Ethereum just pushed up staking supply by nearly 30% while price tests the 200-day EMA near $3,339 on the daily chart. This setting puts long-term commitment and key resistance levels in the same frame.

Piling out Ethereum New highs reached as locked supply approaches one-third

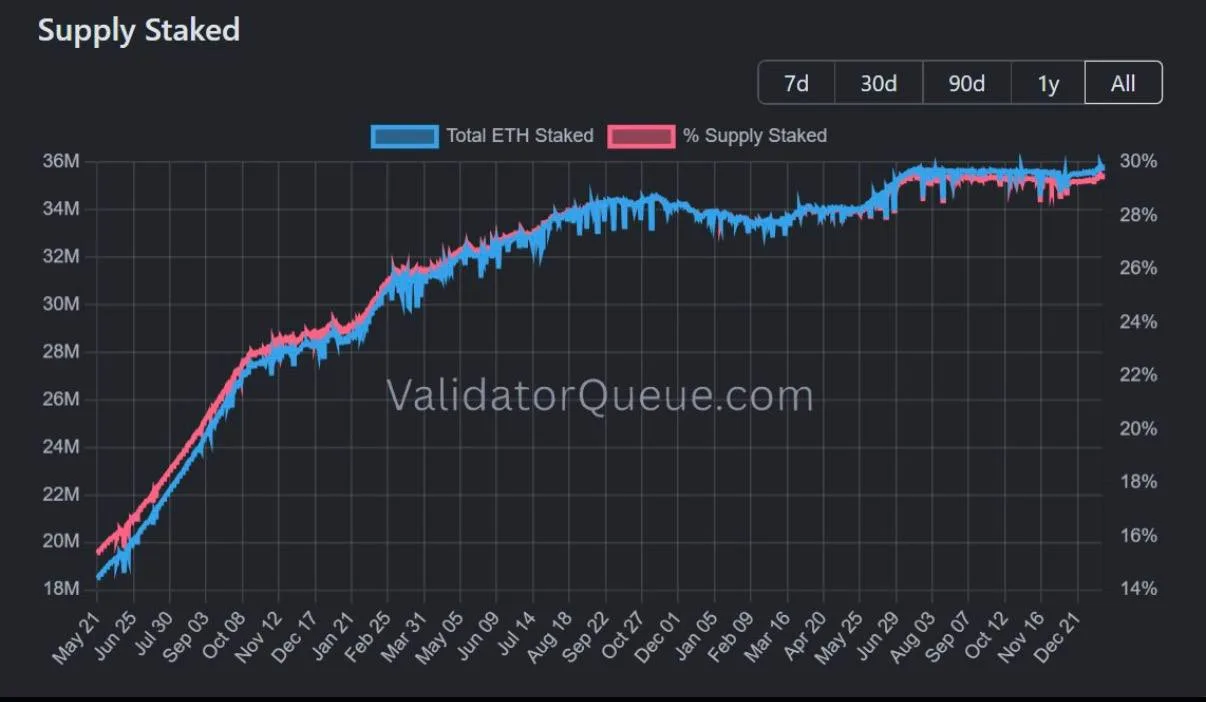

Ethereum staking exceeded 36 million EthereumAccording to data shown by ValidatorQueue.com and a post by X user Broke Doomer (@im_BrokeDoomer), the share of fixed supply in the network has been pushed to nearly 30%. The post also notes that the value of securing the Ethereum network is over $118 billion based on staked balances.

The supply of Ethereum is at stake. sauce: Validator Queue/X

ValidatorQueue.com’s “Supply Staked” chart shows totals Ethereum The stakes have increased from around 18 million to 20 million at the start of the timeline to more than 36 million as of the latest. On the other hand, the percentage line also rose in parallel, rising from the mid-teens to just under 30%.

The steepest gains came early in the series. Ethereum Sales accelerated to the low 20 million range and then exceeded 30 million. The curve then flattened, with totals hovering in the low-to-mid 30 million range, before resuming the upward trend toward its current peak.

Recent readings show that wagering balances have stuck around the mid-35 million range before rising again. At the same time, the supply share remained near the 30% mark, indicating that the increase in staking kept pace with changes in circulating supply over the same period.

Ethereum Testing 200-day EMA after rebound from $3,075 area

Meanwhile, Ethereum rose to about $3,374 on Bitstamp’s ETHUSD daily chart on January 14, 2026, with its price pushed into the area of the 200-day exponential moving average near $3,339, up about 1.53% during the session. This move followed a rebound from the low $3,000s. Ethereum Return to the top of some short-term trend gauges shown on the chart.

Ethereum USD daily chart. sauce: TradingView (Bitstamp)

A post by Swazers Charts (@SwazersC) previously stated: Ethereum Calls rose about 9.6% and said the approach to the 200 EMA is a key test. The chart annotation also marks a previous “rebound” level near $3,075, which is below the current trading zone and in line with the most recent swing low area in early January.

What is displayed on the indicator panel is Ethereum The stock is trading above the 9-day EMA near $3,196, the 21-day EMA near $3,128, and the 50-day EMA near $3,140. The cluster below this price reflects near-term strength after the pullback, while the 100-day EMA near $3,288 sits just below the 200-day EMA, adding another layer of resistance near current levels.

Swaythers chart pointed to $3,668 as a potential next level. On the chart, that target is above the 200-day EMA zone, so the question at hand is; Ethereum It remains above its long-term average at the daily close and could turn into support on a retest.