Federal Reserve Chairman Jerome Powell has issued a new statement on interest rates and tariffs.

Speaking at the ECB Central Banking Forum, organized by the European Central Bank (ECB) every year in Sintra, Portugal, the Fed president said the US economy is in good condition and inflation is heading towards a 2% target.

Jerome Powell said the US economy is in a solid form and inflation is moving as expected when excluding the impact of tariffs.

He said interest rates suspended by the Fed will be reduced to see the impact of tariffs and as long as the economy is strong, waits are the right approach.

Powell added that if they hadn’t had Donald Trump’s tariffs they would have been cut by now.

“The US economy is in good condition and inflation continues to decline towards its 2% target.

Putting tariffs aside, we can say that inflation is moving in the direction we want it to.

When we saw the scale of the tariffs, we began to wait for interest rate cuts.

In the current situation, I think the best thing to do before cutting interest rates is to wait and get more information.

“We see the labor market gradually cool down, but it’s not at the level we want.”

July signal for interest rate reduction!

Powell said the majority of the Fed hopes for rate cuts later this year, but he noted that it is not yet clear whether July will be too early to cut interest rates.

“I don’t know if July is too early to cut interest rates. There’s no chance that any meeting will be cut off from the table. That depends on the data,” Powell said.

They probably had lowered their interest rates quite a while ago!

Powell finally answered the question: “Will we cut interest rates if there is no tariff?”

Powell answered the question in a way that offended Trump, saying, “If it wasn’t because of Trump’s tariffs, we’d cut interest rates by now.”

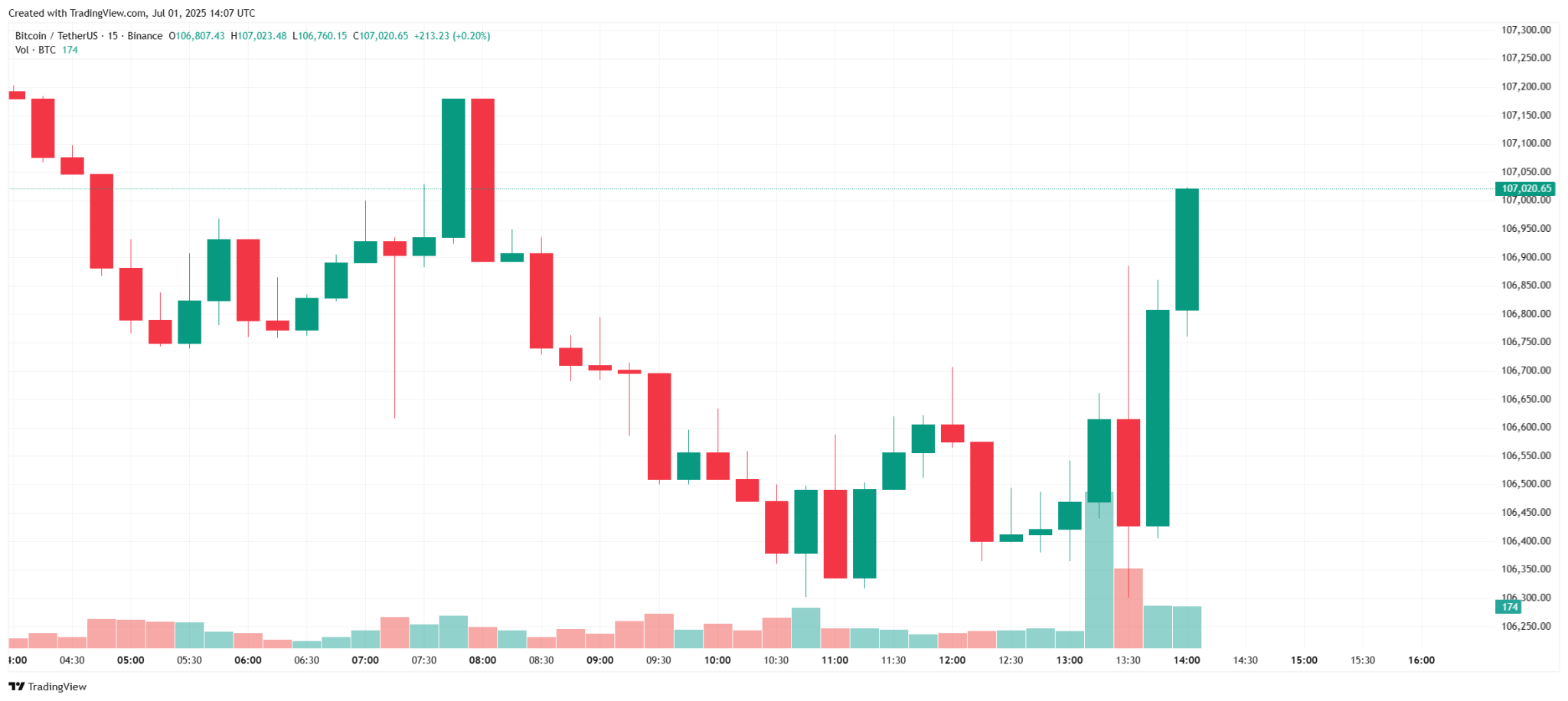

Powell gave no clear dates for interest rate cuts, but Bitcoin rose from $106,400 to $107,000 in the last few minutes after it softened.

The battle between Trump and Powell!

While arguing that the economy is in good condition, Donald Trump has sternly criticised Powell’s interest rate policy and stressed the need for interest rate cuts.

At this point, Trump has emphasized that there should be aggressive interest rate cuts to stimulate the economy, but Powell continues to insist that interest rates should not be changed, and should proceed according to the data due to concerns about tariff inflation and instability.

*This is not investment advice.