The Ethereum rally in early August raised its biggest Altcoin to a $4,793 cycle peak by August 14th, marking one of the most powerful performances of the year.

However, the sharp rise has caused a wave of profits. It has since put a lot of pressure on the assets and lost many of its recent profits. With sell-offs in the derivatives market intensifying, ETH is facing the risk of breakdowns below the $4,000 price mark.

ETH faces heavy sales pressure

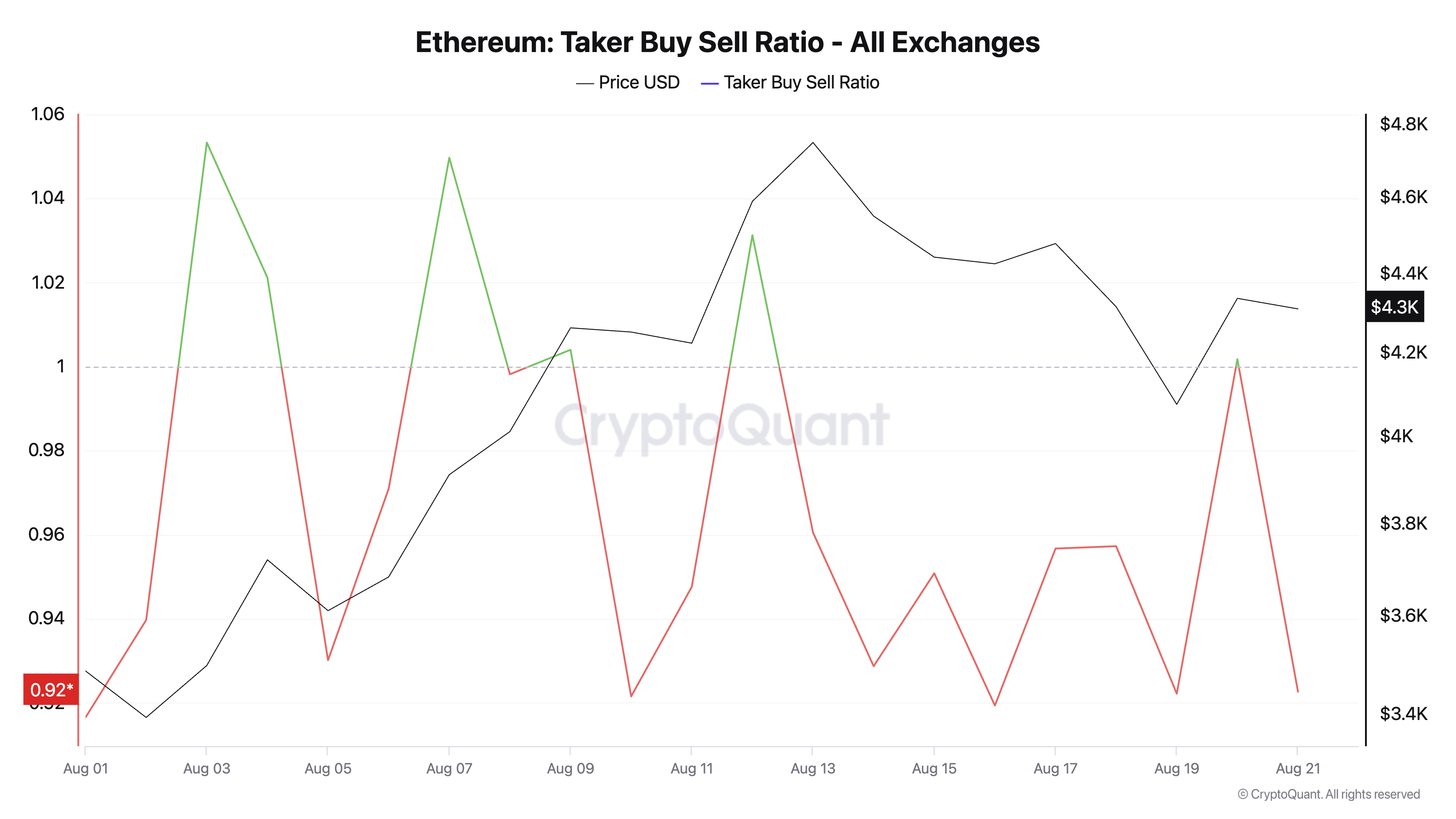

ETH prices are overwhelmed by a weaker slope of emotions among derivative traders. This is reflected in the Taker-Buy/Sell ratio, which has remained primarily one since the beginning of August.

At press time, this is 0.92 per person, indicating that sales orders dominate buy orders across the ETH futures market.

Eth Taker buying and selling ratio. Source: Cryptoquant

The Taker Buy-Sell ratio measures the balances of buy and sell orders in the futures market for assets. More than one ratio shows stronger purchase pressure, indicating that traders are actively chasing price increases. On the other hand, values below reflect the dominant sales pressure associated with profit or bearish sentiment.

ETH’s taker buy/sell rates have been nearly below one person since the start of August, confirming sustained sales among futures traders.

Because of context, coin performance was largely muted for most of the year, so when the uptrend finally began in July and extended to early August, many traders seized the opportunity to lock in profits.

This growing sell-side pressure supports weakening bullish sentiment and can get worse if ETH continues to prices.

Traders throw away high risk bets amid price pressure

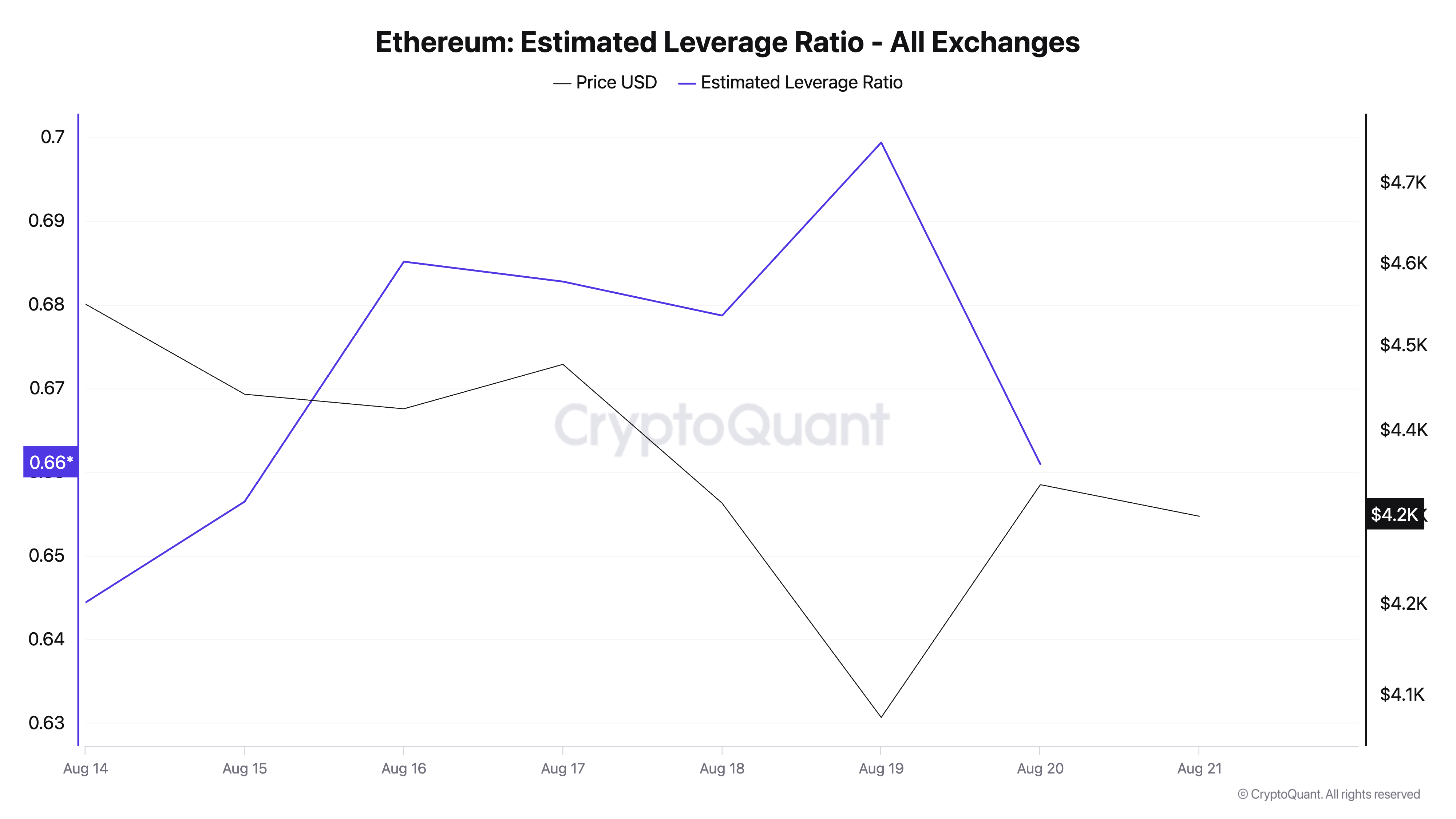

The recent decline in ETH estimated leverage ratio (ELR) also confirms low confidence among coin holders. According to Cryptoquant, Eth’s ELR is currently at 0.66. This is the lowest in the last five days.

ETH Estimated Leverage. Source: Cryptoquant

The ELR of an asset measures the average leverage used by traders and executes trading in cryptocurrency exchanges. It is calculated by dividing the public interest on an asset by the exchange reserves for that currency.

When assets fall, it indicates a decline in risk appetite among traders. This trend shows that ETH investors are becoming increasingly cautious this week, avoiding high-leverage positions that could exacerbate potential losses.

Which of the first came: $3,491 or $4,793?

At the time of writing, ETH is trading for $4,295. If the sell-side pressure is increased, AltCoin can retest the support floor for $4,063. If this important price mark gives way, ETH could plummet to $3,491.

Conversely, ETH could rise to $4,793 if new demand enters the market.

Post Ethereum’s early August surge meets reality checks as Bears Eye Dip first appeared for under $4,000.