further supported by the fact that ETH remains near the highest level ever. Once early investors start booking profits, cryptocurrencies usually tend to face some degree of sale after reaching a new peak.

You might like it too: Vitalik Buterin uses Focil Framework to reaffirm Ethereum’s fairness

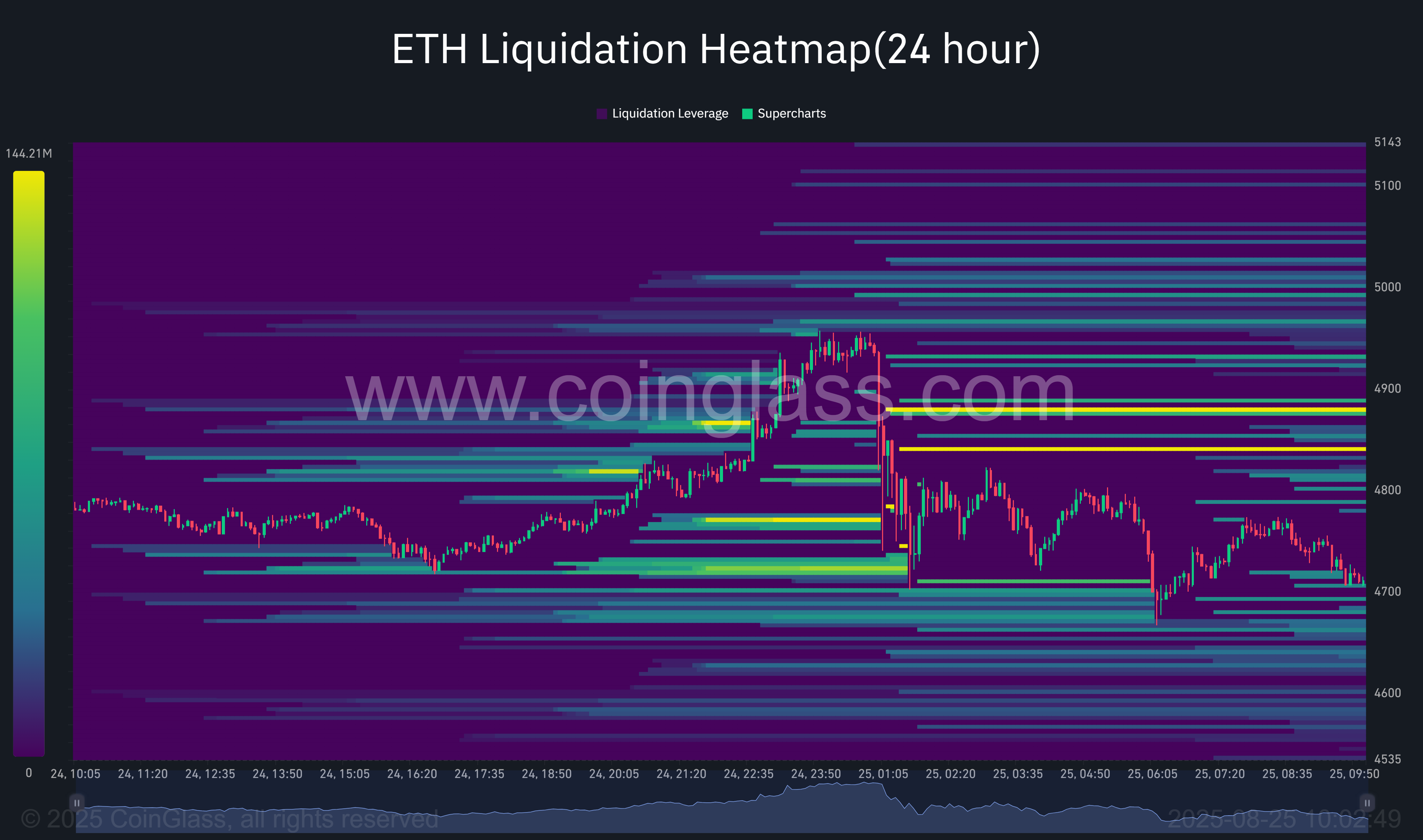

Meanwhile, data from Coinglass shows that the sudden drop from the new High in Ethereum was caused by a long wave of clearing, as the excess covered location was washed away near the top. Over the past 24 hours, ETH’s total liquidation was $216 million, with nearly $130 million coming from a long position.

ETH liquidation data | Source: Coinglass

At the time of reporting, the tight settlement zone remains clustered above $4,900. New attempts to invade high could lead to another liquidation cascade. If this occurs, the ETH may slip further towards the $4,600-4,680 range.

Nevertheless, unlike the previous cycle, Ethereum was able to enter next September under another macro environment marked by the presence of the Spot Ether ETF and the Ministry of Corporate Treasury, which holds ETH.

The nine-spot ether fund attracted $2.79 billion inflows in August, reflecting strong demand for ether among institutional investors since then of $5.43 billion in the previous month. This contrasts with Bitcoin’s counterpart, with outflows totaling $1.19 billion this month.

In addition to changing market dynamics, ether has emerged as one of the most closely monitored crypto assets this month, bolstered by a wave of regulatory momentum and corporate accumulation.

On the daily chart, Ethereum has been trading within parallel channels rising since late June, featuring higher and higher lows within two upward trend lines. This structure usually shows a continuation of the general bullish trend if prices remain limited within the channel.

Ethereum prices form a rising parallel channel for daily charts – August 25th | Source: crypto.news

At the time of reporting, Ethereum consolidates near the midline of the channel, suggesting an equilibrium period between trading pressures. In particular, tokens continue trading above the 20-day index moving average. This indicates that short-term momentum remains in favor of the bull.

Additionally, the Super Trend Indicator flipped the green, placed itself below the price, offering another bullish confirmation.

Meanwhile, the relative strength index fell to a read of 60, indicating that the bullish momentum persisted but never entered the acquired territory. This suggests that Ethereum still has room to move forward before it faces buyer fatigue.

Ethereum MACD Chart – August 25th | Source: crypto.news

If bullish momentum continues, the next major upward target is at $5,200. This represents a gain of 10% from the current level and marks the channel’s upper limit. Breakouts above this level can accelerate further profits, especially when accompanied by strong volume.

On the downside, immediate support is found for $4,349. This is a level that matches the 78.6% Fibonacci retracement of the latest upward swing.

Breaks below this level can disable the current pattern and trigger deeper corrections towards the lower boundary of the channel.

read more: Ethereum is approaching the “danger zone” but on-chain metrics shine

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.