The US Federal Reserve is entering a “gradual” era of money printing, which will “moderately” stimulate asset prices, but will not be as dramatic as many “massive printings” of Bitcoin ($BTCEconomist and Bitcoin supporter Lynn Alden says the community is hopeful.

“My base case is broadly consistent with the Fed’s expectations, which is to grow the balance sheet at roughly the same pace as total bank assets and nominal gross domestic product (GDP),” Alden said in the Feb. 8 Investment Strategy Newsletter, adding:

“Overall, this means I continue to want to own high-quality rare assets, and I tend to rebalance away from very happy areas and into unowned areas.”

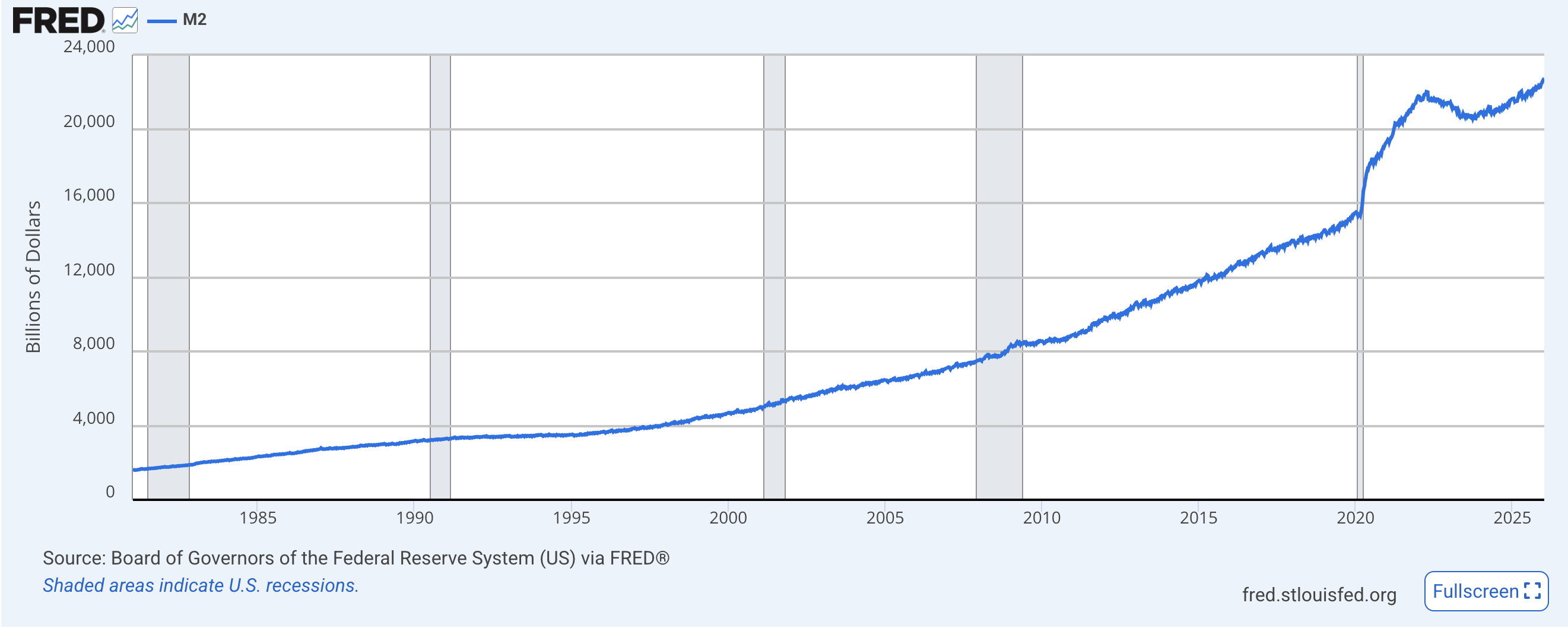

The Federal Reserve’s M2, a measure of the money supply, continues to expand over time. sauce: fred

The comments came after President Donald Trump nominated Kevin Warsh to be the next Fed chairman, sparking outrage among market traders who perceived Warsh to be more hawkish on interest rates than other Fed candidates.

Interest rate policy can affect the price of virtual currencies. Credit expansion due to an increase in the money supply is usually considered bullish for assets, while a contraction in the money supply due to rising interest rates usually leads to an economic slowdown and a fall in prices.

Related: Bitcoin investor sentiment cools amid fears of US government shutdown and uncertainty about Fed policy

No interest rate cut is expected at the next FOMC meeting

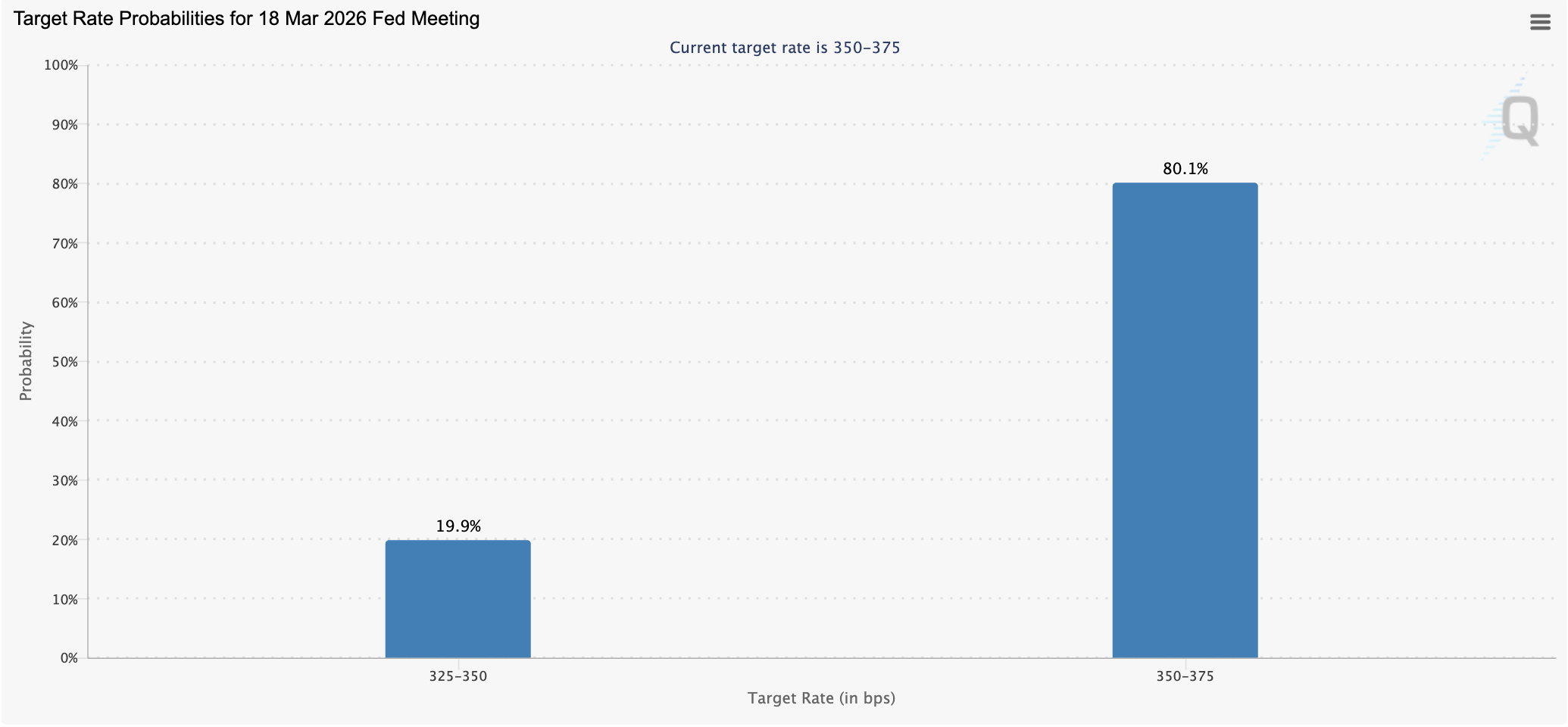

About 19.9% of traders expect a rate cut at the next Federal Open Market Committee meeting in March, down from Saturday when CME FedWatch showed 23% of respondents expected a rate cut.

Probability of target interest rate ahead of March FOMC meeting. sauce: CME Group

Current Fed Chairman Jerome Powell has repeatedly issued mixed forward guidance on interest rate policy, despite cutting interest rates several times in 2025.

“In the near term, the risks to inflation are tilted to the upside and the risks to employment are tilted to the downside, so it’s a difficult situation. There is no risk-free path to policy,” Powell said after the FOMC meeting in December.

Fed Chair Jerome Powell’s term expires in May 2025, but Warsh has not yet been confirmed by the Senate as the next chair, raising investor uncertainty about the direction of interest rate policy in 2026.

magazine: TradFi fans ignored Lynn Alden’s work $BTC Hint — Now she says reach 7 figures: X Hall of Flame