On Monday, Ethereum may have survived a brutal sale, but signs of a proper comeback still fall in on balance. The current price is $4,172, the market capitalization is $503 billion, and the 24-hour trading volume is $486 billion. In all eyes, the recent price range between $4,029 and $4,497 is equivalent to a panic attack or the beginning of a stylish rebound.

Ethereum

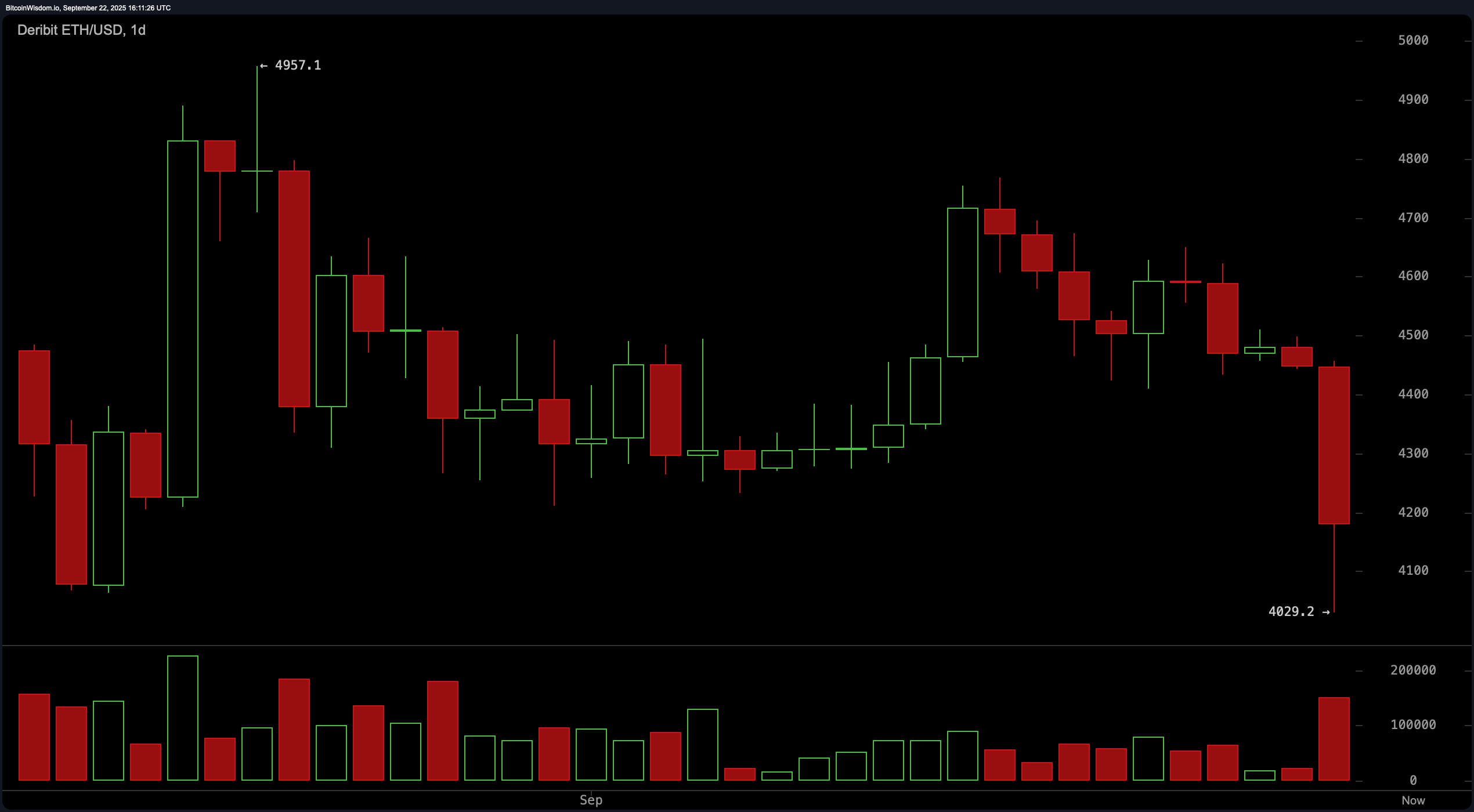

It’s not a sugar coat. The daily chart provided classic surrender candles with a dive of around $4,600 to $4,029. Traders saw Life flash before the portfolio as a wave of massive panic sales was confirmed.

The support was pulled like a rug below the $4,400 level, but the small wick at the bottom of the candle indicates that somewhere else someone saw the value of the confusion. If Ethereum wants red, they should hold a compelling show with the next couple’s candle. Smart Money waits for the price action to exceed $4,300 before taking bait. Exit Dream dances the mark between $4,500 and $4,600.

eth/USD via Delibit on September 22, 2025. One day chart.

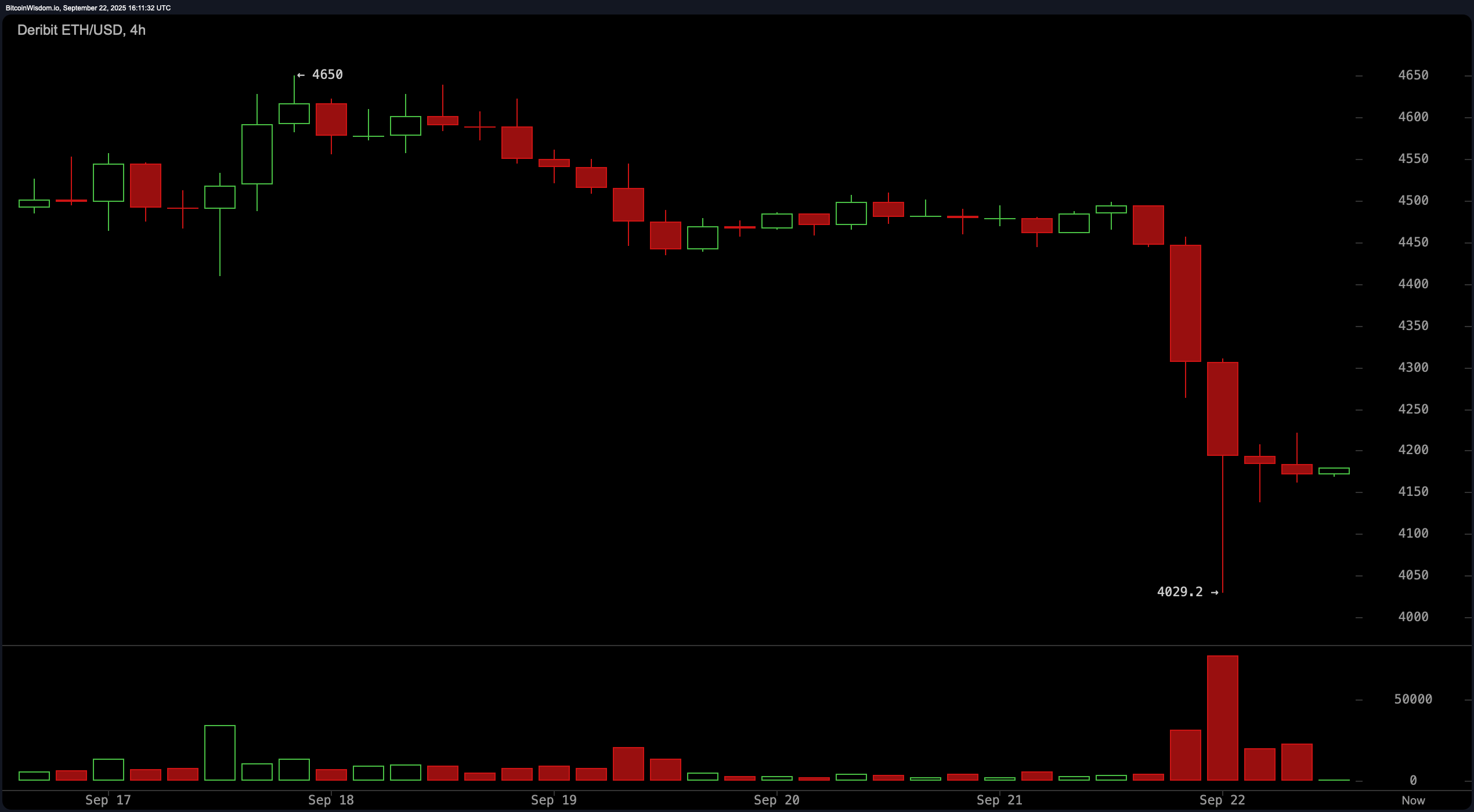

Zoom in to the 4-hour chart and the party is not lively. Ethereum has broken down from the $4,650 level and is lined with red candles lined up like a bad decision at the roulette table in Vegas. The momentum has cooled, but it’s not a good way. It’s like your phone is dead halfway through. Volume spiked during drops, classic climax sales behavior. Bulls who want to back in will see a break above $4,250 on volume checks and beware of near $4,500 on resistance levels. Is there anything under $4,050? Queue the trap door.

eth/USD via Delibit on September 22, 2025. 4 hour chart.

So let’s talk about Hourly Chart, the market’s heartbeat monitor. Ethereum’s short-term tendencies depict a story of heartbreak and hesitation. After peaking at around $4,498.70, it required a sharp nose and began to lodge around the $4,150-$4,200 zone. The juicy volume highlights a hint of around $4,029 that the worst may be behind us. If the price can regain $4,250 with volume muscle, the Bulls might play. But don’t be cheeky: the $4,400 stand, as a stone wall of resistance, can really quickly regret optimism by falling below $4,100.

eth/USD via Delibit on September 22, 2025. 1 hour chart.

Decode the secret language of technical indicators. For these oscillators and moving averages? They are whispering sweet things, and none of them are bullish. Relative Strength Index (RSI) of 39.7, Probabilistic 31.3, Commodity Channel Index (CCI) is -126.2, Mean Direction Index (ADX) of 15.0, A great oscillator at 10.1 makes me cry as if I’m waiting for someone else to make the first move. However, momentum at -537.4 and moving average convergence divergence (MACD) level of 23.8 are already “bearish.” Basically, the mood is “Yikes” dash.

And finally, the moving average behaves as they have seen well. All short-to-midrange indicators (Exponential Moving Average (EMA) and Simple Moving Average (SMA) are flashing negative signals over a period of 10 to 50. Only long-range indicators such as EMA and SMA for the 100th and 200th periods are holding bullish flags. Translation: The short-term momentum is still packed against the other way around, but the long-term trends have not yet been thrown into the towel.

In summary? Ethereum is licking the wound and there is a faint light that could potentially be rebound, but the chart calls for patience. Bears are still louder unless prices start stacking higher and higher lows, especially in lower time frames.

Bull Verdict:

If Ethereum sees breakouts above $4,150 and more than $4,250 in volume, the short-term gathering for $4,500 is not off the table. The long-term moving average still supports upward trends, suggesting that bulls can regain control.

Bear Verdict:

Despite signs of surrender, Ethereum’s technical indicators and moving averages remain largely bearish in the short term. Without a confirmed reversal and break above the main resistance level, this could result in a dead bounce before lowering another leg.