Crypto World is staring May 30th, when two major events scheduled for the day could have a major impact on the digital asset market. This will bring the long-awaited FTX creditor repayments and the deadline for decisions from US regulators of Crypto ETF.

FTX repayment: Inject liquidity or attenuate emotions?

Almost 27 months after the catastrophic collapse in November 2022, FTX is preparing to pay off its creditors in the end, with over $50,000 expected to start on May 30th.

The exchange, led by CEO John Ray III, is now withdrawn from a $11.4 billion cash reserve and begins paying out funds, according to bankruptcy lawyer Andrew Mortdelich.

Billions of injections of the hands of investors from crypto can draw momentum, especially when those funds are reinvested into digital assets when sentiment is carefully bullish.

SEC ETF decision: delays are still expected

FTX News gives reasons for optimism, but the SEC continues to halt progress in crypto ETFs. The list of applications Bloomberg tracks shows over 70 ETF filings across a variety of assets, including XRP, Solana, Litecoin and Ethereum. Almost all of these applications are within the scope of review.

The first key deadline round on May 30th will begin FTX payments on the same day. However, analysts are broadly hoping that the SEC will again delay approval, and hopefully push forward with key decisions in August, where perhaps more regulatory clarity is pending.

Related: Solana as XRP spotlight, 72 Crypto ETF seeks SEC approval this year

Optimism is bubbly bubbly now that Paul Atkins has been sworn as chairman of the 34th second. The return of Atkins, a known advocate of capital market efficiency, could break through the restrictive attitude of Gary Gensler’s leadership, entering an era more encrypted in the SEC. However, that shift may not show any teeth until the end of summer.

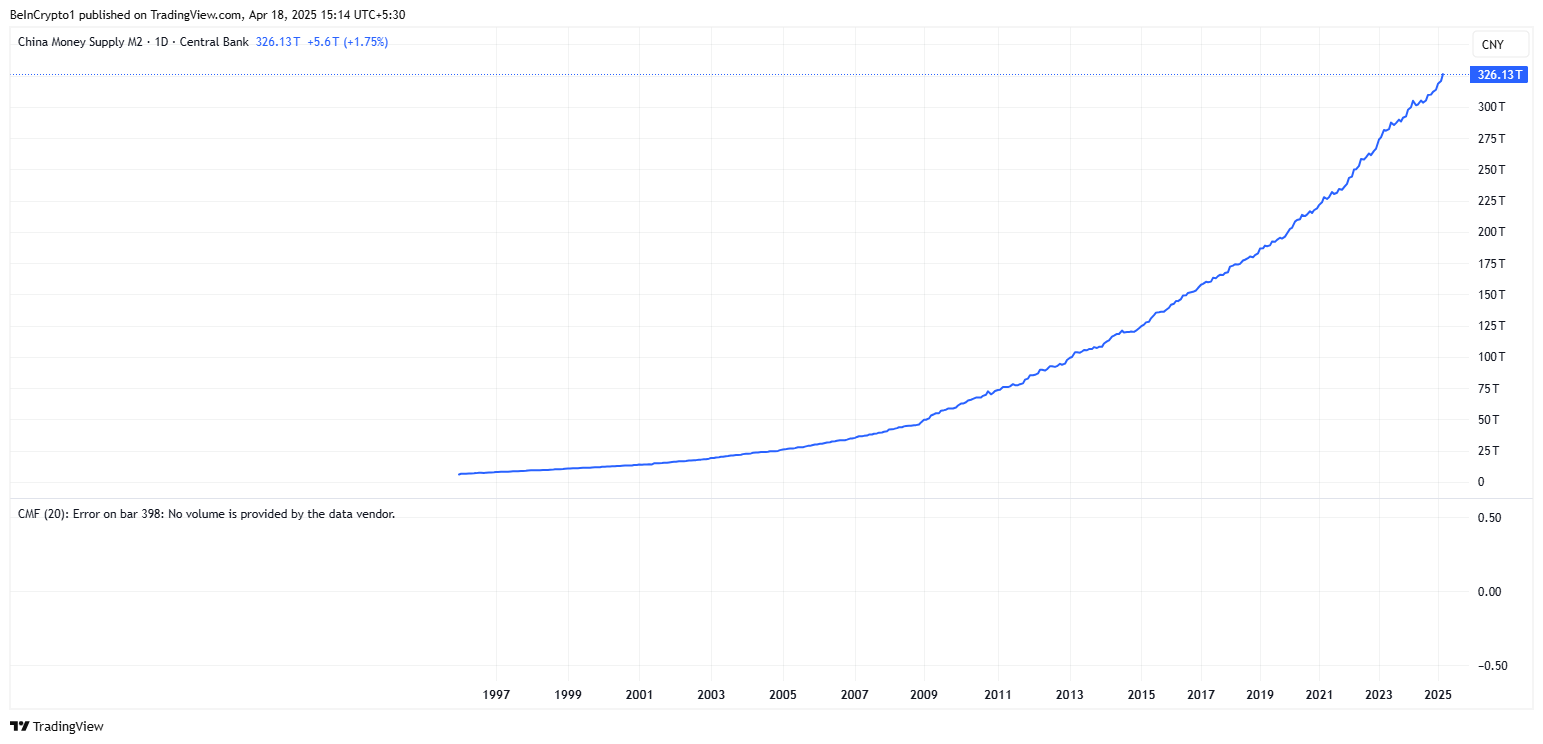

Macrofactor: China’s record money supply

In parallel macro tales, China’s M2 money supply surges to an all-time high of $44.7 trillion, indicating a continuous surge in global liquidity. Historically, such extensions have correlated with gatherings of risk-on assets such as crypto.

Related: Bitcoin’s advantage reaches a new cycle peak as altcoins cannot keep up

“Money printers are back. Risk assets are likely to become parabolic,” analyst Kong Trading said. The implications are clear. If liquidity is rising and repayment capital is re-entering the market, a perfect storm could brew.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.