Bitcoin (BTC) has once again turned green after closing August with a drop of over 13% in early August. However, recent moves suggest that a large wallet linked to Galaxy Digital could cause sales pressure that could hinder recovery.

On-chain data also reveals changes in Bitcoin Zilla’s behavior in September.

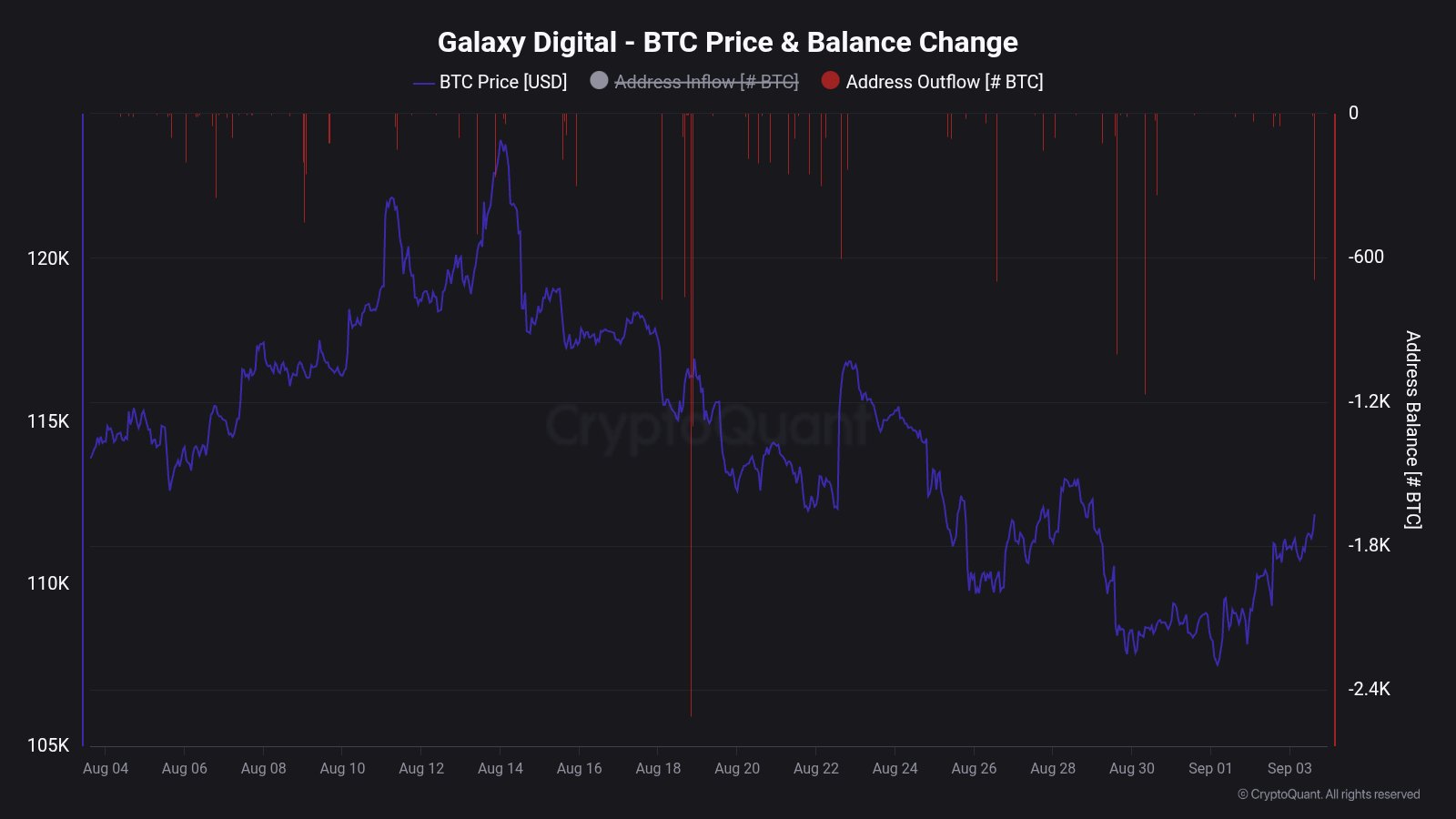

Galaxy Digital Wallets Show Bitcoin Sales in early September

Galaxy Digital is a digital asset management company that provides cryptocurrency-related financial services, including OTC transactions.

Recently, wallets tied to Galaxy Digital have been associated with large whale transactions and are attracting more attention. Observers believe that leaks from these wallets could indicate potential Bitcoin sales pressure.

An hourly spill of 691 BTC was recorded on September 4th, according to analyst Maartunn.

Changes to Galaxy digital balance. Source: Cryptoquant.

“This type of spill can precede short-term sales pressures. We check the liquidity, spreads and price response,” Maartunn said.

The concern appears to be valid. The chart shows that Galaxy Digital Wallet has consistently recorded multiple spills ranging from 2,400 to 600 BTC over the past month. Meanwhile, Bitcoin prices fell in August.

Additionally, Onchain Lens, another on-chain surveillance X account, highlighted the revitalization of Bitcoin wallets after 12.8 years of dormant. The wallet moved 0.25 BTC worth $28,000, but still holds 479.44 BTC.

The revitalization of dormant whales’ wallets in early September, less than in the last two months, shows that Bitcoin is trading at six-figure levels while early Satoshi-era whales continue to wake up.

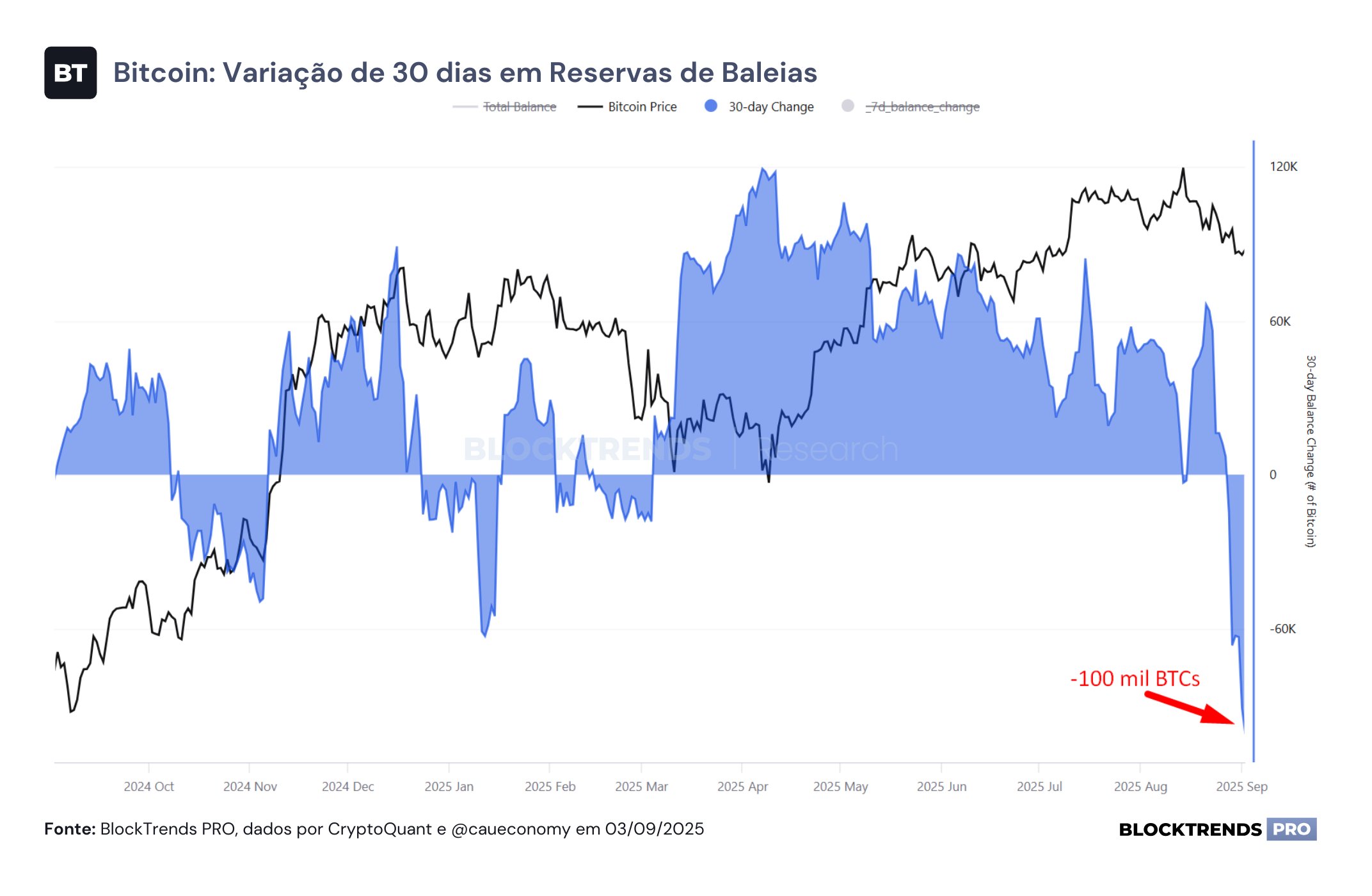

The Whale sold over 100,000 BTC last month

Cauê Oliveira observed a wider trend among Bitcoin Zillas, noting that it has sold over 100,000 BTC over the past 30 days. Block trend data shows that this is the largest monthly sales wave since 2022.

The balance of the Bitcoin Whirl changes. Source: BlockTrends

“Yes, whales have dumped the maximum amount of this cycle, but prices have not been as painful as they do for other periods,” Oliveira commented.

The most reasonable explanation for Bitcoin’s resilience is the strong demands that coincides with whales’ sales.

BlockTrends also reported that in 2025, companies had accumulated $43 billion in Bitcoin in 2025, the largest inflow in history. In the first eight months alone, they invested $12.5 billion over 2024. These companies currently own more than 6% of all BTC, 21 times higher than 2020.

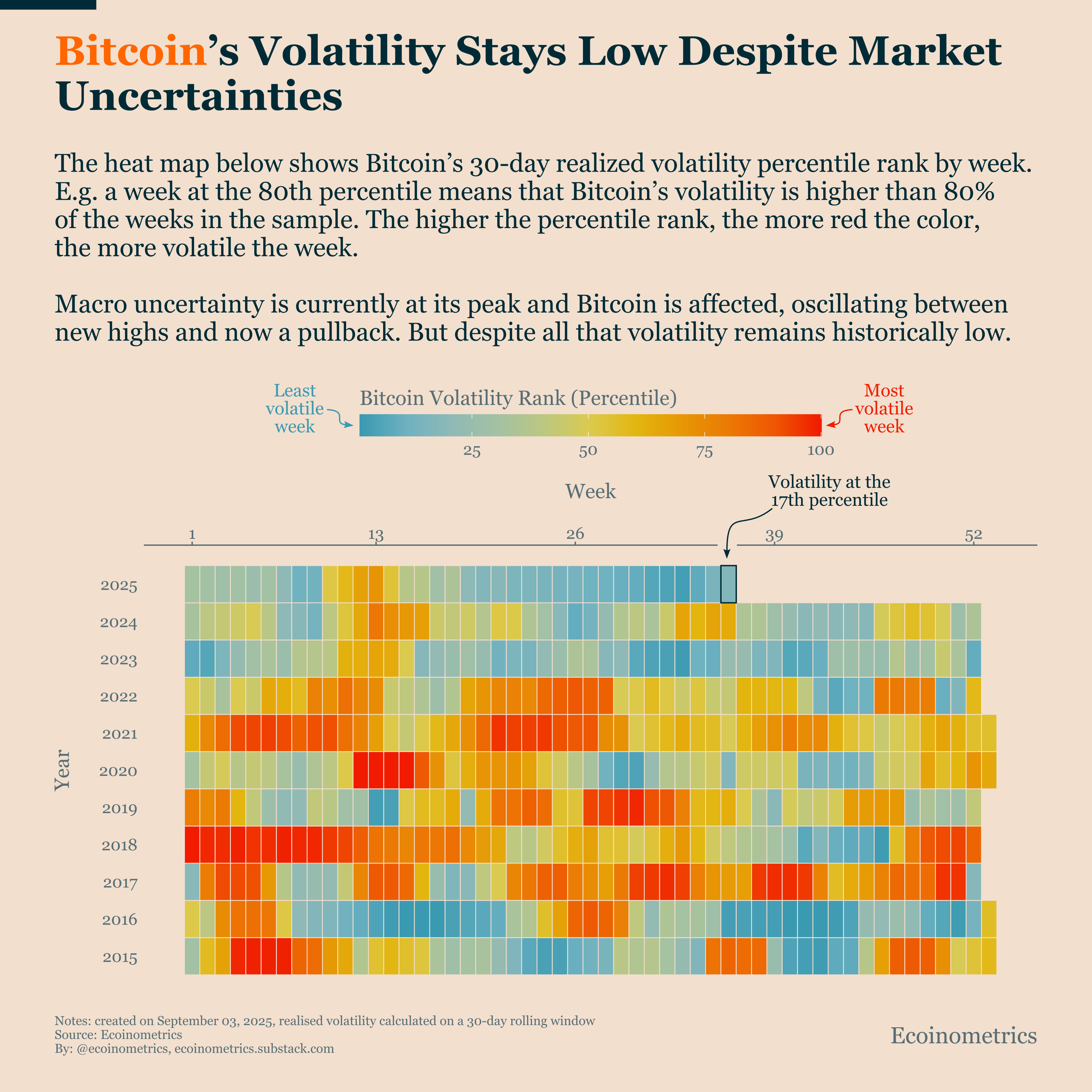

The Eco-Inometrics report also shows that despite macroeconomic uncertainty, Bitcoin volatility remains very low.

Bitcoin volatility headmap. Source: EcoInometrics

“Now, Bitcoin’s 30-day perceived volatility is less than 83% of the week of the last decade. Uncertainty yes, panic no,” Eco-Inometrics said.

This strong accumulated demand has significantly improved Bitcoin’s ability to absorb selling pressure. It also reduced the volatility of assets. Such stability is a key feature of mature assets and helps us move away from the longstanding perception that Bitcoin is a high-risk instrument in traditional finance.

The leak of Post-Galaxy Digital Wallets has sparked the fear of Bitcoin sales pressure.