Ethereum Validator exit queues grow day by day, reaching the highest level ever. As ETH recovered, the network experienced the biggest leakage of validators.

Validators have left Ethereum Network as of July 25th using a record number of unknown requests. For the past 10 days, Ethereum Network has launched an unprecedented withdrawal as traders tried to free ETH. Validators occur as ETH trades around $3,465.55.

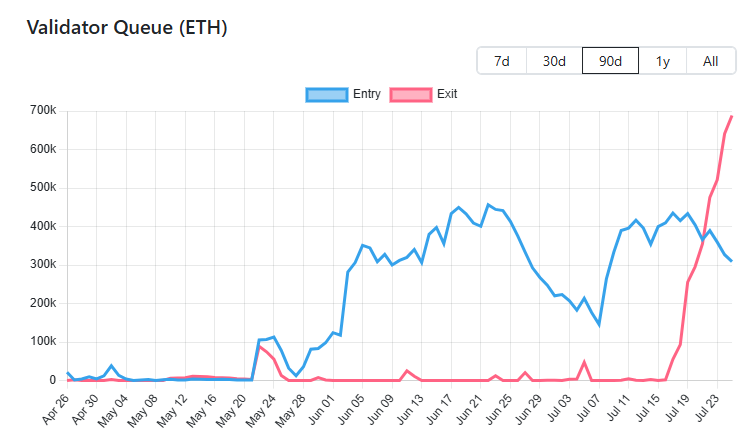

The sudden increase in demand to release ETH from beacon chain contracts began on July 16th and initially appeared to be a normal validator turnover. Soon, the queue grew to 688,356 ETH and waited for release to exceed $2.6 billion.

A request to withdraw ETH, which has been accelerated since July 16, due to increased market gatherings and financial companies’ exposure. |Source: Validator Queue

Ethereum released at this rate will not collide with the market for several days. Currently, waiting times have grown to 11 days, with record highs. Current unstaked episodes indicate that facilities may face obstacles when using beacon chains due to unpredictable episodes.

Ethereum Network still has over 2M validators and there is no major threat to network security. The ultimate effect of ETH can be closer to selling some big whales. Some early holders may prepare free Treasury ETH or sell to finance companies with OTC transactions.

Early Ethereum Validators may try to make a profit

The main reason Rush bets is to make a profit as ETH reaches $3,800. Many effective people bet coins at a much lower price and may want to unlock the value of ETH.

Validator rollovers may be partly due to network upgrades this year. This allows the validator to deposit 2,048 ETH instead of multiple deposits of 32 ETH.

Validator Exodus also happened when several companies began to announce ETH’s financials. The impact of Sharplink games and Bitmine has increased the demand for Ethereum as a long-term valued reservoir.

Another 308,713 ETH is ready to bet on the beacon chain, indicating the demand for passive income. Ethereum Validator Staking is considered a viable option for a collection of ETFs, and some Corporate Treasury Departments may be partially locked for staking.

Lido dao unstaking accelerates

Lido dao Staking queue It is also close to the highest peak ever. I’m waiting for more than 223k ETH to be unorganized. Over the past few days, Lido Dao’s wait times have more than doubled from 70 hours to over 150 hours on average.

At this point, almost all ETHs are a few days away from entering the spot market. However, there are other use cases for the coins that are released.

For one, a portion of Lido Dao has flowed into Binance’s staking program. Binance carries around 20% of the existing ETH and features its own vibrant trade between liquid staking tokens and L1 ETH.

Currently, market anomalies are increasing demand for Binance’s liquid staking tokens. Wbeth prices have risen significantly Premium $3,957.52. Approximately 80% of the amount of Wbeth depends on binance and traders can trade for Ethereum, so there is no need to go through the withdrawal queue.

Wbeth can be used for arbitration, but it is a limited opportunity and may take several days to complete.