ether $ETH$2,048.66 This week, a whale bet turned into a multi-million dollar horror story as bulls were found to be heavily tilted to the upside as cryptocurrencies plummeted.

One bullish stock is Trend Research, a trading firm led by Liquid Capital founder Jack Yee. The company has spent the last few months borrowing stablecoins from DeFi giant Aave to build up $2 billion worth of bullish (long-term) bets on Ethereum, reportedly backed by Ethereum.

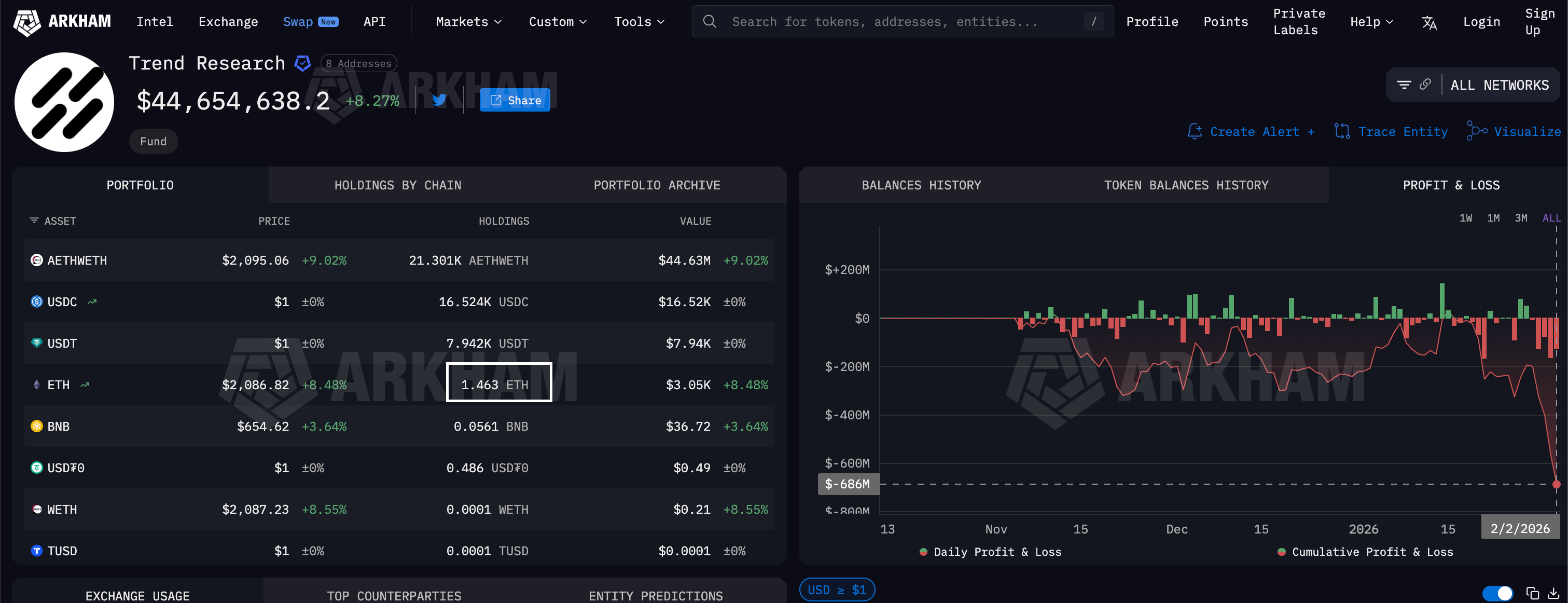

Arkham said the position exploded this week, leaving the company with a $686 million loss.

This explosion highlights the enduring reality of the crypto market. That means volatility can still make or break a trader’s fortunes in a single week. It also shows how traders continue to pursue risky, leveraged loop plays: borrowing stablecoins. $ETH Collateral – Despite these bets, each downtrend exploded spectacularly.

Millions of dollars lost in trend research. (Arkham)

how did you fall

The team is confident in Ether’s long-term potential and expected a quick recovery from below $4,000 in October.

But that never happened. The ether continued to slide, putting the long position of the “looped ether” at risk. As prices fell, the stablecoin collateral backing leveraged bets shrunk, while fixed debt grew in classic leveraged fashion.

The final blow came this month as Ether began to fall rapidly along with Bitcoin. $BTC$68,811.85 Trend Research responded by liquidating more than 300,000 ethers, according to data source Bubble Map.

“Trend Research has started sending large amounts of $ETH Moved to Binance to pay off debt on AAVE This cluster moved a total of 332,000 $ETH Binance is worth $700 million in 5 days,” Bubble Map said on X. The company currently holds just $1.463 $ETH.

Jack Yi described these sales as a risk management measure.

“As multiple owners of this round, we remain optimistic about the performance of the new bull market. $ETH Over $10,000, $BTC Over $200,000. We are making some adjustments to control risk, but our expectations for a future mega-bull market remain unchanged,” Yee said in a post on X.

He said volatility is the biggest characteristic of crypto circles, adding that now is the best time to buy tokens. “Historically, countless bulls have been thrown out by this volatility, but what often follows is a two-fold rebound,” he noted.