According to the data, the Etherum Gift Volume has overturned the amount of Bitcoin, and a signal that strong speculative interest is flooded with assets.

Ether Leeum Gift Volume was fired with Price Rally.

According to the data from the analytical company GlassNode, Ethereum could surpass Bitcoin in terms of future trading volume. Here, the volume of trading indicates the amount of transactions that were naturally given on another centralized exchange. In the current context of the topic, the amount related to the future market is especially interested.

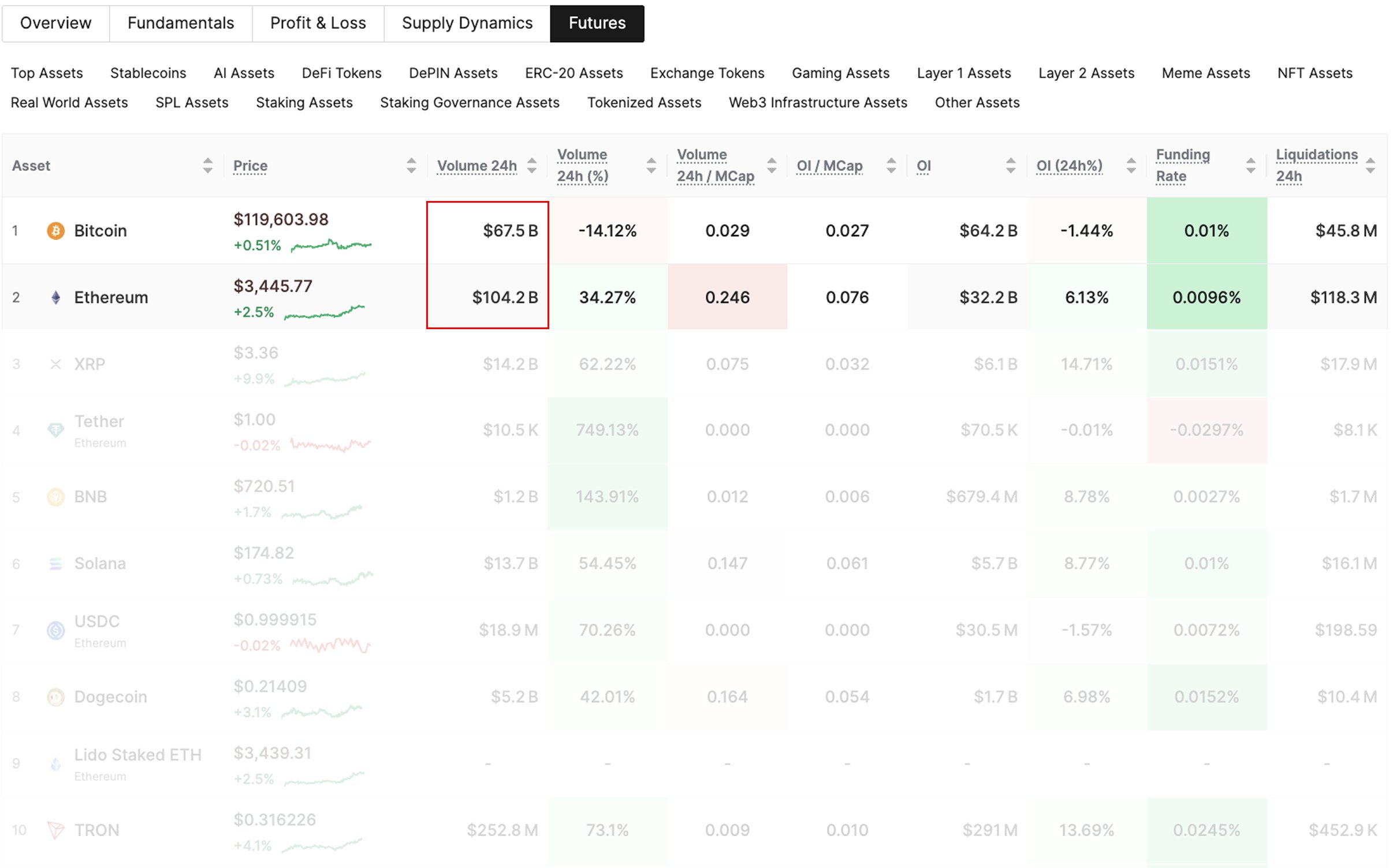

Below is a table that shows how the comparison between Bitcoin and Ethereum compares this metrics at the point of view of GlassNode.

Looks like the ETH futures volume far outweighs the BTC one | Source: Glassnode on X

As you can see, Bitcoin has registered $ 67.5 billion in futures trading, especially lower than $ 14.2 billion by Ethereum. Cryptocurrency usually does not happen because it observes more speculative demand than ETH or altcoins.

In the same table, the data from several other futures related indicators are also displayed. The BTC Open Interest has reached $ 64.2 billion at the time of post, which is an indicator of the current future position on all derivatives platforms.

The same indicator for ETH was $ 32.2 billion, and its original digital assets are still far ahead of the total market positioning. In other words, the 24 -hour change of this metric decreased 6.1% of Ether Leeum and 1.4% of Bitcoin.

New demand for ETH has occurred as the price of strong inflows (ETF) has fallen from the market.

Interestingly, all of these interests have been toward Cryptocurrency, but the average funding rate is still not positive. The rate of financing is an indicator of a periodic fee that traders exchange in the futures market.

When this metrics are green, long investors mean that they pay a premium to short investors to maintain their position. This trend means that there is a strong thinking between merchants.

In this table, it is clear that the financing rate reached 0.0096%of Etherrium even after the surge in future trading volume. This is less than 0.01%of Bitcoin. Therefore, a new positioning for ETH occurs, but investors are still not optimistic.

“This setting has no signs of strong dumping interests, OIs and overheating.”

ETH price

At the time of writing, Ether Leeum trades $ 3,600, up almost 21% last week.

The price of the coin has surged during the past few days | Source: ETHUSDT on TradingView

DALL-E, GlassNode.com’s main image, TradingView.com chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.