Two exchange trade funds (ETFs) that allow investors to wager against Ethereum with leverage have emerged as their best performances from the start of the year (YTD). Bloomberg senior ETF analyst Eric Balknas shared this on X, pointing out that he wasn’t expecting it.

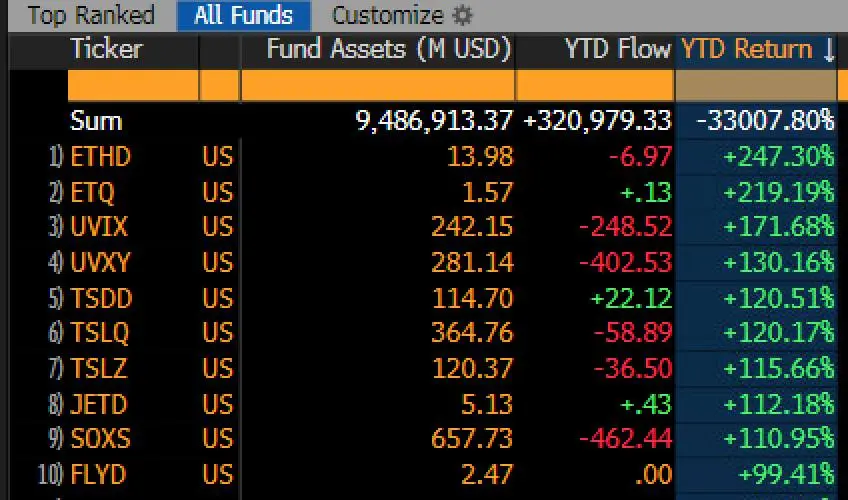

According to Bloomberg data, the two ETFs, the ProShares Ultrashort Ether ETF (ETHD) and the T-Rex 2x reverse ether daily target ETF (ETQ), are up 247.30% and 219% YTD, respectively. The double-longer Vix futures ETF predicted Bulk Eggs would be third in the first place.

Leveraged short ETH futures ETH is the best performance of the year. (Source: Eric Balchunas))

Balkuna said:

“The best performing ETF of the year is the -2x Ether Etf Sethd, an increase of 247%.

Rather than directly shorten Ethereum, the two ETH ETFs are instead using ETH futures contracts to wager on assets, but their flying performance underscores the token struggle. Tokens have already been one of the worst years of record, with YTD and price exceeding 50% at an invisible level since 2022.

Interestingly, the two funds have minimal managed assets, with ETHD winning $13.98 million in AUM following a $6.97 million outflow this year. The ETQ is not good, with only $1.57 million AUM despite a slightly positive netflow.

Two funds have also been down in the long term. ETQ had a performance of 3.56% in six months, while ETHD has dropped by 18.09%.

Ethereum takes a break from the struggle after suspending at tariffs

Meanwhile, ETH took a break from the struggle with a surge in value over 10% after President Donald Trump announced a suspension of tariffs in all countries except China for 90 days. Following the news, ETH has gone from $1,440.82 to $1,687.18, sparking rebound speculation.

Naturally, the value of the short ETF is worth it, with ETHD dropping 24% to $55.60 and ETQ dropping 24.66% to $23.59. However, they remained YTD, and ETH’s outlook remains relatively negative, with tokens already ejecting some of their recent profits.

Despite double-digit percentage gains, ETH is well below $2,000 and positive emotions are very slim. Part of the factor behind the worsening emotions is the surrender of some long-term holders.

According to Blockchain Analysis Platform Lookonchain, the whales, which held ETH because they were worth $8, dumped 10,702 ETH for $16.86 million after two years of dormant. The address has a history of selling ETH during major dips, which will be added to the growing ETH sell-0ff.

Nevertheless, some market experts believe that a sale by long-term holders could represent a good buying opportunity. Crypto analyst Ali Martinez believes this could be a good entry point for those who want to accumulate.

He said:

“Long-term #ethereum $eth owner is in ‘Suball’ mode. In the opposite case, this could indicate a risky accumulation zone and a risky accumulation zone. ”

His views are consistent with those of others who believe that ETH is already at the bottom and has future bullish events that could lead to price increases. Crypto Influencer Ted Pillows believes Pectra upgrades, ETH staking ETFs and tokenization booms could lead to a significant rise in ETH prices.

However, many believe that current market uncertainty does not support rebounding, and ETH can fall. Cryptoquant analyst Mac_D has identified $1,290 as the next major support level for ETH.