Ethereum fell to six-week lows and slid below the $4,000 level amid the weaker market.

The Altcoin King now costs $3,938, indicating that bearish momentum continues to dominate. Despite the decline, certain on-chain signals suggest that this recession could provide opportunities for purchase.

Ethereum investors have opportunities

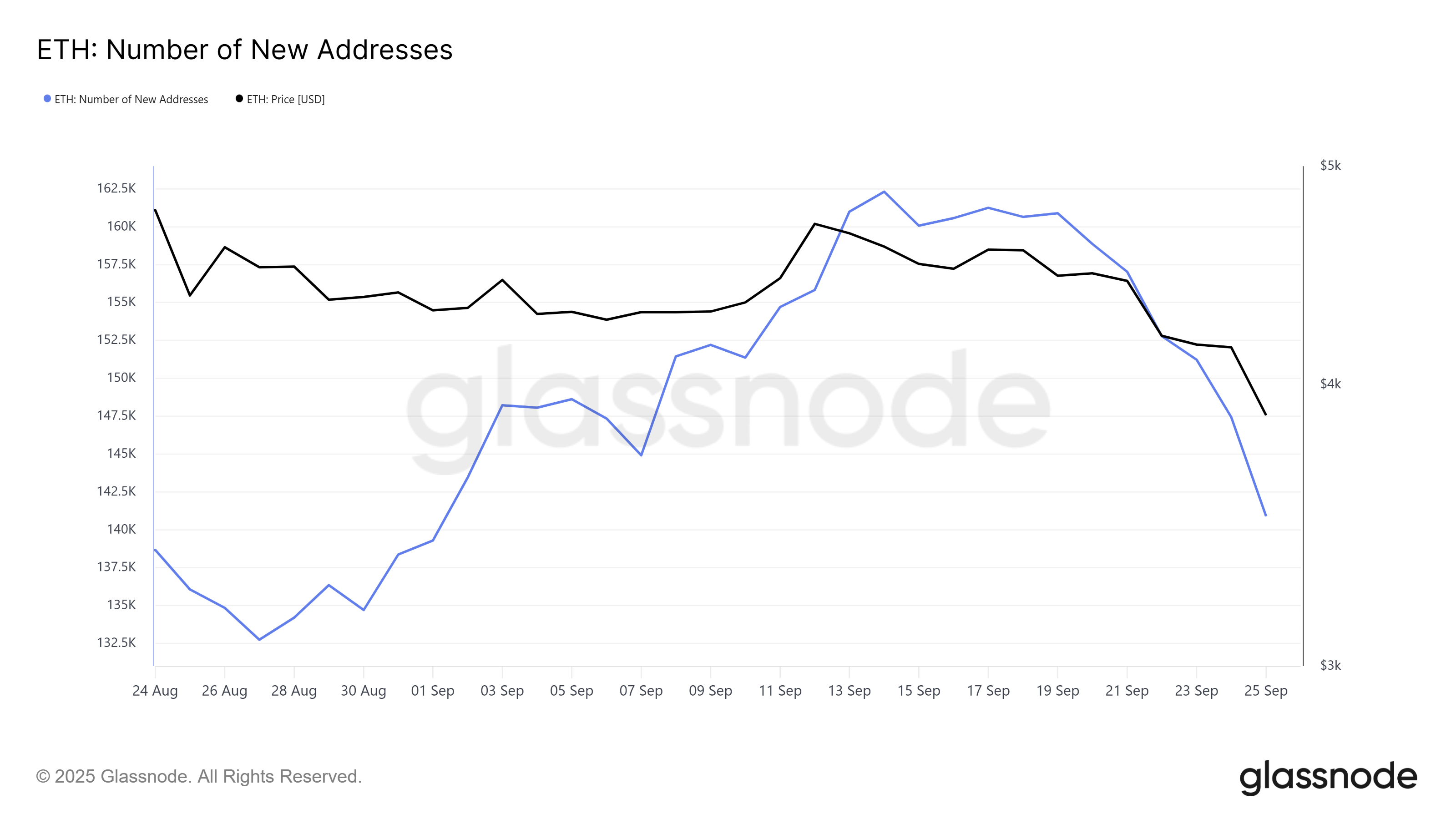

Creating new addresses on the Ethereum Network has been significantly slower and activity collided with the month soon. This decline indicates a decline in interest from potential investors. Without new participation, Ethereum is struggling to generate upward momentum.

The lack of new entrants into the ecosystem underscores concerns about slowing demand. A fresh influx usually provides important support for long-term gatherings as more users can embrace the assets.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

New address for Ethereum. Source: GlassNode

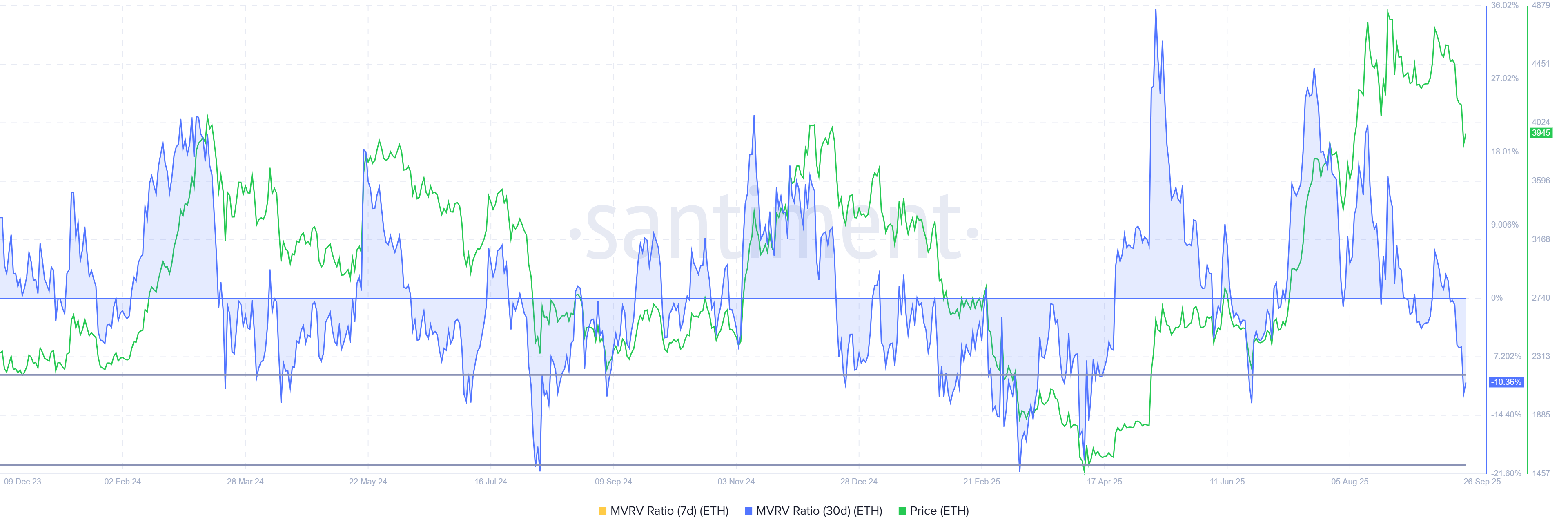

Meanwhile, Ethereum’s MVRV ratio shows a more optimistic outlook. Currently, the metric places ETH within the opportunity zone. This is from -9% to -30%. Historically, this zone has marked a point where losses often occur as a rapid accumulation.

When profits decline and holdings fall into losses, investors tend to hold or buy at a low level instead of selling. This behavior often creates the basis for recovery. The possibility of demand being updated is important even amid bear pressure, as ETH remains in this zone.

Ethereum MVRV ratio. Source: Santiment

ETH prices require push

At the time of pressing, the Ethereum priced at $3,938 and was sought to establish $3,910 as a support floor. This decline marks a significant break below the $4,000 level, highlighting short-term weaknesses.

Given current signals, ETH can remain in the range below $4,074 resistance until the emergence of stronger bullish cues. Market sentiment suggests consolidation rather than a sharp recovery, keeping investors cautious.

ETH price analysis. Source: TradingView

However, if Ethereum supports $4,074, the push to $4,222 could last. The move will require investor participation, maintaining an influx to counter the bearish momentum and ultimately negating short-term negative outlook.

Post Ethereum prices are down six weeks, but falling into the opportunity zone first appeared in Beincrypto.