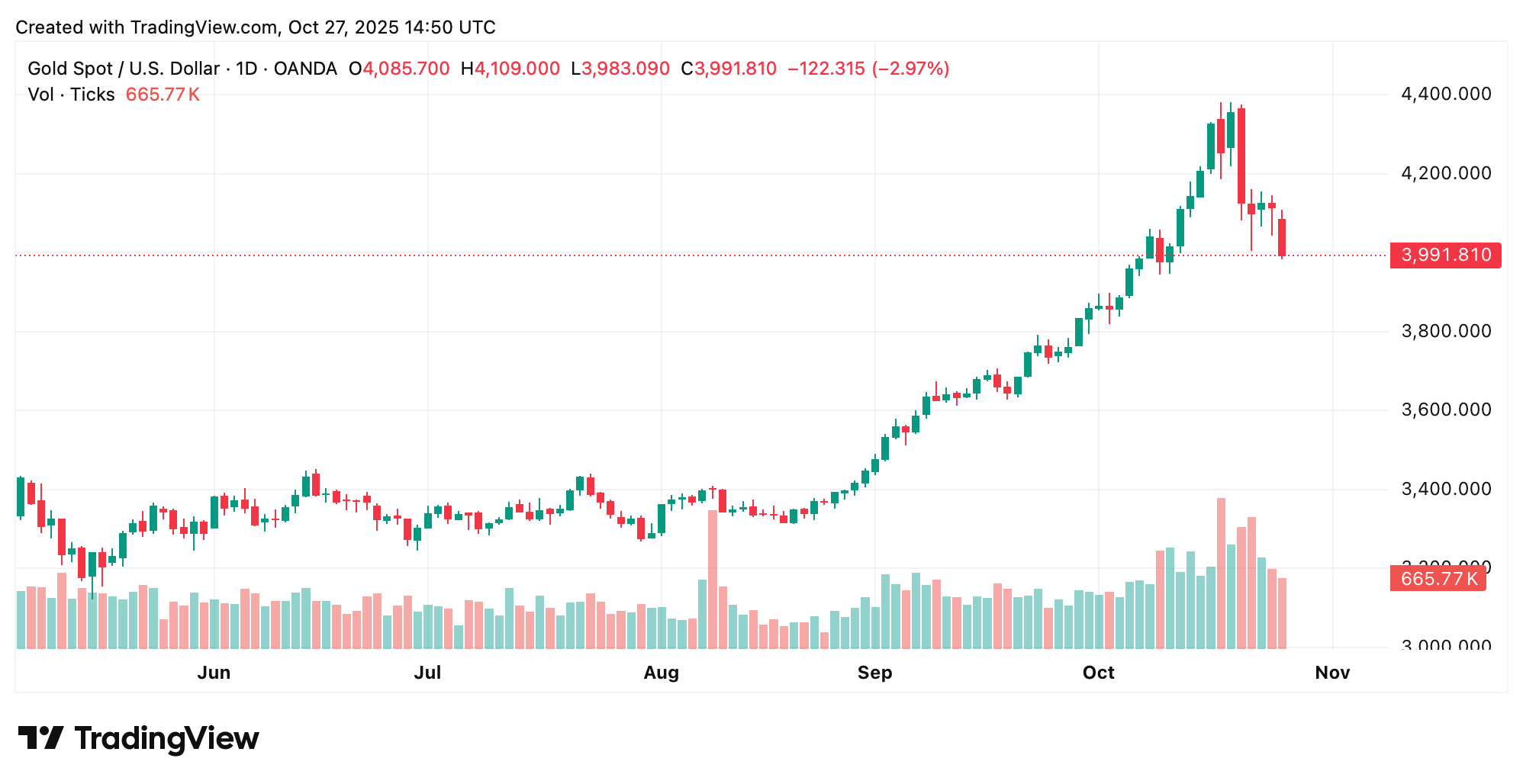

Spot gold tripped the $4,000 wire and landed at $3,991 per troy ounce. Meanwhile, silver stopped at $46.47. The two high flyers finally caught their breath after breaking through a record altitude.

Gold fell to $3,991. Silver Steady Approx. $46

Gold fell by a large margin as the U.S.-China trade talks came to light, stocks looked upbeat and near-term demand for the safe-haven asset shrank. As Reuters noted on Monday, the move reflects the mood of the market, which is a little less banker and a little more brunch. As of 11 a.m. ET on October 27, the gold price per troy ounce was $3,991.

Combined with an at-times weak dollar, traders shuffling positions ahead of this week’s central bank calls, and fixed income desks adjusting duration in line with the Federal Reserve’s widely expected interest rate cuts, there are headwinds that are dampening bullion’s recent vertical rally.

Silver, which was in the doldrums earlier this month, is also easing its exuberance. Dealers say one reason spot prices have retreated from their all-time highs is that London’s coffers now have some extra space after heavy capital inflows from the United States and China. On Oct. 20, Reuters hit a benchmark of $54.47 before hitting the $52 mark as borrowing tensions eased.

If you zoom out, the market is still bullish. Gold fell below $4,000 for the first time, and silver briefly topped $50 on shelter demand and expectations for policy easing. Despite today’s pullback, both contracts remain significantly up on the year.

Looking ahead, constructive forecasts remain until 2026. A Reuters poll on Monday showed silver will average above $4,000 a year for the first time next year, supported by continued deficits and solar demand.

The focus now shifts to US statistics, earnings and policy decisions later this week. At least for now, we’ll see whether shelter-in-place outflows return or risk appetite continues to suppress metals prices.

Frequently asked questions 📉

- What is the spot level today? Gold is $3,994 per ounce and silver is $46.47 per ounce.

- Why did gold fall below $4,000? Improved risk appetite associated with trade optimism reduced demand for shelter.

- What’s weighing on silver right now? Recently, new inflows have eased the squeeze in London, easing record prices.

- What do the predictions say? A Reuters poll predicts that silver will be supported by industrial demand, with the average price of gold rising above $4,000 in 2026.