Ethereum (ETH) has recently seen an astonishing revival, approaching its all-time high (ATH) record of $4,878 after a long consolidation period. On Tuesday, ETH broke the $4,600 mark for the first time in the year, outperforming other cryptocurrencies. Bitcoin (BTC) and XRP.

Ethereum etfs attracts $8.2 billion

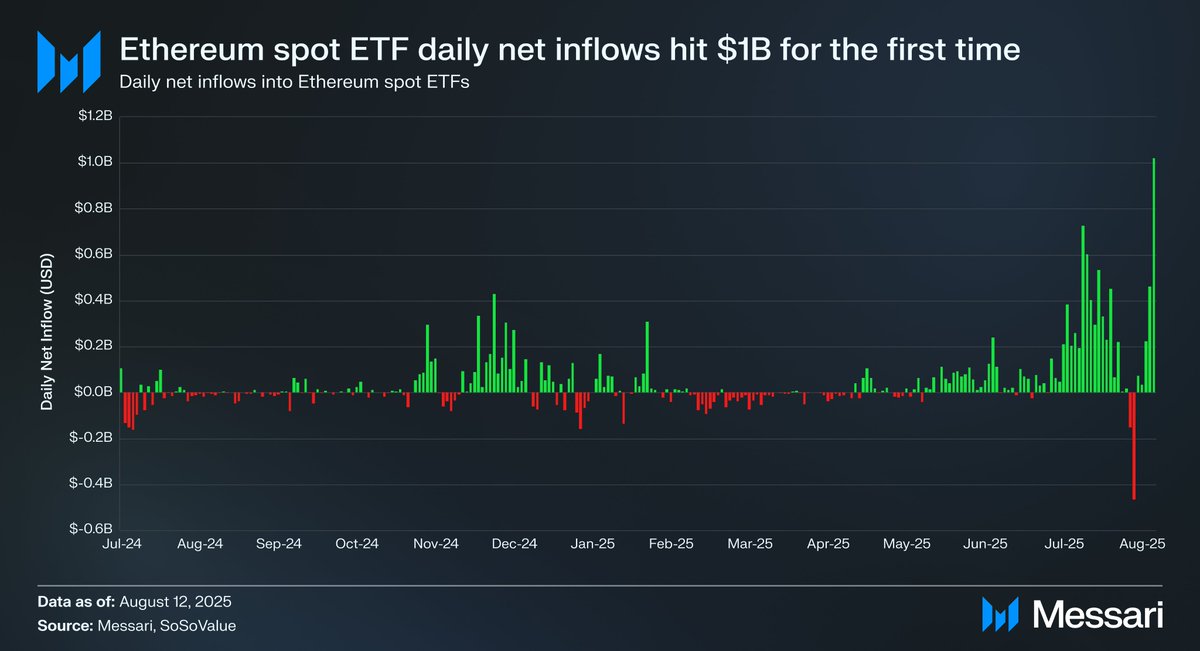

This price performance was largely due to a significant inflow of capital into Ethereum Spot Exchange Trade Funds (ETFs), which recorded an astounding $1 billion inflow in one day. This is the biggest day to date.

According to data From Messari, the year-to-date inflow to Ethereum ETFs reached $8.2 billion, accounting for around 1.5% of ETH’s market capitalization.

By contrast, Bitcoin Spot ETFs yesterday had an influx of $178 million, or $19.4 billion per year, accounting for just 0.8% of BTC’s market capitalization. BTC continues to lead with absolute flow, ETH It attracts nearly twice the capital compared to its size, indicating a change in investors’ sentiment.

Recent growth in Ethereum prices has been affected by the development of favorable regulations. Signature of Genius act President Donald Trump can establish a new regulatory framework for stable coins and strengthen adoption and integration within the financial system.

Major banks such as Morgan Stanley, JP Morgan, Citigroup and Bank of America are actively investigating the implementation of cryptocurrencies in which the dollar is imposed, further examining the potential of this market.

Public companies accept ETH

Jake of Messari Highlights This regulatory development and key data point is that it contributes to a reversal of the bearish outlook on Ethereum prices that have been spotted over the past few months due to its poor performance.

Currently, around $130 billion in stubcoins are protected, accounting for around 50% of the market share, with an increasing number of $7.2 billion tokenized real-world assets (RWAS) and companies being built on the Ethereum blockchain.

Additionally, it is being held by public companies currently employing 865,000 ETHs. strategy (formerly MicroStrategy) Bitcoin’s Ministry of Finance approach. It reflects the diverse institutional buyers converging on Ethereum as a long-term investment.

Sharplink has appointed Ethereum co-founder Joseph Lubin as chairman and has more than 360,000 ETH. Bitmine has moved from Bitcoin mining to the Ethereum Treasury model, but Bit Digital has shifted its focus to Ethereum completely, accumulating over 120,000 ETH.

Tangible capital flows

Institutional investors have also accumulated ETH on an impressive scale, with around 25 million ETHs acquired since June. Analysts say this accumulation is not driven by retail speculation, but reflects strategic allocations. Institutional companies.

Ultimately, the convergence of demand for stubcoin, tokenization, enterprise infrastructure, and the Ministry of Finance will result in a tangible capital stream, as evidenced by chain activities and public company disclosures. As Jake says:

The interest in direction is to become assignments. $ETH is not reevaluating it because Crypto wants it. Wall Street balance sheets are forcing movement.

Dall-E featured images, charts on tradingView.com