The major Altcoin Ethereum has rebounded slightly in the last 24 hours, recording a modest 1% profit on transactions close to the $4,000 level at press.

This comes amid a wider improvement in today’s market sentiment across the crypto sector. However, despite the recovery, on-chain data suggests that bear pressure is playing hard.

ETF spill threatens Ethereum’s short-term recovery

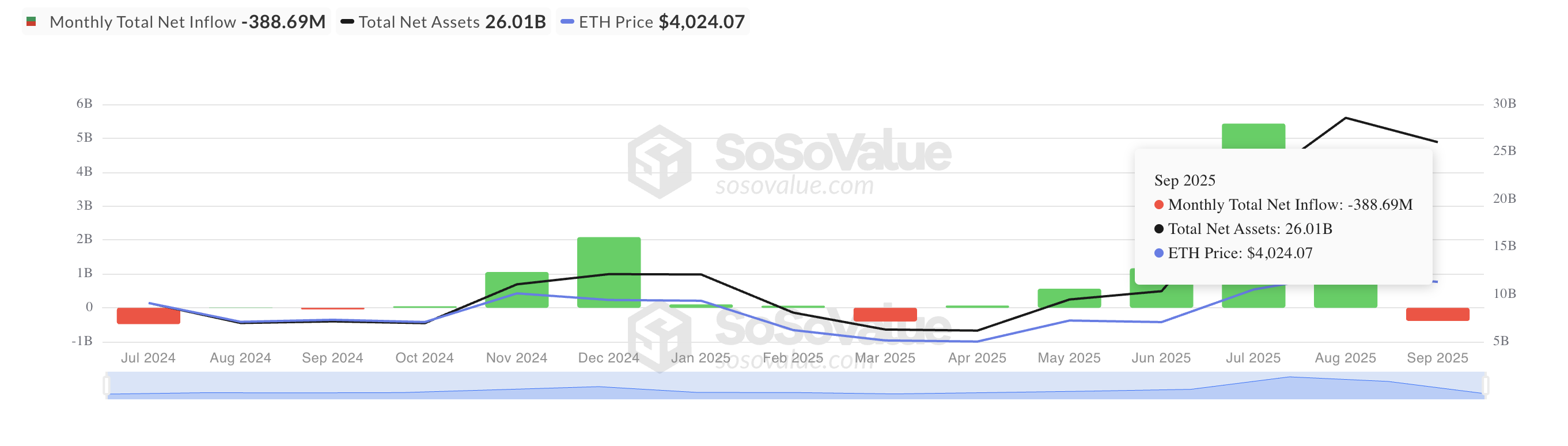

One of the most important red flags comes from the flow of facilities flowing into Altcoin. According to Sosovalue, net outflows from Spot ETH Exchange-Traded Funds (ETFS) totaled $796 million this week, bringing the annual liquidity outlet from those funds to $388 million.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

All Ethereum spot ETF net flow. Source: SosoValue

If this pace continues, September marks the first month of net spills of ETH ETFs since March. This underscores the weakening of institutional demand for assets.

ETF flows are an important marker of investor sentiment, and sustained outflows indicate a steady escape for institutional players. With these big money backers retreating, ETH’s ability to maintain a push of over $4,000 is increasingly threatened.

Furthermore, feelings among long-term ETH holders are gradually getting worse, as reflected in indicators of the vibrancy of their climbing. For each GlassNode, this key metric has been at a high of 0.70 since the beginning of the year, indicating a strong sell-off from this investor cohort.

The vibrancy of ETH. Source: GlassNode

Vitality measures the movement of long tokens by calculating the ratio of coin days to the total accumulated coin days. Once that drops, LTHS has chosen to move the assets off the exchange and hold them.

Conversely, like ETH, when the metric climbs, when long-term tokens are moved or sold, there is a signal of profit from long-term holders. This trend contributes to downward pressure on ETH prices, suggesting the possibility of further declines.

Ethereum has $3,875 in support

A 1% rebound in ETH appears vulnerable in ETF spill installations and long-term holders sold to the market. The support level of $3,875 is currently retained, but if it does not attract new purchasing pressure, it could be a further phase of decline.

In this scenario, Altcoin’s price could fall below this major price range and fall to $3,626.

ETH price analysis. Source: TradingView

However, if today’s rally gains strength and demand rises, the price of ETH could be pushed to $4,211.

Facing a vulnerable $4,000 recovery from Post Ethereum, faced with headwinds from holders, first appeared in Beincrypto.