Ethereum continues to face pressure following a $2,100 regional refusal, testing low demand zones with prices below key support levels.

Technical Analysis

By Edris Dalakshi

Daily Charts

In the daily time frame, ETH stays firmly in the bearish structure, consistently printing low highs and low lows. The $2,200 regional refusal and subsequent breakdown below the $1,900 dollars have reestablished bearish momentum, with prices heading around $1,600 to the next major demand zone.

The 200-day moving average has also turned slightly downward, far surpassing price action, and strengthening long-term bearish bias. Additionally, RSIs are hovering near unsold areas, but there are few indications of inversion, provided they do not have bullish divergence or changes in momentum. Unless ETH regains $2,200 with strong confidence, resistance is kept to a minimum.

4-hour chart

The 4-hour chart checks for a breakdown of up-channels that support previous recovery attempts in ETH. The price has not been held above the $1,900 level that served as a support during the integration and is now crushed at nearly $1,800.

A clean refusal and sharp sale starting at $2,100 suggest that the buyer quickly lost momentum and the seller stepped in with strength. Although RSI is currently located in deep sales territory, there is little evidence of Dip Buinging’s interest as it does not form a strong bouncing or bullish structure. For now, ETH looks weak and even if short-term bounce occurs, it could close at $1,900 unless a stronger buyer intervenes.

Emotional analysis

By Edris Dalakshi

Funding rate

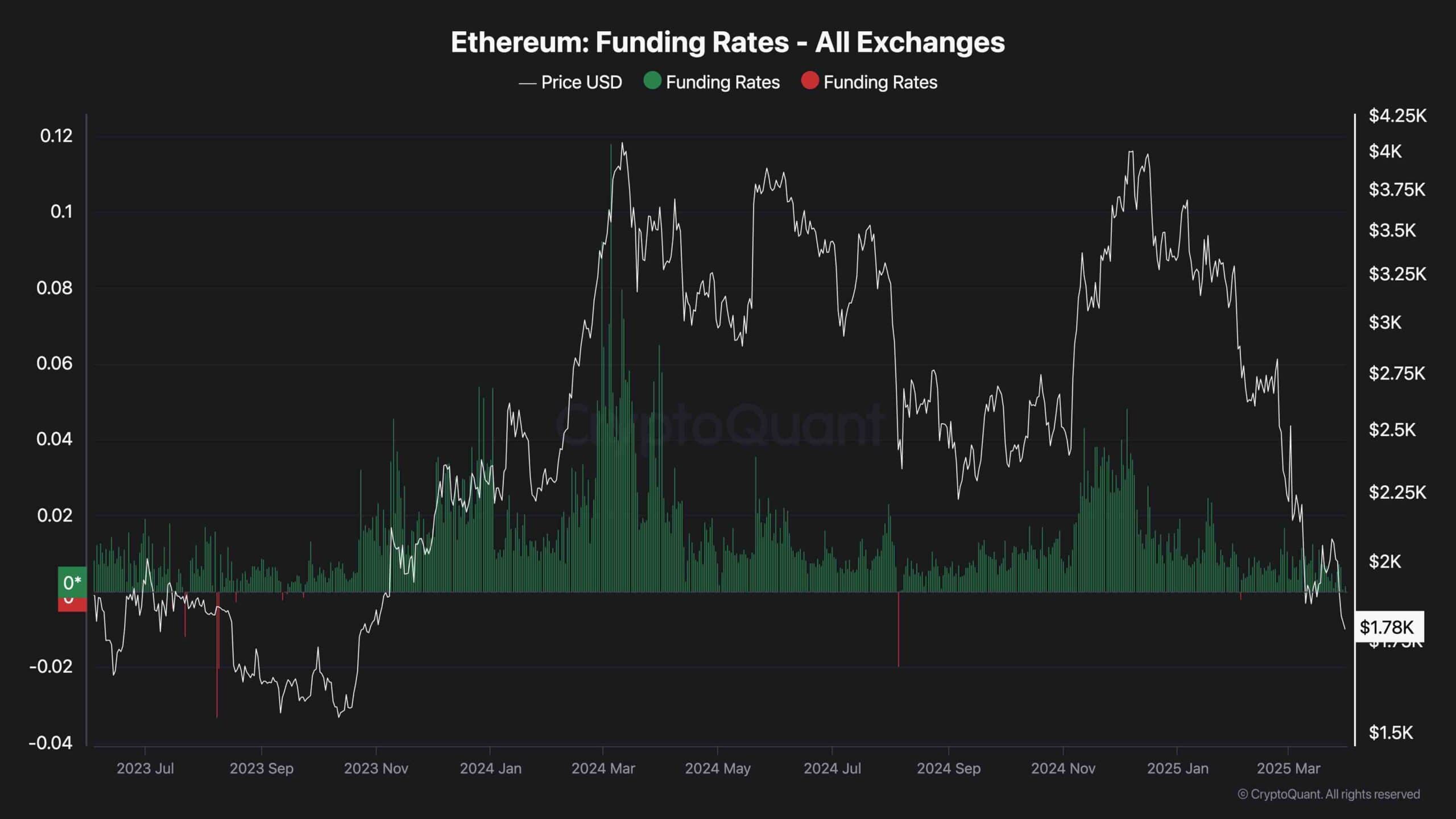

Ethereum’s funding rate across all major exchanges is reversed neutrally or slightly negatively, indicating a significant decline in aggressive long positions. This change suggests that traders are more defensive and less willing to chase upside down, usually coinciding with a cooling period or continuous negative drift.

Neutral funding could reduce the likelihood of a liquidation cascade, but also shows a lack of confidence in a strong bullish reversal. Feelings remain cautious and the market could continue to be under pressure unless there is a positive revival of funds coupled with regaining key technical levels.